WESTBOROUGH, Mass. — ISO-NE told the Planning Advisory Committee on Tuesday that it plans to conduct all three economic studies requested by stakeholders last month.

Marianne Perben, ISO-NE manager of technical studies and resource adequacy, presented the 2019 Economic Study Draft Scope of Work and High Level Assumptions to the PAC. (See “Economic Study Requests Focus on Wind,” ISO-NE Planning Advisory Committee Briefs: April 25, 2019.)

The studies will cover:

- A New England States Committee on Electricity (NESCOE) request to analyze various scenarios for integrating offshore wind by 2030, focusing on the impact on the transmission system and wholesale market. The study will examine a range of 2,000 to 8,000 MW of OSW resources, Perben said.

- A request by transmission developer Anbaric Development Partners to review the impacts of OSW on energy market prices, emissions and regional fuel security in 2030. The study will look at an 8,000- to 12,000-MW range of OSW.

- A RENEW Northeast request to evaluate transmission upgrades that would increase the hourly operating limits of the Orrington South interface in Maine.

The three studies will rely on a number of common assumptions, including: modeling Forward Capacity Market and energy-only generators at their seasonal claimed capability; using the most recent U.S. Energy Information Administration forecasts for New England coal, oil and natural gas prices; and reflecting CO2, SO2 and NOx prices in fossil fuel generation. Michael Henderson, the RTO’s director of regional planning and coordination, cautioned participants that “these are economic studies, not detailed transmission studies.”

In response to a question about why the RENEW study would exclude the western Maine cluster of resources in the interconnection queue, Perben said the cluster was not part of the request.

Asked about varying threshold prices in the analysis, Perben said ISO-NE uses them to facilitate analysis of load levels where the amount of $0/MWh resources exceeds the system load. They “are really just a way to know when to curtail those resources,” she said.

New Hampshire 2029 Needs Assessment Outlined

Jinlin Zhang, the RTO’s lead engineer for transmission planning, gave the committee a briefing on the New Hampshire 2029 Needs Assessment.

In February, ISO-NE suspended its New Hampshire 2027 Solutions Study process in order to incorporate changes in the draft 2019 Capacity, Energy, Loads and Transmission (CELT) forecast data, which showed the regional net load figure the RTO was using was too high.

The RTO used the draft 2019 forecasts to update the models to reflect the change in load, energy efficiency and solar PV volumes from the 2018 CELT, Zhang said.

She highlighted the “very important date” of June 10 as the deadline to notify the RTO of any resources it should consider including in the Needs Assessments.

Resources to be included are those that have cleared a Forward Capacity Auction, have signed contracts from state-sponsored requests for proposals, or are otherwise obligated by contract.

Two projects that received capacity supply obligations (CSOs) in FCA 13 have been added to the 2029 cases, she said. A 632-MW combined cycle plant in Connecticut is far from the study area and therefore modeled offline, while a 123-MW solar farm connecting into the Albion Road 115-kV substation in Maine is modeled at about 32 MW, or 26% of nameplate.

In addition, four generators have been set as out-of-service in the 2029 cases, with one generator in New Hampshire (Schiller 4 at about 48 MW) fully delisted for the second consecutive FCA, which is the cutoff for considering the resource unavailable for dispatch when performing a Needs Assessment. If a resource does not operate for three calendar years in a row, it is deemed to be retired.

The New Hampshire 2029 Needs Assessment will consider sensitivity study scenarios of the unavailability of all major generators in Central New Hampshire, as well as the addition of the 1,090-MW New England Clean Energy Connect (NECEC) project that would deliver Canadian hydropower and wind energy to the Larrabee Road 115-kV substation in Maine. NECEC was proposed in response to a solicitation by Massachusetts utilities.

Although NECEC does not yet have an approved contract from Massachusetts regulators, ISO-NE recognizes the project may be approved prior to or soon after the completion of the Needs Assessment, Zhang said.

In addition, the RTO will examine the unavailability of one Comerford and one Moore hydro generator.

