By Michael Kuser

NYISO on Thursday recommended steps to prevent certain wholesale market suppliers, designated as carbon-free in the New York Clean Energy Standard (CES), from collecting double payments for carbon-emission reductions that have already been captured by renewable energy credit contracts.

“The idea is to prevent these resources from benefiting from a change in [locational-based marginal prices] resulting from a carbon price,” said Michael DeSocio, the ISO’s senior manager for market design. DeSocio presented a report on the treatment of REC contracts to the state’s Integrating Public Policy Task Force (IPPTF), which met by teleconference.

NYISO proposes applying a carbon charge to wholesale market suppliers with active, fixed-price REC contracts with the New York State Energy Research and Development Authority that are based on a REC solicitation that began or was completed prior to the carbon pricing rules taking effect.

At the July 16 IPPTF meeting, the ISO said it was considering options to reduce or eliminate the potential for such double payments. (See NY Sets Carbon Pricing Timeline, Reviews Progress.)

NYSERDA Only

“I want to remind everybody that NYISO is not a party to any of these agreements, and we’re aware of resources only because NYSERDA has made us aware of them,” DeSocio said.

The proposal is limited to NYSERDA contracts because the ISO believes it has no authority to put conditions on out-of-state REC contracts, DeSocio said.

Wholesale market suppliers with such NYSERDA REC contracts are initially settled at the LBMP, including the carbon component. NYISO will then deduct the carbon charge from the supplier’s settlement based on the social cost of carbon and the real-time marginal emission rate for the supplier’s zone.

“This carbon charge will be applied to the actual output of the resource based on the proportion of the REC contract to the nameplate capacity,” DeSocio said.

Generators designated as carbon-free under the CES, and whose NYSERDA REC contract has expired, will settle at the LBMP including the carbon component — and not be subject to a carbon charge. Zero-emission credits and offshore wind RECs are not included, as they have an option to adjust to changes in market conditions, he said.

‘Hard Squeeze’

Seth Kaplan of EDP Renewables said, “NYSERDA has entered into REC contracts for virtually all of the output of the facilities they contract with — that’s just what they do.” He suggested that NYISO check with NYSERDA about how much of the output it buys from projects.

Kaplan said the ISO “is assuming that RECs are carbon payments and that therefore there is a problem to be solved.” He referred to an updated Brattle Group analysis showing a minimal effect of carbon pricing on pre-2020 RECs, with actual customer costs of 4 cents/MWh in 2020 and 2 cents/MWh in both 2025 and 2030.

“It raises a very serious question of whether the hard squeeze that you’re putting on companies that have taken risk and moved forward under REC contracts is worth the juice that comes out of the bottom of the orange, [and] of whether this is an enormous effort that would produce, as I believe [Brattle’s Sam] Newell said, nearly invisible impact, and whether this is really worth the trouble,” Kaplan said.

Kathy Slusher, director of energy procurement and utility regulatory affairs for the State University of New York, said the university system has a campus that will put a bid request out for 150,000 RECs, representing 150,000 MWh of energy in a “ready commodity market.”

“However this is going in NYISO would interrupt that market and would really throw everything for renewables in New York up in the air because none of us could sign a [power purchase agreement] because we don’t know if we’re going to get RECs, what value they would have, or if they’d be able to be sold,” Slusher said. “Sorry … but I think NYSERDA punted this over to [NYISO] and it doesn’t belong in your court.”

To the extent that there’s a secondary market for RECS, the ISO doesn’t know about it or seek to administer some clawback, DeSocio said.

Weird Dynamic

Anne Reynolds, executive director of the Alliance for Clean Energy New York, said that not considering REC sales elsewhere “does raise a weird dynamic.”

“If you’re saying the generators can’t sell their RECs to NYSERDA and still realize the carbon charge revenue increment, but they can sell them to someone else … there’s no logical reason for that, and it illustrates again that a REC payment and a social cost of carbon are not the same thing,” she said.

