By Rich Heidorn Jr.

FERC moved Thursday to apply its proposed new methodology for calculating transmission owners’ return on equity rates to dockets in MISO and the South.

The commission’s directives mirror its Oct. 16 order in a case involving the New England Transmission Owners (NETOs), in which it solicited briefs on its plan to consider other metrics in addition to the discounted cash flow (DCF) model it has relied on since the 1980s.

As in the Oct. 16 “briefing order,” the commission ordered parties in ROE litigation over MISO’s TOs to submit briefs in a paper hearing (EL14-12-003, EL15-45).

Separately, the commission also approved an order providing guidance on how the new methodology should be applied to seven pending ROE proceedings involving units of Entergy, American Electric Power, Southern Co. and others (EL17-41-001 et al.).

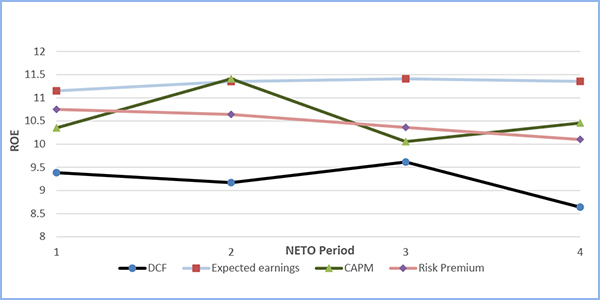

FERC has proposed giving equal weight to results from the DCF and three other techniques: the capital asset pricing model (CAPM), expected earnings model and risk premium model. (See FERC Changing ROE Rules; Higher Rates Likely.)

Remand

The commission announced its new policy last month in response to the D.C. Circuit Court of Appeals’ April 2017 ruling vacating its 2014 order on the NETOs’ rates. The court said FERC failed to meet its burden of proof in declaring the NETOs’ existing rate unjust and unreasonable. (See Court Rejects FERC ROE Order for New England.)

FERC said it would use three of the models — the DCF, CAPM and expected earnings — to establish a composite zone of reasonableness that will determine whether it accepts or dismisses ROE complaints. (The risk premium model results in a single number and cannot produce a range of rates.)

“Under this approach, we would dismiss an ROE complaint if the targeted utility’s existing ROE falls within the range of presumptively just and reasonable ROEs for a utility of its risk profile unless that presumption is sufficiently rebutted,” the commission said.

When a complaint is warranted, FERC would base any subsequent rate on the average of the results from each of the four models.

The first of two complaints over the MISO TOs’ rates was filed for the period Nov. 12, 2013, through Feb. 11, 2015. Under the new formula, averaging the result of the risk premium analysis (10.36%) with the midpoints of the DCF (9.29%), the CAPM analysis (10.06%) and the expected earnings analysis (11.41%) results in a preliminary base ROE of 10.28%, with the incentive-based total ROE capped at 13.06%.

Using DCF alone, FERC reduced the MISO TOs’ base ROE from 12.38% to 10.32% in a September 2016 order. (See FERC Cuts MISO Transmission Owners’ ROE to 10.32%.)

If the commission’s revised methodology calculation prevails, it said it will order refunds of amounts collected in excess of 10.28%.

The MISO TOs include units of Ameren, American Transmission Co., Entergy, Indianapolis Power & Light, MidAmerican Energy and ITC Holdings. A second challenge to their 12.38% rate was filed in February 2015, with complainants arguing the base ROE should be no higher than 8.67%.

FERC said parties in the case must submit briefs within 60 days on whether its proposed revisions should apply and, if so, how.

Guidance in Other Dockets

In addition, the commission told litigants in seven other ROE dockets they should address its proposed new methodology in their proceedings.

“We do not believe that allowing participants to address the briefing order’s proposed new methodology in their ongoing proceedings, and continuing those proceedings without abeyance on that basis, will result in wasted time and resources because we believe that continuing with settlement discussions or hearing procedures will move those proceedings closer to resolution,” the commission wrote.

“In addition, these ongoing proceedings involve issues of material fact that the commission determined would be more appropriately addressed in hearing and settlement judge procedures, and the briefing order’s proposed new base ROE methodology does not change that determination. While the issues of material fact to be addressed are expanded with the inclusion of the three additional financial models, the most effective procedures for addressing base ROE issues continue to be the ongoing hearing and settlement proceedings.”

FERC Chair Neil Chatterjee said he hoped the commission’s new policies will reduce delays and “pancaked” rate complaints. He noted that one of the pending complaints has been awaiting resolution for more than five years.

“This means that transmission owners still don’t know what they made in 2013, and consumers still face uncertainty about their bills,” he said.