By Amanda Durish Cook

CARMEL, Ind. — Storage is glaringly absent from MISO’s potential plans to manage a possible 40% renewable penetration on the grid, stakeholders told the RTO this week.

During a Nov. 28 workshop to discuss its ongoing findings on the impact of increased renewable integration, MISO suggested using computer-optimized transmission buildout and more pronounced ramping from remaining conventional generation to respond to a 40% renewable resource mix.

MISO last month said it would need to take significant steps to reinforce its grid to handle a 40% penetration comprising 75% wind and 25% solar. The RTO said it found a possible “inflection point” at 40% and that it would be difficult to operate within system limits at that point. (See Study: MISO Grid Needs Work at 40% Renewables.) Its multiyear study seeks to determine what the grid needs to maintain the planning reserve margin, operate within the physical limits of the system and support voltage and frequency.

MISO’s renewable penetration currently stands at about 10%. Findings issued last month indicate the RTO could reliably absorb a 20% renewable penetration without damaging frequency response. (See MISO: 20% Renewable Limit for Adequate Frequency Response.)

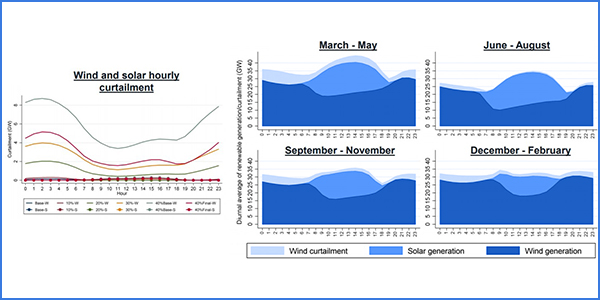

But at 40% renewables, MISO has found that renewable curtailment becomes more pronounced during shoulder months, though wind curtailment would occur in every hour during an average day, except in summer. It would also confront significant stability issues.

During the Nov. 28 workshop, MISO policy studies engineer Maire Boese said the RTO will likely need to rely on transmission solutions to keep the majority of the renewable energy deliverable to load at the 40% level.

“We want to make sure energy reaches load instead of seeing it be curtailed or not dispatched,” Boese said.

Transmission planning can also become more influenced by computing power and mathematic modeling, MISO concluded.

Yifan Li, of MISO’s policy studies group, said that even with the modeling process, “engineering judgment and human experience” are still the driving factors behind selecting transmission project candidates, although that is changing.

“We’re getting to a point where we can seek some help from computers … to find transmission solutions,” Li said.

Such an automated process led MISO to identify about 80 potential new transmission candidates, down from a pool of about 11,300, he said. The additional transmission would cut down on curtailments and make renewables more deliverable to load, MISO said last month.

The expansion includes 266 miles of circuit at 200 kV or less, 763 miles of 230-kV circuit, 1,373 miles of 345-kV circuit, 316 miles of 500-kV circuit, 267 miles of 765-kV circuit and 408 miles of HVDC line. The transmission solutions do not include a new line linking MISO Midwest with MISO South.

With new transmission, 38.4% of the 40% renewable penetration would be deliverable, as opposed to 34.7% without the solutions, MISO determined. Curtailment of a 40% renewable mix would fall from 18.2% to 9.6% on average.

A 40% renewable mix would also place more ramping responsibility on thermal units, the RTO found.

Where’s the Storage?

At the workshop, LS Power’s Pat Hayes asked if MISO has studied what levels of storage would be helpful at different points of renewable penetration.

“So far, we haven’t found a strict need for storage,” Policy Studies Manager Jordan Bakke said. “Storage really hasn’t been found to be needed in the areas we’ve studied so far. … When we looked at the issues and we looked at the solutions, the solutions were pretty straightforward.”

Bakke said MISO so far recommends “extracting more flexibility from the current fleet, rather than building something else.”

MISO said as renewable penetration increases, the number of thermal units online increases during off-peak hours despite a decrease in average output. The RTO would especially rely on online coal and combined cycle gas units for ramping in the morning and evening.

Not an Economic Analysis

Veriquest Group’s Dave Harlan said MISO might consider developing incentives to keep remaining thermal units online if they’re needed for ramp capability.

But Bakke said the study is exclusively focusing on the physical needs of the system rather than monetary outcomes. MISO’s study does not contemplate whether conventional generation could economically survive in a landscape with 40% renewable penetration.

“The purpose is not to talk about the money issues,” he said.

Boese said coal asset owners may have to investigate whether their units can handle the more frequent ramping MISO has forecasted. “Less megawatts of coal are available with more ramping,” she said. “That’s something to keep in mind if you’re a generation owner.”

“There’s something like a feedback loop here,” said consultant Roberto Paliza, adding that MISO was failing to answer a key question by not investigating whether conventional generation could economically withstand being needed for more pronounced ramping but less run-time overall. He said the RTO was neglecting to find out if the assistance would be there when needed to facilitate renewable penetration.

But other stakeholders said MISO’s conventional generation solution to combat increasing curtailment conspicuously leaves storage out of the conversation.

Clean Grid Alliance’s Natalie McIntire said it seemed that MISO was looking only to existing conventional generation to manage renewable variability and that storage could also cover ramping flexibility.

Bakke said MISO forecasts very little curtailment from overgeneration, and that curtailment largely correlates to wind delivery issues at night.

Stakeholders responded that storage could hold the wind energy until morning. For that to be useful, Bakke said the storage would have to be locally sited and not general system storage.

Multiple stakeholders asked MISO for another analysis that includes assistance from storage and at what point an influx of storage produces diminishing returns.

Bakke said going forward, MISO would gauge storage solutions in the final phase of the study. He said MISO staff hear “loud and clear” that stakeholders would like to see how both renewables and storage interact on the grid.

Harlan also criticized MISO’s report for only showing averages of system conditions with renewable penetration. He said to properly plan resources, stakeholders need to see the most extreme scenarios that can occur.

MISO staff asked for more written stakeholder feedback on the analysis so far. They said stakeholder suggestions will shape the scope of the study’s third and final phase, which will begin in early 2019.

Bakke said the third phase of the study will either examine renewable penetrations beyond 50% or investigate penetrations up to the 50% benchmark more thoroughly.