By Michael Kuser

FERC last week approved ISO-NE’s proposed values for the installed capacity requirement (ICR), Hydro-Québec interconnection capability credits and related values in time for the RTO’s Forward Capacity Auction 13 on Feb. 4.

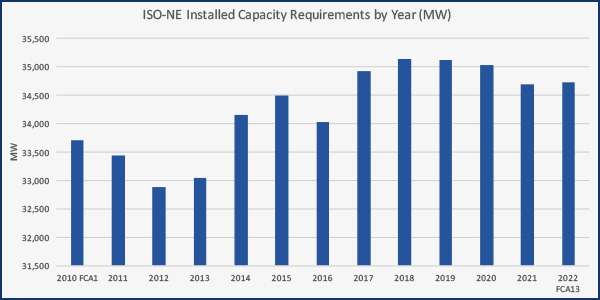

The RTO proposed an ICR of 34,719 MW for FCA 13’s 2022/23 capacity commitment period.

The commission’s Jan. 4 order found “that the underlying system reserves assumption used to calculate the ICR-Related Values is just and reasonable” and that the filing “sufficiently supported the use of different tie benefits and outages assumptions to calculate the ICR-related values than those used in the Fuel Security Study” (ER19-291).

ISO-NE and NEPOOL together filed two sets of ICR-related values, with one set assuming FERC would accept termination of the capacity supply obligation for Invenergy’s delayed 485-MW Clear River Energy Center Unit 1 for the 2021/22 Capacity Commitment Period, which the commission did in November. (See FERC Ends Clear River CSO, Denies Invenergy Waiver.)

The commission in December approved ISO-NE’s interim proposal to use an out-of-market mechanism to address concerns about fuel security and implement an interim fuel security study process for FCA 13, 14 and 15 to establish whether a resource submitting a retirement de-list bid is needed to maintain regional fuel security. It also accepted ISO-NE’s proposal to treat resources retained for fuel security purposes as price-takers by requiring them to submit offers into the FCA at a zero price. (See ISO-NE Fuel Security Measures Approved.)

Contested Issues

Contested issues in the most recent proceeding pertained to assumptions that affect the ICR and system-wide demand curve.

The New England Power Generators Association (NEPGA), the New England States Committee on Electricity (NESCOE) and others protested various aspects of the RTO’s calculations and methodology.

But the commission disagreed “with NESCOE’s argument that the increased reserves assumption should be rejected because it exacerbates an alleged bias in ISO-NE’s ICR calculations. … As an initial matter, we are not persuaded that the cited reductions in ICRs weigh on the justness and reasonableness of the specific system reserves assumption change that ISO-NE proposes in this filing.”

The commission also found “inconsistent” with the Tariff a request by FirstLight and NEPGA that it require the grid operator to recalculate the ICR using alternative assumptions used in the fuel security study.

“We also disagree with NEPGA and FirstLight’s assertions that, because fuel security resources are entered into FCA 13 as price-takers, ISO-NE must use the same tie benefits and outages assumptions in its analyses,” said the commission.

Lastly, the commission noted its finding in the fuel security compliance order (ER18-2364) “that the current design of the Forward Capacity Market does not account for fuel security attributes in solving for the resource adequacy problem, which creates the need for a separate Fuel Security Study process in the interim. However, the commission also reaffirmed in that order its support for market solutions as the most efficient means to provide reliable electric service to New England consumers at just and reasonable rates.”