By Rich Heidorn Jr.

PJM utilities and independent power producers joined wind, solar and nuclear generators in support of the RTO’s controversial price formation proposal, with some commenters urging it to go further and one saying the plan should be an “off ramp” from the capacity market (ER19-1486, EL19-58).

But Maryland regulators and the Independent Market Monitor asked FERC to reject the proposal, saying it would add billions in costs for negligible benefit.

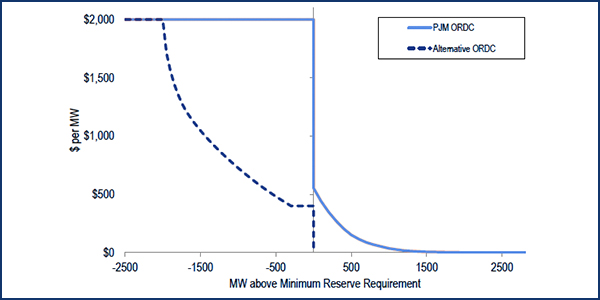

PJM filed its proposal unilaterally in March after a yearlong discussion with stakeholders produced no consensus. The RTO said its plan borrows concepts used by other RTOs to capture the real-time actions of grid operators, including a revised operating reserve demand curve (ORDC); improved utilization of existing capability for locational reserve needs; alignment of the day-ahead and real-time markets; and increased penalty factors. (See PJM Files Energy Price Formation Plan.)

PJM’s plan received backing in comments by Exelon; FirstEnergy; Duke Energy; the PJM Power Providers Group (including Calpine, NRG Energy and Talen Energy); the Nuclear Energy Institute; the American Wind Energy Association; the Solar Energy Industries Association, and eight energy trading firms.

‘Pulling Back the Curtain’

Exelon cited an affidavit by PJM dispatch director Christopher Pilong, which it said “pulls back the curtain of the PJM control room and provides new, conclusive evidence” that operators are using out-of-market actions to commit reserve capability by inflating load forecasts. “These practices are so pervasive that, without them, PJM would have been in a reserve shortage in almost one-third of five-minute intervals in 2018,” Exelon said.

The company filed an affidavit by NorthBridge Group consultant Michael Schnitzer, who said PJM’s estimate of $556 million in additional annual payments by load is misleading, because it only measures the impact of the proposal on market prices and energy and reserve procurement volumes.

Schnitzer estimated PJM’s proposal “would create at least $200 million of net benefits by both increasing reliability through incremental reserve purchases and by reducing production costs,” Exelon continued. “PJM’s proposal is therefore the rare market reform that both creates incremental reliability benefits while simultaneously reducing total costs.”

NEI said PJM operators’ “load biasing” has contributed to the financial pressures facing nuclear plants.

“Over the course of the entire year, the average operator bias was 515 MW of out-of-market additions. PJM’s filing makes clear that this bias is a natural result of the asymmetric incentives facing operators. The consequence of failing to have sufficient reserves could be calamitous, whereas the downside of excess procurement can be rationalized as just a small instance of market price suppression,” NEI said. “Given the scale and frequency of these biases, however, the cumulative effect is quite large.”

AWEA and SEIA agreed with PJM that the lack of alignment between the RTO’s day-ahead and real-time markets is unjust and unreasonable and that reforms are needed to provide the flexibility needed to respond to the increase in variable generation. “As explained by PJM, ‘every other [RTO] has a methodology to procure the reserve products needed in real time in advance of the operating day except PJM.’”

More Action Sought

FirstEnergy said the RTO’s proposal was so “watered down” it will fail to create the “meaningful price impact that is needed to spur increased investor confidence in the PJM wholesale markets.”

In addition to approving PJM’s proposal, FirstEnergy said FERC should order the RTO “to conduct a holistic review of all of PJM’s wholesale markets to ensure that generation resources that provide key attributes, such as fuel security, fuel diversity and resilience, receive compensation for the attributes they provide to the electric grid.”

The eight energy trading firms, members of the Energy Trading Institute, backed PJM’s proposal but said it represents only “low hanging fruit” and that the RTO should take further action to fix its energy market.

“To be clear, ETI is not advocating for an energy-only construct, but both PJM staff and its stakeholders should focus on getting the prices right in the energy market and not on continual and Sisyphean revising of the capacity market constructs to meet newly arising needs,” the traders said. “The capacity markets were intended to be residual markets, not a panacea for all revenue needs.”

