By Christen Smith

Shell Energy wants a seat at the GreenHat Energy settlement table, saying it is “uniquely situated” in the proceeding and could bear a disproportionate financial burden based on its outcome.

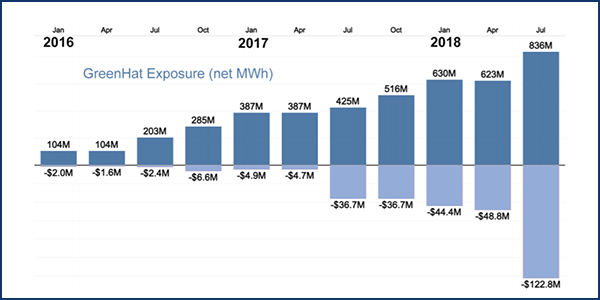

In its request for rehearing filed Friday, Shell argued FERC erred when it dismissed more than a score of late-filed motions from intervenors seeking to participate in the unwinding of GreenHat’s financial transmission rights portfolio. The company was declared in default in June 2018 after it failed to make good on its mounting losses.

“Departing from longstanding FERC policy against settlements that may have an impact on others not present during the negotiations, the commission has initiated a course of action that will allow a handful of parties to decide” the best way to liquidate GreenHat’s portfolio, Shell said (ER18-2068). PJM has said having to liquidate the portfolio under existing rules could cost members $430 million or more.

On June 5, the commission gave RTO members 90 days to settle disputes about how to move forward before kicking off a paper hearing on PJM’s request to clarify FERC’s ruling rejecting the waiver. (See FERC: PJM Settle Disputes Before GreenHat Hearing.)

On Monday, Chief Administrative Law Judge Carmen A. Cintron canceled a settlement conference scheduled for Wednesday “to allow more time to prepare for future conferences.” Cintron said the cancellation would not affect a conference set for July 26.

Shell was among more than 20 petitioners that filed after the comment period for PJM’s waiver passed. FERC rejected the late filings, saying none demonstrated “requisite good cause for late intervention.”

But Shell says a PJM Tariff provision caused its tardiness, a circumstance that it says none of the other petitioners face.

“Shell Energy entered into three bilateral transactions involving transfers of a portion of GreenHat’s now defaulted FTR portfolio to Shell Energy and back to GreenHat,” the company wrote. “As a result, PJM informed Shell Energy that it would seek guarantee and indemnification from Shell Energy for the portion of GreenHat’s FTR portfolio that was so transferred. Liquidation of GreenHat’s FTR portfolio could substantially affect the amount sought by PJM under the guarantee and indemnification claim.” (See Shell Energy Seeks to Avoid Liability in GreenHat Trades.)

Shell says PJM didn’t tell the company it would be subject to this clause until after the comment period passed and that no other party participating in the settlement discussions could “adequately represent its interests.”

“Because any settlement to resolve issues related to the massive GreenHat default will necessarily impact all PJM members subject to default allocation assessment (and, in turn, ratepayers), excluding Shell Energy and others from settlement negotiations among only a few parties is unlikely to result in a settlement that is in the public interest,” the company said.

Shell further argued that its participation would not “unfairly prejudice or burden” the allowed parties, none of whom opposed its intervention.

“As Shell Energy originally explained, it is not presenting new evidence or law, nor altering any previously established procedural schedule,” the company wrote. “Shell Energy accepts the record as it stands.”