By Michael Kuser and Robert Mullin

ISO-NE floated a portion of its long-term market proposal to address fuel supply constraints, and five stakeholders presented their own concepts at the June 10-12 meeting of New England Power Pool’s Markets Committee.

The RTO faces an October deadline to file a market design with FERC that permanently addresses the regional fuel supply issue — specifically winter scenarios when natural gas supplies are limited.

In March, the RTO filed an interim proposal with the commission to address winter energy security for the commitment periods covered by Forward Capacity Auctions 14 (2023/24) and 15 (2024/25). That plan would “provide incremental compensation to resources that maintain inventoried energy during cold periods when winter energy security is most stressed” (ER19-1428). (See ISO-NE Filing, Whitepaper Address Energy Security.)

The interim proposal consists of five core components, including a two-settlement structure, a forward rate, a spot rate, trigger conditions (such as extended cold snaps) and a maximum duration for compensation. But some stakeholders have found the plan to be unduly complex, with the Massachusetts attorney general contending it represents the most dramatic change to the energy and ancillary services markets since their inception.

Keeping it ‘In Market’

ISO-NE’s proposed long-term solution looks to be no less complex — and transformative — than its short-term one. Senior Market Designer Andrew Gillespie’s presentation last week focused on just a portion of the plan — a proposal to create day-ahead ancillary services products intended to ensure that in-market processes begin to cover more of the RTO’s next-day operating requirements.

“Meeting these requirements via ‘in-market’ awards improves resources’ incentives to arrange energy supplies facing uncertainty,” the presentation said.

ISO-NE’s proposal calls for the creation of an hourly energy call option: option sellers would offer resources in hope of clearing in the day-ahead option market. As the buyer of the option, the RTO would specify an option price for each hourly interval before submission of option offers, which would occur in concert with submission of hourly energy offers. A resource could submit offers for both options and energy for the same hours, subject to limitations based on its physical parameters.

A resource with a cleared day-ahead option would then have an option position open for a given interval, which would be “closed out” at the real-time LMP for that interval.

“If the real-time LMP is greater than the strike price, the unit will be debited an amount equal to the product of the option quantity and the difference between the real-time LMP and the strike price,” the presentation explained.

The resource would also be credited for real-time energy and reserves supplied at applicable real-time prices.

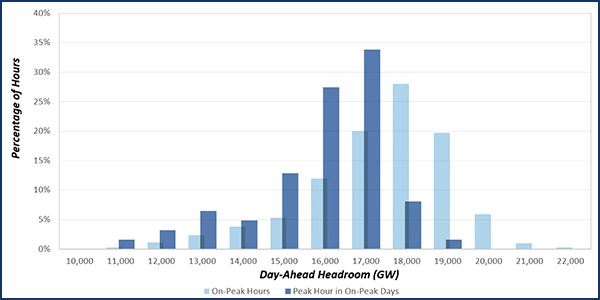

Day-ahead headroom is the difference between the sum of day-ahead schedule amounts and the sum of real-time economic maximum values for the winter on-peak hours. | ISO-NE

ISO-NE expects that the total volume of call options it procures will meet day-ahead ancillary services requirements.

“These amounts would be based, at a minimum, on the procedures currently applied by the ISO in developing a reliable next-day operating plan,” ISO-NE said.

From a supplier’s perspective, Gillespie’s presentation points out, the option is on real-time energy — not a specific real-time ancillary service; regardless of why the option was awarded, it will still be settled against the real-time LMP.

The RTO commissioned Analysis Group to provide some context on how the proposed changes might affect energy market outcomes. Company principal Todd Schatzki on Wednesday said its study concluded that the proposed improvements could change the way market participants make resource decisions and change economic offers in ways that improve energy security.

Gillespie also noted that the RTO is reviewing a stakeholder suggestion to develop its proposed Multi-Day Ahead Market (M-DAM) separately, after the rest of the energy security improvements are filed with FERC in October.

Massachusetts AG: Simpler, More Physical

In a proposal prepared by London Economics, the Massachusetts attorney general’s office recommended a simple auction format of sealed bids with a uniform clearing price.

Marie Fagan of London Economics described the Forward Stored Energy Reserve (FSER) proposal as a limited amount of insurance for a limited challenge; she said details on the timing of the auction and other matters would be discussed at the July 8-10 MC meeting.

The pros of a uniform clearing price? Each bidder that clears the auction is paid the same price as the highest-cost clearing bid. Bidders can also submit low bids at short-run marginal cost (SRMC) for low-cost (infra-marginal) plants, ensuring they will be chosen.