Former Montana regulator Travis Kavulla, director of energy policy for the R Street Institute, said the PJM proposal is “laudable” but may not be just and reasonable without also making changes to the capacity market. “It is not clear why consumers, having paid for capacity once through the forward capacity market, should be expected to pay again for a type of operational capacity in near real time,” Kavulla said. “The commission should make clear that a market design shaped around an increasingly robust ORDC is an off-ramp from, and an eventual substitute for, the forward capacity market, which is an inferior vehicle to pay resources for the capacity that customers actually require.”

Kavulla noted that PJM’s base case projects energy and capacity revenues will increase by $556 million annually while production costs rise only $30 million. “In other words, the vast majority of ORDC revenue is paying for resources’ fixed costs and not the costs associated with production under this new market design. At the same time, avoided uplift costs — one of the core reasons to adopt ORDC that PJM proffers, with which we agree — amount to little more than $3 million.

“An ORDC with high price caps remains administrative in nature, but at least its administrative elements seek to correct blunter and worse administrative interventions in the markets — namely operator commitments and lower price caps,” Kavulla continued. “Importantly, ORDC does not require the degree of speculative planning that forward capacity markets do. Either a resource has dispatchable headroom in near real time, or it does not.”

Insufficient Evidence

The Monitor and the Maryland Public Service Commission said PJM’s proposal is overly expensive and not supported by evidence that current rules are unjust and unreasonable.

“PJM’s proposal, if implemented, would cost ratepayers billions of dollars with no commensurate benefits,” the PSC said. “Furthermore, energy and operating reserve market revenues would increase without an appropriate offset in the capacity market, thereby resulting in billions of dollars in over-recovery.”

The PSC said the real problem is that PJM’s dispatchers lack appropriate tools and generator operating information.

“It is vexing that after seven years of market implementation and in this modern age of technology, communications and telemetry, PJM is unable to provide its dispatchers with actual, real-time resource operating data and performance capabilities from the generators it controls on its system,” the PSC said.

The PSC challenged PJM’s proposal to increase maximum prices — including compounding of multiple reserve products — to $12,000/MWh, saying the RTO’s current maximum of $3,700 is “on par” with the $3,725/MWh cap in NYISO and the $3,500/MWh maximum in MISO.

“While an overreliance on wind and solar resources during times of operational stress may merit additional review in the future, such resources currently contribute minimally to the PJM grid,” the PSC said. “For example, PJM indicates that when the system experienced its peak demand during the most severe recent cold weather event, wind and solar resources amounted to approximately 1.4% of the total generation output.”

Public Citizen also opposed the filing, saying it is “simply a regional version of U.S. Energy Secretary Rick Perry’s grid resilience bailout push.”

“PJM is run less as an independent transmission operator and more as a price-fixing cartel: PJM management is free to conspire with certain of its powerful members, promoting pricing changes designed to deliver bigger profits to said members,” the group said.

It said FERC should order an evidentiary hearing to investigate “the cabal involving PJM management and certain transmission owner-members that control generation assets.” It also said Commissioner Bernard McNamee, a former Department of Energy official, should recuse himself from the case.

Monitor: Prices Reflect Oversupply

The Monitor said PJM’s current energy and ancillary service markets are producing just and reasonable rates and that the RTO’s proposal would increase costs by more than $1.7 billion per year.

The proposal “shifts scarcity revenues from the capacity market to the energy market but does not propose that capacity market revenues reflect that shift,” the Monitor added.

It rejected complaints that energy and reserve prices are too low, saying they are a function of cheap fuel and excess capacity, noting the RTO’s reserve margin — 25.9% in June — is 62% above the required 16% margin.

“Frequent reserve pricing at zero is just and reasonable because it is an efficient, competitive outcome. This market design and market outcome is common among the RTOs. Finding it unjust and unreasonable in the PJM market would naturally extend to the other RTO markets.”

If the commission does rule PJM’s current rules unjust, the Monitor said FERC should reject the RTO’s plan in favor of its own proposal, which was the most popular of five voted on by the Markets and Reliability Committee in January — albeit at 52%, still below the two-thirds threshold needed for endorsement. (See PJM Stakeholders Deadlock on Energy Price Formation.)