By Christen Smith

With two months to go before Exelon says it will pull the plug on Three Mile Island, Pennsylvania lawmakers unveiled legislation Monday to spend $500 million annually to subsidize the state’s nuclear fleet.

The Keep Powering PA Act (House Bill 11) would add a nuclear power mandate to the 2004 Alternative Energy Portfolio Standards Act (AEPS). Prime sponsor Rep. Thomas Mehaffie (R), who was joined by 19 co-sponsors, said the bill “properly values the environmental benefits the nuclear power industry has been delivering to our state for decades.”

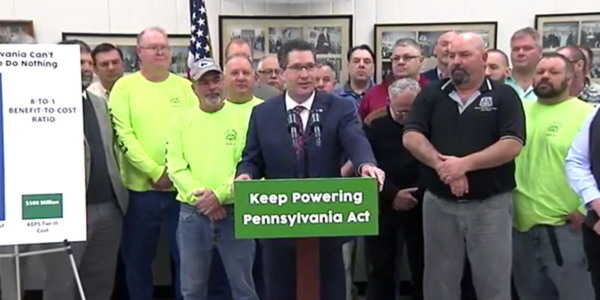

“While the market is designed to price electricity on a day-to-day basis, it is the role of the legislature to set the long-term policies for this state,” he said during a press conference on Monday at the Ironworkers Local 404 Union hall in Harrisburg. “The markets do not treat all clean sources of energy the same and they do not penalize polluters. As state legislators, we need to take a step back, recognize this and we need to take truly into account the cost of doing nothing.”

Pennsylvania Rep. Thomas Mehaffie (R) introduces House Bill 11. | Facebook

3rd Tier

HB 11 would create a third tier of resources in the alternative energy portfolio from which companies must purchase at least 50% of their electricity by 2021: nuclear, solar, geothermal and low-impact hydropower. The first two tiers of the legislation include 16 resource types with targets of 8% and 10%. (See Draft of Pennsylvania Nuke Subsidy Bill Leaked.)

Mehaffie said his bill would provide consumer protections through capped pricing and the prevention of “double dipping” across programs. He estimated the bill would cost $500 million — one-eighth of the $4.6 billion in annual costs he claims would result should all five nuclear plants in the state shut down: $788 million in higher electric prices; $2 billion in lost state GDP; and $1.86 billion in costs associated with carbon emissions and harmful criteria air pollutants, including SO2, NOX and particulate matter.

“For the state legislature to ignore the challenges facing these plants, it would be one of the most irresponsible and irreversible decisions we’ve made in a generation,” he said.

The Pennsylvania Rural Electric Association and several union officials endorsed the bill, as did Exelon, which has threatened to shutter TMI later this year if lawmakers fail to act by May. (See Exelon: Need Pa. Action by May to Save TMI.)

David Fein, Exelon Generation’s senior vice president of state governmental and regulatory affairs, urged support for the bill in an emailed statement on Monday, saying it “will put Pennsylvania on a path to a clean energy future [and] preserve 16,000 good-paying jobs.”

Exelon successfully lobbied for nuclear subsidies in New York and Illinois after threatening to close plants experiencing financial strain. Exelon manages the largest nuclear fleet in the country, with three facilities located in Pennsylvania alone. (See Seeking Subsidy, Exelon Threatens to Close Three Mile Island.)

Joe Gusler, president of the Central PA Chapter of Building and Construction Trades Council, speaking in favor of House Bill 11. | Facebook

Criticism

Critics argue the plan awards undeserved subsidies and have questioned generators’ claims of hardship.

“The notion that if we do nothing, nuclear power plants will simultaneously shut down and prices will be impacted is disingenuous at best — Exelon, FirstEnergy Solutions and Talen Energy are making too much money to justify shutting down,” said Steve Kratz, spokesman for Citizens Against Nuclear Bailouts, a coalition of power generators and energy, business and manufacturing associations, in an email Monday. “What does Rep. Mehaffie know that industry experts — who have all testified that competition and reliability aren’t a problem — do not?”

He noted that Exelon applied in July to extend the license of its Peach Bottom Units 2 and 3 through 2054. The group also cited research by the Kleinman Center for Energy Policy at the University of Pennsylvania that projected the subsidies would increase Pennsylvania’s electric rates by $981 million annually.

“Adding already profitable nuclear power plants to the AEPS is a bailout that would significantly increase consumer electricity prices, eliminate consumer choice and fundamentally change the way Pennsylvania’s competitive energy markets operate,” Kratz said.

He also pointed to data from PJM’s Independent Market Monitor, whose most recent State of the Market report noted improved earnings for the RTO’s nuclear fleet. Although a “significant proportion” of nuclear plants did not cover annual avoidable costs in 2016 and 2017, the Monitor reported that nuclear plants benefited from substantially higher LMPs and forward prices in 2018.

A coalition of environmental groups — including the Sierra Club, Natural Resources Defense Council, Clean Air Council and Conservation Voters of Pennsylvania — said the bill also locks the state into propping up aging and expensive nuclear plants at the expense of more efficient renewable technologies.

“Pennsylvania’s policymakers ought to be working to significantly scale up clean, safe and affordable renewable energy from wind, solar, geothermal and low-impact hydropower,” the group said. “Building a clean energy economy around renewable energy in tandem with a declining, enforceable limit on carbon pollution from power plants will reduce emissions significantly in Pennsylvania as well as create jobs and protect health and the environment.”

Supporters of the bill argue, however, no plan for a cleaner Pennsylvania succeeds without nuclear power — which they say generates 93% of the state’s zero-carbon electricity. Mehaffie said one nuclear plant produces more power than all of the state’s wind and solar assets combined. Nuclear generation supplied about 42% of Pennsylvania’s net generation in 2017, compared with 4.5% for renewables, according to the Energy Information Administration.

“If we lose one or more of these plants, then we might as well forget about all the time and money we’ve invested into wind and solar,” Mehaffie said. “It’s the only baseload power supply being created without any carbon emissions. If our state wants to move forward with a cleaner environment, there is simply no way possible to get there without our nuclear power plants being open.”

Gene Barr, president and CEO of Pennsylvania’s Chamber of Business and Industry, said the nuclear mandate unnecessarily walls off 70% of the market, potentially forcing the state to import power — a reversal of the state’s role as an energy exporter.

“The General Assembly must be aware of the possibility that FERC will soon direct the grid operator to deduct the value of these state subsidies out of market payments, leaving the state in an even worse position — significantly higher energy costs with no tangible benefit,” he said.

MOPR Ruling

Last June, a FERC order concluded that increasing state subsidies for renewable and nuclear power were suppressing PJM capacity prices. The commission’s 3-2 ruling required PJM to expand the minimum offer price rule (MOPR) to cover all new and existing capacity receiving out-of-market payments, including renewable energy credits and zero-emission credits for nuclear plants. The MOPR currently covers only new gas-fired units. (See Little Common Ground in PJM Capacity Revamp Filings.)

Stu Bresler, PJM’s senior vice president of markets and operations, testified before both the House Environment Resources & Energy Committee and the Consumer Affairs Committee on Monday that the success of the RTO depends upon its ability to evolve with technology and consumer demand. However, stakeholders’ recent focus on refining capacity market rules has left PJM’s reserve and energy markets ignored, he said.

“It is imperative that the resources called upon by PJM to maintain system reliability are appropriately valued for the services they provide, and today’s reserve and energy pricing rules fall short of that mark,” he said. “By setting energy and reserve prices to levels that accurately reflect system conditions both during normal conditions and most importantly when reserve quantities become tight, resources operating to protect reliability collect revenues for the capability to respond when needed most.”