By Hudson Sangree

FERC has accepted CAISO’s revised proposal to protect electricity ratepayers from funding shortfalls in the ISO’s congestion revenue rights market.

CRR holders will be paid for their entitlements “only to the extent the CAISO collects sufficient revenue through day-ahead market congestion revenues and other sources to fund those entitlements,” the commission said in its Nov. 9 decision (ER19-26).

“We agree with CAISO that the proposal reasonably distributes the burden resulting from congestion revenue insufficiency and will help improve the revenue insufficiency and auction revenue shortfall,” FERC said. “Rather than relying solely on LSEs to make whole CRR holders in the event those obligations are revenue insufficient, CAISO’s proposal distributes the burden to all CRR holders.”

CAISO filed its proposed revisions Oct. 1 after FERC rejected an earlier plan to eliminate full funding of CRRs and instead scale payouts to align with revenue collected through the day-ahead market and congestion charges. In rejecting the earlier plan, the commission objected to how the ISO would treat counterflow and prevailing-flow CRRs differently (ER18-2034). (See CAISO Modifies CRR Plan, Seeks Quick Approval.)

The ISO acknowledged that its revised proposal relies on “essentially the same methodology” found in its prior proposal, with one “important” modification: a provision to net CRRs with both prevailing-flow and counterflow CRRs within a holder’s portfolio before scaling the payment to that holder.

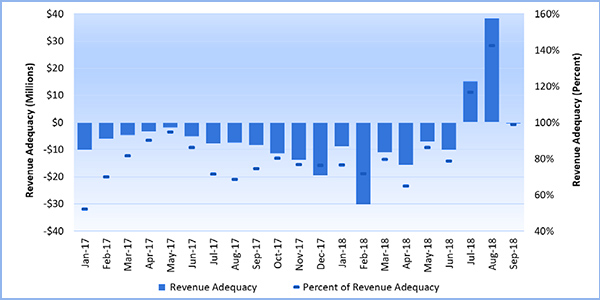

CAISO also noted in its revised filing that CRR revenue shortfalls have continued into this year, and it urged the commission to quickly approve the revised plan to relieve ratepayers from paying costs for fully funding CRRs in 2019. The ISO’s Department of Market Monitoring has estimated that the shortfalls — which are allocated based on power consumption — cost California ratepayers about $100 million a year.

In ruling for CAISO, the commission rejected protests by the Western Power Trading Forum, which argued that the ISO’s stakeholder process on the revisions had been rushed and that they did not fully address FERC’s concerns on symmetry.

The commission also found that CAISO’s plan would curtail a commonly used strategy to exploit market loopholes.

“CAISO’s constraint-specific approach … discourages strategies that attempt to exploit differences between the CRR model and the day-ahead market,” it said. “Under CAISO’s current CRR process, congestion revenue insufficiency and the auction revenue shortfall can be driven by market participants purchasing CRRs over constraints that appear to be nonbinding in the CRR auction but are actually binding in the day-ahead market.

“According to CAISO’s analysis, this practice has been a driver of both revenue insufficiency and the auction revenue shortfall. Under CAISO’s proposal here, if there is a substantial difference between the CRR model and the day-ahead market such that the payments due to CRR holders vastly outstrip the available congestion revenues, then payments to CRRs will be scaled, making the strategy potentially less viable.”