By Michael Kuser

FCA 14 Capacity Zone Development Preview

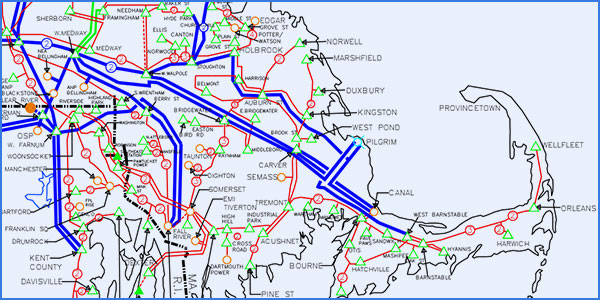

MARLBOROUGH, Mass. — ISO-NE last week kicked off its formal annual review of the transmission system to delineate zones for Forward Capacity Auction 14, which will be held in February 2020 to cover the 2023/24 capacity commitment period.

Al McBride, the RTO’s director of transmission strategy and services, told the Planning Advisory Committee that “we’re coming out of a significant backlog of interconnection requests in Maine.” He noted that FERC’s approval last year of clustering has enabled the queue to move forward. (See FERC Approves ISO-NE Queue Clustering.)

The first cluster of more than 600 MW is proceeding through the system impact study process, as is an external elective transmission upgrade of 1,200 MW, which are collectively driving the creation of a Maine capacity zone, he said. The RTO is not proposing a Northern Maine capacity zone because the deliverability standard requires new resources in the state to be deliverable throughout the Maine load zone.

“That’s a significant number of new resource additions,” McBride said. “Maine used to be export-constrained, particularly from north to south, but after the Maine Power Reliability Program upgrades, there has been headroom. This headroom would more than be used up by the projects moving forward in the system impact study process.”

The trigger to model an export-constrained zone is based on the quantity of existing and proposed new resources compared with the maximum capacity capability in the zone.

Zone formation is a two-step process: First, identify the potential zonal boundaries and associated transfer limits to be tested for modeling in the Forward Capacity Market; then use objective criteria to determine whether or not the zone meets the trigger to be modeled for the capacity commitment period.

To form capacity zone boundaries, the RTO considers significant changes over the past year, including new transmission upgrades, resource retirements and new capacity resources.

Boundary Specifics

ISO-NE does not expect transmission upgrades in the Southeastern Massachusetts and Rhode Island (SEMA/RI) area to change the boundaries of that area or the Southeast New England zones, McBride said.

Most of the SEMA/RI Reliability Project upgrades have not yet been certified for use in the FCM, and certifications for FCA 14 will be known in January 2019. However, if the SEMA/RI Reliability Project upgrades are certified, planners will assume they will be in place for the 2023/24 period.

Mystic 7 will be retiring with the start of the 2022/23 period. The RTO has previously analyzed different potential future retirement scenarios, including the loss of Mystic 7 and other units, and did not expect such retirements to drive a change in capacity zone boundaries.

Capacity interconnection requests as of Nov. 1 are more than 700 MW from West/Central Massachusetts, with the rest, all nameplate, being more than 4,100 MW from New Hampshire/Vermont; more than 6,200 MW from Maine; more than 7,700 MW from SEMA/RI; and more than 2,700 MW from Connecticut.

SEMA/RI 2028 Needs Assessment

ISO-NE’s SEMA/RI 2028 Needs Assessment Scope of Work study assumes the complete retirement of the 2,274-MW Mystic plant and includes analysis assuming that Vineyard Wind and the New England Clean Energy Connect (NECEC) projects will be in service, according to Kannan Sreenivasachar, ISO-NE’s transmission planning technical manager.

Sreenivasachar told the PAC on Thursday that the study for the 10-year horizon will be using data from the 2018 Capacity, Energy, Loads and Transmission (CELT) report to determine the forecasts for the peak load levels evaluated.

All transmission and generation facilities operating as of June 1, 2018, are included in the base cases, and the 34,092-MW 90/10 summer peak load includes 5.5% transmission and distribution losses.

The study evaluates reliability performance and identifies reliability-based needs in the SEMA/RI study area for the year 2028 while considering future load distribution, resource changes based on FCA 12 results, and the 2018 solar and energy efficiency forecasts, Sreenivasachar said.

The study assumes that resources without an obligation (typically through the FCM) cannot be relied upon to resolve a reliability need and are therefore not considered in the steady state analysis. However, they do contribute to the available short-circuit current, as they may be in service as part of the energy dispatch of the system, he said.

The study bases its short-circuit base case on the expected topology in the 2023 compliance steady state base case. No significant project is expected in the 2023-2028 time frame, and hence the 2023 case was considered acceptable, Sreenivasachar said.

Asked about future generation selected in state solicitations, Director of Transmission Planning Brent Oberlin said there were two options.

He said if the RTO finishes the study ahead of final approval of those projects, the identified needs will be based on conditions without the generation in place. Upon approval of the generation, the needs will be changed to those associated with the scenarios that included the generation. If the generation is approved prior to the completion of the study, the needs associated with scenarios that do not model the generation can be ignored.

Stakeholders should submit comments on the study to pacmatters@iso-ne.com by Dec. 2. The RTO plans to post the draft study and intermediate study files in the first quarter of next year before completing the study area 2028 Needs Assessment and presenting it to the PAC by Q2 2019.

The RTO’s next steps will be to review transmission certifications for FCA 14 with the Reliability Committee in January, and to further discuss the potential capacity zone boundary construct at the PAC in the first quarter of 2019.

Moody’s Sees Region in Good Economic Shape, for Now

Moody’s Analytics Director Ed Friedman told the PAC that New England is leading the Northeast in economic development, particularly job growth, which is not typically the case, as that occurs more frequently earlier in an economic expansion or business cycle.

“That’s been a good development over the past year, but probably not sustainable over the long term,” Friedman said.

Massachusetts and New Hampshire have led the region in new hiring since last October, both outpacing the national average, with Rhode Island very close to the U.S. figure of about 1.7% in employment growth.

“The drivers are the booming tech sector in Boston … and in and around the Seaport district,” he said.

New England is unfortunately hampered by a generally weak and aging demographic outside places like Massachusetts, which holds back labor force growth, he said. “Very good job growth just cannot go on forever” without a growing population to feed the labor force.

The better than 3% wage gains posted in most of the region’s six states over the past year — only Connecticut and Rhode Island fell below that level — will likely continue over the coming year, but consumer confidence in New England is lower than in any other part of the U.S., Friedman said.