By Jennifer Chen

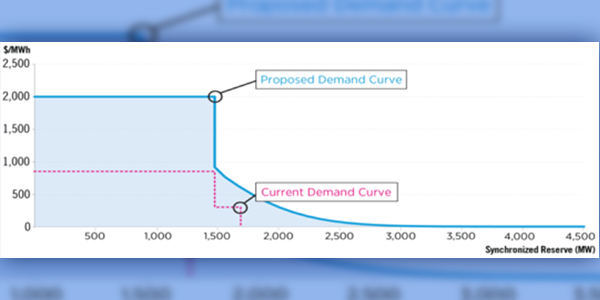

PJM is seeking to procure more reserves at higher prices by augmenting its operating reserve demand curve.

Because the reserve and energy markets interact, energy prices will increase too. Consumer costs could grow by $512 million to $1.7 billion per year, and about 95% of this revenue would flow to fossil and nuclear resources.

CO2 emissions could increase by up to 537,000 short tons (or decrease by about 116,000 short tons if higher prices bring down energy consumption). On the high end, CO2 emissions would roughly equal driving another 100,000 cars around for a year.

Comments on PJM’s proposal are due May 15 at FERC.

What is the problem PJM is trying to solve?

Operating reserves provide insurance against uncertainty in future supply and demand, which a grid operator must balance. A power plant might fail, demand might spike, or there may be less wind and solar power available than forecasted.

PJM believes that its market is not procuring enough or sufficiently paying reserves that can start up within 10 to 30 minutes. To be clear, PJM is not claiming that there are insufficient reserves on its system or that reliability is at stake in the near term. With 40,000 MW of excess capacity, PJM has a surplus accessible to its control room operators. However, PJM would rather procure a consistently higher level of reserves through its market and rely less on its operators committing and compensating reserves as needed.

PJM also asserts that a higher penetration of renewables will require more accurate market price signals and improved grid flexibility.

What kinds of reserves, how much and are there substitutes?

Less reserves are needed as future uncertainty decreases. Improving forecasts reduces uncertainty, as does shortening the forecast’s look-ahead horizon. For example, the wind forecast 10 minutes from now is dramatically more accurate compared to the forecast for 30 minutes or an hour from now.

PJM’s proposal focuses on 10-minute start-up reserves to address the uncertainty in a 30-minute look-ahead forecast and 30-minute start-up reserves for a 60-minute look-ahead. But modeling shows that shortening the look-ahead from 30 minutes to 15 minutes in PJM’s proposal reduces the amount of reserves needed and cuts the proposal’s estimated costs by about $183 million per year, or about 36%.

Newer, faster resources can help address uncertainties on shorter time frames, but older, less flexible resources need longer advance notice. Current market and operational rules are tailored to conventional resources, but market rules that enable operating the grid closer to real time can incentivize more flexibility from resources.

Ensuring that the grid can cost-effectively integrate renewables is important, but PJM singles out a particular kind of reserve instead of prioritizing reforms based on a comprehensive assessment. For example, PJM’s 2014 Renewable Integration Study found that it can operate its system with up to 30% of its energy generated by wind and solar without significant reliability issues by investing in transmission and adding regulation reserves. PJM’s variable renewable penetration is low, so it has time to pursue these reforms.

Regulation reserves can respond within milliseconds to minutes and correct for inaccurate forecasts in real time, much faster than the reserves PJM is seeking to increase. CAISO, ERCOT and SPP — grid operators with more renewables than PJM — provide separate regulation up and down services. This helps when wind generation is high at night, demand is at its lowest and inflexible power plants operating at their minimum levels cannot further reduce output. Regulation down would be more valuable than regulation up in this case and could be provided by energy storage or responsive demand from customers. Regulation reserves decrease the need for reserves with slower response times, such as those PJM is seeking to beef up.

Load-following reserves operate on the minutes to hours time frame (similar to the reserves in PJM’s proposal) and can offset net demand after accounting for daily variation in renewable generation. However, there are substitutes for this type of reserve that also provide other services and thus may be more cost effective. Today, the energy market itself provides a load-following service. Accurate wholesale energy prices can attract resources capable of responding within five minutes. They can also encourage customers to reduce or shift demand to save and earn money through demand response. Transmission and newer technologies also reduce the need for load-following reserves by relieving congestion and evening out the variations in renewable generation.

Thus, before deciding to procure more 10- to 30-minute start-up reserves, PJM could improve its forecasts; shorten its look-ahead; consider increasing regulation reserves and separating them into up and down services; invest in needed transmission (particularly newer technologies implementable today); and improve energy price signals.

Which resources benefit from PJM’s proposal?

