By Michael Kuser

NYISO’s electricity markets have reached an “inflection point” as new technologies and “ambitious” public policy goals require the ISO to develop measures to manage the grid’s “next evolution,” according to the ISO’s annual Power Trends report released Thursday.

Last year’s report covered the implications of state policies calling for 50% of the electricity consumed by New Yorkers to come from renewable sources by 2030.

“A year later, however, policymakers seek even more aggressive goals of 70% renewable energy by 2030 and 100% clean energy sources by 2040,” NYISO Executive Vice President Rich Dewey said in a press briefing to discuss this year’s report. The report noted that the ISO is working with stakeholders and policymakers to finish a plan to price CO2 into wholesale markets to support the state’s goal of reducing emissions. (See More Details Divulged on New NYISO Carbon Pricing Study.)

Dewey also highlighted a February proposal by the state’s Department of Environmental Conservation to require peaking units to reduce their emissions of smog-forming pollutants.

“The proposed new rule, which calls for phasing in compliance obligations between 2023 and 2025, could impact approximately 3,300 MW of simple cycle turbines in New York City and Long Island,” he said.

The ISO is engaged in the rule development process and will work to inform policymakers, market participants and investors of the rule’s implications for bulk and local system reliability, but it had no plans to testify at a Tuesday DEC hearing on the subject in Albany, Dewey said.

NYISO has initiated the second phase of its 2018/19 Comprehensive Reliability Plan, which includes a study scenario evaluating the reliability impacts of a potential retirement of all 3,300 MW of peaking units impacted by the DEC’s proposal.

Changing Grid and Goals

“Another trend is the recognition of the need to pay attention to the power transmission infrastructure within New York, both from a transmission and from a generation standpoint, which is aging and needs to be reinvested in to ensure we maintain reliable operation of the system,” Dewey said.

He also highlighted the need to maintain a resilient grid “in light of an uptick in severe storms” and other issues related to climate change.

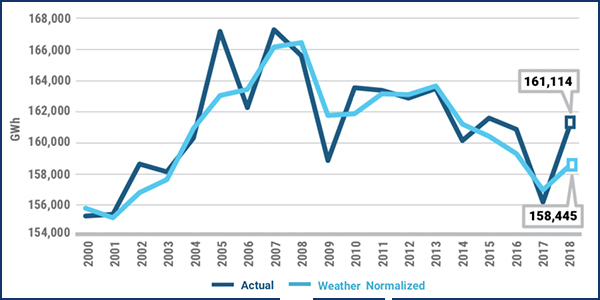

The Power Trends report also points to a 10-year trend of declining electricity demand in New York, partly because of economic changes, but also increased energy efficiency. The ISO sees demand continuing to decline on EE and behind-the-meter resources, predominantly solar, Dewey said.

“When we look at peak demand, the impact of energy efficiency and behind-the-meter solar will continue to flatten and slightly decrease the need for peak as we move forward into the future,” he said.

Dewey also pointed to the opportunity for storage to become a valuable resource for grid management. The Public Service Commission in December doubled New York’s storage goal to 3,000 MW by 2030 and required the state’s utilities to reduce building energy use by an additional 31 TBtu to meet an EE target of 185 TBtu by 2025. (See NYPSC Expands Storage, Energy Efficiency Programs.)

A countertrend to EE is the increasing adoption of electric vehicles, which will put upward pressure on peaks, with a greater impact in winter than in summer because the peak occurs in the evening, which coincides with consumer EV charging habits, Dewey said. The new report takes its load data from the 2019 Gold Book, NYISO’s annual load and capacity forecast, which this year shows EV usage driving a 66% increase in New York’s projected baseline peak demand growth rate over the next two decades. (See NYISO Draft Gold Book Shows EVs Driving Load Growth.)

The report emphasized the ISO’s faith in competitive markets to provide incentives for investment in renewable resources and finance a more robust transmission system to move power to load.

Absent such infrastructure upgrades, investment in upstate New York renewables could yield diminishing returns for the state’s effort to boost renewable energy output and reduce carbon emissions, Dewey said.

“The NYISO believes that competitive wholesale electricity markets remain central to facilitating the accelerated changes policymakers have proposed in a way that will support system reliability and economic efficiency,” the report said.