By Hudson Sangree

California officials expressed concern last week that the state’s push toward 100% clean energy and the rapid growth of community choice aggregators could imperil grid reliability if not carefully orchestrated.

The development is worrying enough that state regulators are considering creating a centralized process to ensure resources needed for long-term resource adequacy (RA) get sufficient financial support.

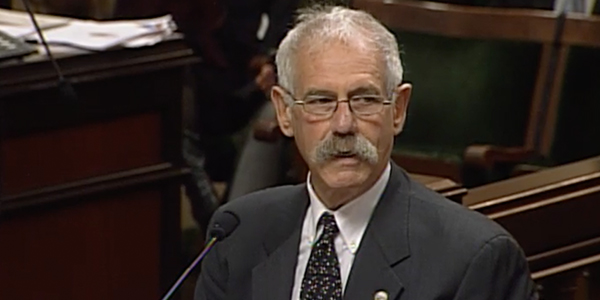

Michael Picker, president of the California Public Utilities Commission, told lawmakers Wednesday that the state has moved away from its traditional model of vertically integrated utilities, with a few big owners of generation and wires also providing service to retail customers.

Now there are dozens of different load-serving entities delivering electricity to consumers. Not all of them can meet the basic legal requirement, enacted after the California energy crisis of 2000/01, that they have enough electricity available to meet demand on the year’s hottest days, when demand soars, Picker said.

“Here’s where we get into our uncharted and potentially dangerous territory,” Picker told the State Assembly Utilities and Energy Committee. “We’re neither here nor there.

“The cleanest way would be if we had vertically integrated utilities or we went to full competition where everybody picked their electricity provider and then you had discrete transmission and discrete distribution companies,” he said. “That’s what Texas and New York do. It works for them. [It’s] not clear if it would work here, but it’s also clear we’re not going to go back to a vertically integrated system.

“So the question is, ‘What do you do?’”

‘One of the Things that Scares Me’

Picker made his comments at an informational hearing titled “The Metamorphosis of the Energy Sector: Maintaining Reliability and Affordability on the Road to Decarbonization.” Panelists were asked to address the challenges facing California’s grid as it pursues the legal mandates of SB 100 and other bills that set ambitious clean-energy goals — including a mandate that the state’s LSEs deliver 100% zero-carbon electricity by 2045.

CCAs will require more than 5,700 new generation projects at a median size of 1.75 MW to meet those goals, Picker said. [An earlier version of this story contained the median figure of 175 MW used by Picker at the hearing. The PUC later said he misspoke. The median figure was derived from 56 projects totaling 2 GW that the CCAs had under contract in a recent count. Those projects range in size from less than 1 MW to 200 MW, with a median of 1.75MW and an average size of 40 MW.]

“It’s a challenge,” he said. CCAs, many of which are startups, have customers but not the financial assets to get financing for generation projects, he said. To scale up quickly, you need “large companies with big balance sheets,” he said.

Last year the PUC received an unprecedented 11 requests to waive RA requirements. Ten of those requests came from electric service providers (ESPs), which sell directly to a limited number of nonresidential customers, and one came from an IOU. This year’s batch of waivers may include one or more CCAs, according to the PUC and a group representing CCAs.

In the relatively small geographic pockets controlled by CCAs, there may not be enough transmission capacity to bring in power from outside on peak-demand days, so the CCAs must be able to purchase electricity from generators within their territory, Picker said. But many can’t muster the financial resources to compete for those resources and must ask the PUC for waivers, he said.

“I consider that to be a weakness in the design,” the PUC president said. “I think it’s a big problem.”

If a day arrives when a CCA has insufficient power to serve its customers, the problem could spiral out of control, he said.

“This is one of the things that scares me,” he said. “You may be a small company, but your failure to provide electricity to your customers can cause a brownout that can escalate, and it can actually affect customers in somebody else’s service area.”

State Could Establish a Central Buyer

The state recently required CCAs to secure three-year RA procurement contracts, instead of annual contracts, and many are hoping the change will help the CCAs compete for reliability resources, Picker said. But if the situation doesn’t improve by the end of this summer, “we may actually impose a central buyer,” he said.

Picker said it’s uncertain who might fill that role, but the state’s big investor-owned utilities — Southern California Edison, Pacific Gas and Electric, and San Diego Gas & Electric — would be likely candidates.

“We know that we have to keep the grid whole, and we know that … three large central procurers have made it work,” he said.

SCE’s vice president of energy procurement, Colin Cushnie, urged lawmakers at the hearing to make the IOUs central buyers for the sake of grid reliability.

“We do think the central buyer framework should be adopted for local resource adequacy,” Cushnie said. “We also believe that the IOUs, who are the reliability custodians of our grid, should be the ones designated to be those central buyers.”

AB 56 — introduced in December by Assemblyman Eduardo Garcia, a Democrat who sits on the energy committee —would require the PUC and California Energy Commission to provide the legislature with a joint assessment of options for establishing a central statewide procurer of electricity for all retail customers by March 31, 2020. As currently written, Garcia’s bill focuses on procurement of renewable and other “preferred” resources under state law, which include demand response and behind-the-meter generation.

CCAs Seek Joint Procurement

To some, the idea of a central buyer is anathema to efforts to establish local control of energy procurement and distribution.

Beth Vaughan, executive director of the California Community Choice Association, said the problems cited by Picker could be solved by CCAs banding together to buy electricity, as some have already done.

Four CCAs in Southern California are now purchasing as one entity, and Monterey Bay Community Power and Silicon Valley Clean Energy jointly put out a request for 280 MW of solar coupled with 340 MWh of battery storage for two projects in Kern and Kings counties, she said.

“There’s a lot of experimentation going on in terms of joint procurement, in terms of being able to go out and procure those large sums of megawatts that President Picker referred to,” Vaughan told the committee.

Rainy Days Get CAISO Down

Mark Rothleder, CAISO’s vice president of market quality and renewable integration, told the committee the state is still dependent on natural gas peaker plants and imports of out-of-state electricity to meet its evening ramps and peak demand days.

CAISO Vice President Mark Rothleder said stormy days can cut the state’s solar generation by up to 90 percent.

“As we transition to a low-carbon grid, the ISO may find meeting its demand when the renewable supply is not producing, such as evenings or stormy days, becoming more and more difficult,” Rothleder said.

There are some days, he said, when CAISO’s load is served almost entirely by renewable and zero-carbon resources, including nuclear and hydroelectric. Other days, however, solar output drops to 10 to 20% of its installed capacity, requiring the ISO to make up the difference. Behind-the-meter rooftop solar also falls away, meaning those households need thousands of extra megawatts.

That happened during four days in mid-January, he said.

Such a severe reduction in solar meant the ISO had to round up 14,000 MW of imported electricity, equivalent to the output of seven nuclear plants, he said. It was able to do so in January, but such large quantities of imported electricity are not always available, he said. There are times when the whole West is hot, and the interior West and desert Southwest have little electricity to spare.

“We need to secure that [imported electricity] if we’re going to rely upon it,” Rothleder told the committee.

The state’s gas fleet is becoming more economically distressed because it’s not being called on as much and faces competition from cheaper solar power, he said.

“If [gas plants] start retiring in large numbers, we won’t have those resources available,” he told lawmakers.

The challenge, Rothleder said, is maintaining the right set of resources and capabilities to ensure reliability.

“I am not suggesting we should shy away from the challenge,” he said. “I’m saying we need to be thoughtful about meeting that challenge.”