PJM’s proposal would procure more reserves from coal and gas plants that can ramp up, fast-start diesel generators and energy storage resources. Some flexible technologies will get a boost from reserve revenues, but the largest share of reserve revenue would accrue to gas plants that are already experiencing explosive growth from PJM’s capacity market and to coal plants that could receive a six-fold increase in payments per year to provide synchronized (or spinning) reserves. Some of this revenue would be from plants staying online overnight at minimum output when demand is low.

Wind, solar and nuclear resources are ineligible to provide reserves unless they demonstrate their capability. DR could qualify to provide reserves up to a limit under PJM’s proposal, but the 8,000 MW of DR committed through the RTO’s capacity market is emergency-only and not economically dispatched in its energy and reserves markets.

Separate from higher reserve payments, more than 70% of the revenue increase from PJM’s proposal comes from higher energy market prices. Energy prices increase with higher reserve requirements because resources deployed to generate energy cannot provide reserves, so there is a lost-opportunity-cost payment folded into energy market prices.

Energy price increases make sense when there is a shortage of energy resources. But the modeling of PJM’s proposal shows that it consistently raises energy market prices when there is no shortage because additional reserves are being procured most hours of the year, even during off-peak times and seasons.

So under PJM’s proposal, inflexible generation that is always running benefits from consistently inflated energy prices. For example, coal plants could earn another $120 million to $420 million per year in higher energy revenues on top of higher reserve revenues. Solar, which only produces energy during daylight hours, gets a smaller boost than around-the-clock resources.

Many of the power plants benefiting from the reserve payments and inflated energy prices also receive capacity market payments to be available at all times. The capacity market is intended to supply the revenues needed to maintain a certain level of capacity in PJM that are not available through the RTO’s other markets. Thus, higher energy and reserve revenues should translate to lower capacity revenues. However, any capacity revenue reduction to offset higher energy and reserve costs would not be timely nor commensurate without significant rule changes.

Does PJM’s proposal improve price incentives during times of grid stress?

PJM’s proposal would over-procure reserves (similar to how its capacity “demand curve” over-procures capacity). PJM’s modeling shows that consistently keeping more reserves on the system actually depresses energy prices when the grid is stressed while maintaining higher prices during off-peak times. For example, keeping large power plants running at their minimum output levels would enable them to ramp up and provide energy during peak. Over the peak period, this could be cheaper than deploying reserves that can quickly start without being online, but customers would pay more overall to consistently maintain a higher level of reserves.

Lower prices at peak mute the incentive for flexible resources such as energy storage and DR to participate, while inflated prices overall would inefficiently subsidize inflexible baseload to stay on. This cost would be socialized among all customers, shifting costs to customers who value reserves the least and would rather manage their energy consumption to save money.

Higher prices during times of grid stress with lower prices overall can offer more distinct and accurate price signals to flexible resources while enabling consumers to save. The potential for DR is still largely untapped (estimated to be about 15% of electricity demand), and a key barrier is a lack of price signals.

An alternative to boosting reserves to ensure future reliability

The ultimate goal is not to procure a certain amount of reserves at a sufficiently high price, nor is it to automate through the market potentially inefficient actions that operators take when they conservatively commit extra reserves. The goal is to design markets to produce efficient outcomes and, in doing so, maintain reliability standards and improve grid flexibility cost-effectively.

A market solution that avoids the market distortions introduced by PJM’s proposal is to allow real-time energy prices to reflect the marginal cost of resources delivering that energy. Today, energy offers are capped below what many would consider the willingness of customers to pay for energy (known as the value of lost load).

With such a cap in place, operators are likely to procure additional reserves the market does not commit, without knowing whether consumers want the extra reserves. But if the market accurately values energy, the operators will know that the market is procuring the efficient level of resources and no additional reserves are required.

PJM could propose to lift energy market offer caps beyond the $2,000/MWh permitted for the purposes of setting energy market prices, while verifying that offers above a threshold are based on costs to safeguard against market power. As noted by former FERC Commissioner Norman Bay, the commission, market operators and market monitors are better equipped today to ensure that nothing like the Western Energy Crisis happens again.

Energy, not reserves, is the most fundamental product in the electricity markets today, and ensuring it is accurately valued through market dynamics should precede efforts to administratively set the value for other market products. Enabling true scarcity pricing by allowing real-time energy prices to reflect marginal costs will result in more accurate prices compared to raising energy prices through an adder reflecting a PJM-determined reserve value. Properly valuing energy will enable us to better evaluate how much reserves we truly need.

Jennifer Chen, senior counsel of federal energy policy at Duke University’s Nicholas Institute.