The Massachusetts attorney general’s office prefers a simple auction wherein bids vary depending on bidders’ independent evaluations of costs and other factors, as well as the strike price the bidder wants to offer. | London Economics

But the proposal acknowledged one potential negative outcome of a uniform clearing price — that a bidder could engage in portfolio bidding, raising the bid price over SRMC for plants it expects to be marginal.

London questioned whether ISO-NE’s proposal will be effective from a reliability or cost perspective. It said the FSER is a simple and smaller-scale alternative to the RTO’s complex scheme, helping preserve the market signal when supplies are tight.

NextEra: Reserve Products

NextEra Energy Resources proposed the creation of replacement energy reserve (RER) and generation contingency reserve (GCR) products to be purchased by ISO-NE in the day-ahead market.

NextEra’s Michelle Gardner emphasized that both RER and GCR would be physical products, not financial call options, and as such could increase real-time energy prices when fuel reserves are low.

“Resources that sell the call options would have incentives for next-day fuel arrangements,” NextEra said of ISO-NE’s proposal. “However, the extra incentives are weak at best. They depend on assumptions about lumpy offers and risk aversion. One simply cannot expect a strong response absent a fundamental change to real-time demand.”

If done incorrectly, a seasonal forward market is likely to depress energy market prices and provide the wrong incentives, NextEra said. A physical RER, coupled with the right forward incentives, is key, it said.

Calpine: More Precise; More Cautious

Calpine — which has long suggested that the RTO acted in haste in not allowing the market time to work through its energy security issues — presented an energy security concept dubbed Forward Enhanced Reserves Market, which would procure fuel-secure capacity for the winter months three years prior to the obligation year.

By qualifying resources based on their ability to contract for stored fuel or readily-used stored energy, Calpine proposes that suppliers bid at auction for a total minimum or maximum amount of megawatt-hours they will commit to offer off of stored fuel during an Operating Procedure 21, which is activated when the RTO declares an energy emergency event.

Rebecca Hunter, Calpine senior analyst for government and regulatory affairs, said the benefits of its market design include: fuel security through a diverse pool of resources; timely transition of the evolving resource mix; investment in the existing fuel infrastructure; and market design changes in critical winter months only.

Energy Market Advisors: Use Today or Save for Later?

Brian Forshaw presented a concept by Energy Market Advisors, which has concluded that ISO-NE’s market suffers from:

- Misaligned incentives: Resources lack incentive to procure and maintain energy supplies that may be needed in the future.

- Operational uncertainty: The system may not have sufficient energy available to withstand extended supply losses during winter.

- Inefficient schedules: Energy supplies can be depleted prematurely even when stored energy may be more valuable in the future.

Forshaw’s presentation posed the hypothetical question of whether the RTO should “use stored energy today or save it for later when it may be more valuable?”

“How we answer this question has significant (and differing) impacts for resource owners, system operators and electric consumers,” the company said, concluding ISO-NE should primarily focus on addressing those problems as quickly and efficiently as possible. Forshaw cautioned the RTO against implementing M-DAM and seasonal forward procurement at the same time as day-ahead enhancements, contending that would significantly complicate stakeholders’ development, and FERC’s evaluation of such significant changes.

FirstLight: Filling Buckets

Tom Kaslow of FirstLight, owner of the largest pumped hydro facility in the region, presented his firm’s concept for defining energy security, which asks the RTO to “connect the dots” between fuel security and resource adequacy by ensuring that the latter is backed by sufficient fuel storage. Kaslow’s presentation posed the question in terms of generator fuel tanks, which he termed “buckets”: How many buckets need to be filled, he asked, against how many can be filled?

“If the aggregate gas-only generator winter capability exceeds the region’s capability to access gas to support simultaneous generation at such resources, their actual reliability support to meet winter peak load is less than their aggregate megawatts of capability,” the presentation said.

Based on FCA 13-related values, being resource adequate at the summer peak may not assure enough gas storage to be resource adequate at the winter peak. | FirstLight

FirstLight recommends ISO-NE “establish the highest level of aggregate winter gas-only capability that can be simultaneously fueled at winter peak demand” and give capacity credit to gas-only resources that have firm transportation rights or contracted priority to take LNG during winter.

“Limit qualified gas-only winter capacity on the rest of the gas-only fleet to the level of such generation that can simultaneously operate,” FirstLight urges.

By assuring that each procured megawatt can be fueled, FirstLight says, ISO-NE can avoid sending inaccurate market signals at times when winter capacity is actually not in surplus. At the same time, it will provide efficient longer-term signals for resources to install dual-fuel capability, contract for pipeline transportation or obtain priority access to LNG, it said.