By Michael Kuser

FERC on Thursday approved new ISO-NE penalties for market participants that fail to cover their capacity supply obligations (CSOs) when a new resource is delayed.

The commission’s Dec. 20 order agreed with the RTO “that the failure-to-cover charge rate mechanism establishes a just and reasonable penalty rate for capacity resources that do not cover their CSO in advance of a capacity commitment period and fail to demonstrate the ability to fulfill all or part of their CSO” (ER19-169).

The new Tariff provisions go into effect Dec. 24.

The rule changes are designed to shift the responsibility for covering CSOs to market participants, which ISO-NE says have the best information about project development schedules and potential delays. (See NEPOOL OKs Penalty for Delayed Capacity Resources.)

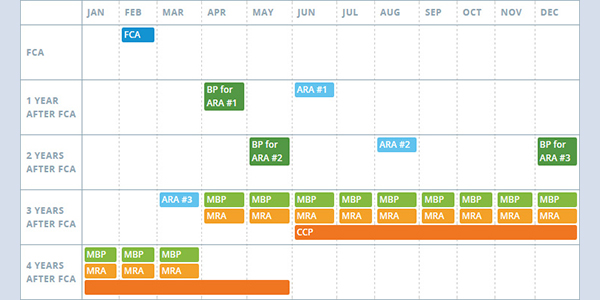

The changes stipulate that for delivery years before June 1, 2022, the monthly dollar/kilowatt-month failure-to-cover charge will be the higher of the capacity clearing price and the clearing price in any Annual Reconfiguration Auction (ARA) for that year. After that time, the charge will be based on the outcome of a second run of the third ARA, using the unproven CSO quantities as a demand bid. Market participants will still be compensated for their CSOs and continue to face Pay-for-Performance risk.

Two Protests Denied

Public Service Enterprise Group filed a protest seeking “staggered effective dates” to incorporate a three-month grace period beginning in June 2019, June 2020 and June 2021 for resources awarded CSOs in the Forward Capacity Auctions associated with those capacity commitment periods.

The company argued that allowing the filing to take effect this month would impose new and unexpected risks and costs on resources that obtained CSOs under the existing rules, in particular its Bridgeport Harbor 5 plant scheduled to go into operation next June.

The commission disagreed “that the proposed effective date violates the filed rate doctrine and rule against retroactive ratemaking. … PSEG fails to quantify or detail the extent to which the risk profile for Bridgeport Harbor 5 is altered or otherwise to support its argument that any such change is unjust and unreasonable.”

Northeastern Massachusetts Consumer-Owned Systems (NEMACOS) also filed a protest expressing concern that load-serving entities may be paying arbitrage margins to suppliers that obtain a higher clearing price in the FCA and cover their capacity obligations in the reconfiguration auctions at a lower price.

The commission found the Tariff provisions that NEMACOS addresses in its protest are not at issue in the proceeding, but it noted that “under both the current Tariff and the proposed revisions, a resource that obtains a CSO in the FCA would have an opportunity to cover its CSO in a subsequent reconfiguration auction and potentially garner an arbitrage margin.”

“Because the failure-to-cover charge rate is designed to always be greater than or equal to the third Annual Reconfiguration Auction clearing price, the proposed revisions will offer no additional arbitrage incentives beyond those already available to resources under the current Tariff,” the commission said.