The study models photovoltaic generation based on the draft 2019 CELT forecast.

“And when we studied generation unavailable, we studied generation unavailable in the neighboring area,” Zhang said. “All interface transfers are within their limits, demonstrating that the established reserves are acceptable.”

The RTO plans to post the updated 2029 Needs Assessment intermediate study files in Q3 2019. The assessment is expected to be completed by Q3 or Q4 2019, she said.

Emergency Actions Eyed to Address Potential Shortfall in Operable Capacity

ISO-NE projects the region’s net installed capacity requirements (ICRs) will increase by 480 MW by 2028 and that operating procedures could be needed to overcome a shortage of “operable” capacity.

Those were some of the highlights of a presentation the RTO gave the PAC on resource adequacy studies to be included in the 2019 Regional System Plan.

Peter Wong, the RTO’s manager of studies and assessment, said net ICR — 33,390 MW this year — is projected to increase to 33,870 MW by 2028.

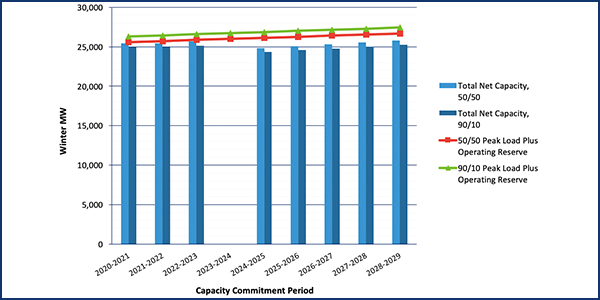

Wong said the 34,839 MW of “known resources,” based on CSOs from FCA 13, are sufficient to meet the net ICR values through the 2028/29 capacity commitment period.

A comparison of the representative net ICRs with the FCA 13 resources plus the energy efficiency forecast shows a surplus of 2,291 MW in 2029, assuming no resource retirements, he said.

However, the RTO’s analysis of “operable” capacity — which deducts unplanned generator outages and gas-fired generation that may not be able to obtain fuel during peak winter periods — indicates the region may have to rely on load or capacity relief measures under Operating Procedure 4 (OP-4) to avoid shortfalls.

The analysis deducted 2,100 MW from the summer capacity based on historical unplanned outages, and 8,600 MW in winter based on the highest planned and unplanned generator outages during 2014-2018 and the highest amount of gas-fired generation at risk during the three-week winter peak.

Under 90/10 peak load conditions, the region could have operable capacity shortfalls of -1,150 to -2,500 MW during the summer and -1,370 to -2,500 MW during the winter.

Assuming 50/50 peak load conditions, New England could fall short of operable capacity during the winter peak for the entire study period and during the summer starting with delivery year 2024/25. Operable capacity shortfalls range from -310 to -470 MW during the summer and -160 to -1,200 MW during the winter.

The RTO said OP-4 actions of up to Action 6 (a 5% voltage reduction) could be needed to meet 50/50 loads and up to Action 9 (requests of all generation not contractually available to market participants and voluntary load curtailments by large industrial and commercial customers) to serve 90/10 loads.

Other operating procedures anticipated include depleting 10- and 30-minute operating reserves and importing power from other regions.

Wong said the RTO is anticipating a possible change in what has historically been a summer-peaking region.

“We are reviewing the growth in demand-side resources and the penetration of PV both behind the meter and in front of the meter, and the penetration of heat pumps,” Wong said. “Penetration of PV is not only shifting the time of the daily peak; it is possible that the system will shift to dual-peaking and then to a winter-peaking system.”

The Power Supply Planning Committee will conduct a final review of all assumptions on June 20 and July 25 and will review ISO-NE recommendation of ICR values Aug. 9 and Aug. 29 ahead of a Reliability Committee review and vote on ICR values on Aug. 20 and Sept. 25.

The Participants Committee will review and vote on the recommended ICR values Oct. 4, which will be filed with FERC by Nov. 5.

— Michael Kuser