Reynolds also spoke of the perception among some industry participants that the Public Service Commission addressed the grid operator’s responsibility regarding RECs in a state proceeding, “but the fact is that petition [Case No. 15-E-0302] has never been answered by the commission; it’s an open petition. In the offshore wind order [Case No. 18-E-0071], there was discussion of the issue, and one sentence that said, ‘it might be more appropriate for the ISO to take on this issue’ or something like that, but there was no ordering clause from the commission telling the ISO to solve this problem.”

She also said the utilities are acquiring RECs through value of distributed energy resources (VDER) payments and that VDER projects are getting LBMPs that include the carbon charge increment. She noted that some VDERs qualify as Tier I renewables (for example, a community solar project getting the value stack and exporting to the grid) and utilities can use those RECs to meet their Tier I obligations.

Warren Myers, Department of Public Service director of market and regulatory economics, said the utilities can use such RECs for compliance: “They’re not tradeable RECs, but they can use them to satisfy their Tier I REC requirements.”

ICAP Demand Curve and Net EAS Revenues

Ryan Patterson, NYISO associate for capacity market design, presented a report recommending that any carbon charge in the wholesale market should be rolled into net energy and ancillary services (EAS) revenue estimates through the existing annual update process.

The ISO analyzed the impacts of carbon pricing on the installed capacity (ICAP) demand curves to illustrate how the annual update process could affect future capacity market clearing prices, finding that net EAS revenue will be impacted by a carbon charge.

Increasing carbon prices and LBMPs will likely impact both cost and revenue, Patterson said. The net EAS revenue offset values and the reference point have an inverse relationship: as net EAS revenue increases, the reference point decreases, and vice versa.

In the last ICAP demand curve reset process, the ISO moved to a historic model that averages projected net EAS revenue over a three-year period preceding the new ICAP demand curves taking effect. The study period ran from Sept. 1 of Year 1 through Aug. 31 of Year 3, using actual historic data such as LBMPs and fuel and emission costs.

The 2017/18 ICAP demand curves used net EAS revenue offset values measured from Sept. 1, 2013, to Aug. 31, 2016, and the ISO implemented an annual update process that allows for specific variables used in calculating the reference point to be recalculated each year between the quadrennial resets.

Changes to the reset process implemented in 2016 were intended to allow for the ICAP demand curves to capture changes in market conditions over time, including the impacts of changes to market rules. Adjustments to the net EAS model to allow for incorporation of a carbon charge will be evaluated as part of the upcoming reset process, Patterson said.

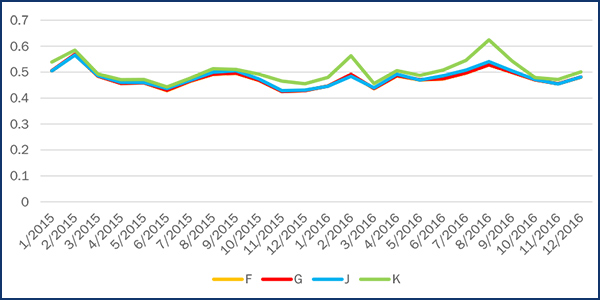

Two datasets were used to run several scenarios, Patterson continued. The first was 2015 and 2016 marginal emissions rates (MER) prepared by Brattle, under which the LBMP was increased by $50/MWh and, to account for the carbon price change, the Regional Greenhouse Gas Initiative price was increased by $50 for hours that LBMPs were adjusted for carbon pricing.

The second dataset was derived from modeling and pricing software (MAPS) runs for 2020, 2025 and 2030, in which LBMPs were output for carbon and no carbon base cases, and then fed into the net EAS model along with projected fuel costs used in each respective MAPS run. As with the previous dataset, the RGGI price was increased by $50 for the carbon cases.

No stakeholder asked questions about the net EAS revenue impact analysis, but Brett Kruse of Calpine said he would like to make a presentation to the IPPTF on Oct. 22 on the issue of how a carbon charge might affect hedges on transmission congestion contracts.

IPPTF Chair Nicole Bouchez, the ISO’s principal economist, shared a revised schedule that foresees the task force meeting on the remaining Mondays this month, collecting stakeholder feedback in November and presenting a formal proposal on carbon pricing Dec. 17.

RTO Insider will have coverage later this week of the task force’s Monday meeting at NYISO headquarters.