By Rich Heidorn Jr.

The New England Power Pool Participants Committee last week approved new penalties for ISO-NE market participants that fail to cover their capacity supply obligations (CSOs) when a new resource is delayed.

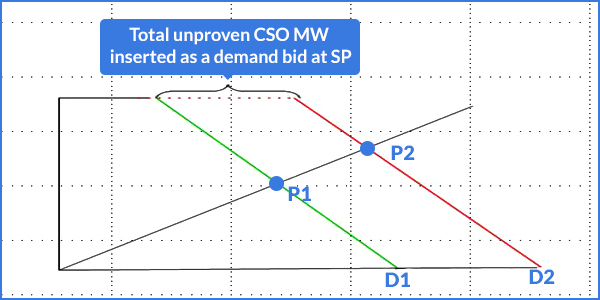

For delivery years before June 1, 2022, the monthly $/kW-month charge will be the higher of the capacity clearing price and the clearing price in any Annual Reconfiguration Auction for that year. After June 1, 2022, the charge will be based on the outcome of a second run of the third ARA, using the unproven CSO quantities as a demand bid.

The rule changes are designed to shift the responsibility for covering CSOs to participants, which ISO-NE says have the best information about projects’ development schedule and potential delays.

Market participants will still be compensated for their CSOs and continue to have Pay-for-Performance risk.

The RTO said it was acting because of the time lag between its last critical path schedule (CPS) meetings with participants in early January and the beginning of the capacity commitment period in June.

Current rules require ISO-NE to assess a new resource’s likelihood of meeting its CSO and submitting a demand bid if it is in doubt. The new rules will eliminate mandatory demand bids by the RTO for resources unable to satisfy all CPS milestones by the start of the delivery year.

The monthly charge would apply unless the participant covers the shortfall through a bilateral contract or with a resource that was previously counted as a capacity resource. Previous resources can be used for up to two years.

The changes were approved by voice vote after members rejected a proposal by PSEG Energy Resources & Trade to allow a three-month grace period before applying the charge for each year between June 2019 and May 2022. PSEG’s proposal failed with a 47.77% vote in favor (Generation Sector – 14.68%; Transmission Sector – 6.71%; Supplier Sector – 15.48; AR Sector – 5.23%; Publicly Owned Sector – 0%; End User Sector – 5.59%; and Provisional Group Member – 0.067%).

The approval completed Phase I of ISO-NE’s two-phase review of rules governing late projects in the FCM. Phase II will take a broader look at the participation of new resources in the market, the RTO said.

As of June 30, ISO-NE said it had identified 26 resources representing almost 30 MW of “unproven” capacity, including almost 28 MW of demand capacity and 2.1 MW of generating capacity. Last month, ISO-NE asked FERC to terminate the CSO of Invenergy’s 485-MW Clear River Energy Center Unit 1 in Rhode Island because it will not be operating in time for the delivery year beginning June 1, 2019 (ER18-2457). (See ISO-NE Asks FERC to End Clear River CSO.)

ICR Values for FCA 13

In a related matter, the Participants Committee also approved by a show of hands a net installed capacity requirement of 33,770 MW for Forward Capacity Auction 13 next year (delivery years 2022-2023). In a separate vote, the committee also approved a 33,750 MW net ICR that will be used if FERC approves the termination of Clear River Unit 1’s CSO.

Net ICRs exclude the Hydro-Quebec interconnection capability credit (HQICC), which members agreed to set at 969 MW. Including the HQICC, ISO-NE projects a reserve margin of 19.3%.

The committee also approved Tariff changes on assumptions used in the ICR calculation. One revision will reduce from 1.5% to 1.0% the amount of load relief assumed from a 5% voltage reduction. A second revision changes the assumption used for the availability of peaking resources in the transmission security analysis from a deterministic derate factor to an equivalent forced outage rate-demand for individual resources, based on their most recent five-year average.

2019 Budgets

In other action, the committee also endorsed the 2019 ISO-NE operating ($198 million) and capital ($28 million) budgets. The operating budget is up $2.9 million (1.5%) from 2018 but down $1.4 million from the preliminary budget presented in August. Including true-ups, the revenue requirement for the operating budget will drop 3.5% from the amount projected to be collected in 2018.

The capital budget is unchanged from 2018.

The committee also endorsed the New England States Committee on Electricity’s 2019 operating budget of $2.35 million, a $45,000 reduction from the five-year pro forma projections endorsed by the committee in June 2017 and accepted by FERC.

Energy Emergency Forecasting

Members unanimously approved changes to Operating Procedure 21 and its Appendix A to create an energy emergency forecasting and reporting process. It includes forecast alert thresholds, criteria for declaring energy alerts and energy emergencies and related data collection provisions.

ISO-NE said the changes are intended to improve market signals for incentivizing resource preparedness before winter 2018/19.

The energy alert thresholds will be based on an assessment of fuel and emissions availability over the next 21 days of operation.

Consent Agenda

Approved as part of the consent agenda were:

- Conforming changes to ISO-NE manuals on price responsive demand, Pay-for-Performance, real-time reserve designation and settlement rules and the Forward Capacity Market; and

- Revisions to provisions regarding deposits for participating in cluster transmission studies.

Presentation on Labor Day Event

ISO-NE COO Vamsi Chadalavada gave a ISO-NE Prices Top $2,400/MWh in Labor Day Heat Wave.)

Chadalavada said higher-than-forecasted temperatures and dew points, particularly in the afternoon of Sept. 3, caused the RTO’s load served to peak at 22,956 MW (23,174 MW including active DR), almost 2,400 MW (11.5%) above its load forecast.

During the 4-5 p.m. hour, the RTO fell 718 MW below the 24,775 net capability required, which includes operating reserves of 2,108 MW.

The RTO purchased 150 MW from New Brunswick between 4:20 and 5:14 p.m. and 229 MW between 5:14 and 6. NYISO provided 251 MW from 5 to 5:30 and 150 MW from 5:30 to 6.

Real-time hub five-minute LMPs ranged from $19.79 to $2,677.05/MWh for the day, with an average of $262.61.

The real-time net commitment-period compensation was the fifth highest for the year and the highest of the summer at $1.9 million, including $1.1 million in economic payments, $540,000 in dispatch lost opportunity costs and $210,000 in rapid-response pricing opportunity costs.

The high prices during the event will increase the peak energy rent adjustment by $7 million each month, for a total of $56 million, through May 31, 2019, RTO officials said.

The PER adjustment is intended as a hedge for load and a tool to discourage capacity suppliers from creating price spikes through economic or physical withholding.

The increased adjustment will affect generators, imports and active demand resources. Self-supply and passive demand resources are excluded.

ISO-NE is eliminating the PER adjustment beginning June 1. The RTO says Pay-for-Performance and changes to the day-ahead energy market made the adjustment unnecessary beyond that date. (See FERC Rejects NESCOE Request on Scarcity Rules.)