ISO-NE COO Vamsi Chadalavada told the New England Power Pool Participants Committee that average day-ahead cleared physical energy during peak hours for July was 99.8% of forecasted load, up from 99.1% during June. “As far as I can recall, that’s about the highest that we’ve seen over the past few years,” he said. [Editor’s Note: Chadalavada approved his comments for publication after the PC meeting.]

The RTO prefers to fill its projected load through day-ahead awards because they maximize flexibility and minimize costs. Once the day-ahead market closes, the RTO’s choices are reduced because long-lead-time generators may not be available, resulting in greater reliance on more expensive, fast-start generators.

Daily net commitment period compensation (NCPC) payments for July were $2.7 million, up $1 million from June. Chadalavada said the payments were mostly the result of high loads in the Southeast Massachusetts/Rhode Island area and transmission outages on two 345-kV lines in Southern Maine.

Chadalavada said the SEMA/RI commitments are the result of a lack of a large generator in the load zone following the retirement of the Pilgrim nuclear plant.

“The need for second contingency protection in SEMA/RI is higher at loads greater than 20,000 MW,” he said.

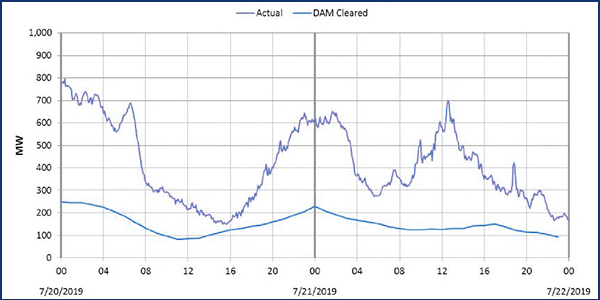

Chadalavada also discussed the July 20-21 heat wave, which resulted in peak loads of more than 24,100 MW for the hour ending 18:00 on both days. The peak for the month, however, came July 30, when load hit 24,300 MW at HE 18:00.

Chadalavada said actual conditions on July 20 were close to the weather forecasts from the day before, but the weather forecasts the RTO relies on overestimated July 21 dewpoints by 3 to 4 degrees, representing 800 to 1,000 MW of load.

About 2,000 MW of generation self-scheduled on July 20 and 400 MW on July 21 to perform “Claim Capability Audits.” There also were some hours of negative prices in Northern Maine driven by New Brunswick imports and wind generation.

That, combined with deviations from day-ahead interchange and wind production schedules, resulted in LMPs ranging from $20 to $60/MWh.

On July 20, there were “substantial amounts of energy in real time that were not part of the day-ahead clear. So, the combination of all of these factors led to lower LMPs than maybe one would expect for a hot weekend,” he said.

Chadalavada also reminded stakeholders of a public meeting Sept. 12 in Boston on Regional System Plan 19. Stakeholder comments on the plan will be reviewed by the Planning Advisory Committee on Thursday.

PC OKs Revisions to Import Capacity Rules

The PC on Friday approved changes to the requirements for submitting external transactions for capacity imports, a move that ISO-NE said will streamline the procedure and align it with its Pay-for-Performance program.

The committee approved without opposition revisions to Market Rule 1, Manual M-11 (Market Operations) and Operating Procedure 9 (Scheduling and Dispatch of External Transactions), as recommended by the Markets Committee at its July 8-10 meeting. (See NEPOOL Markets Committee Briefs: July 8-10, 2019.)

The committee also approved revisions to OP-5 (Resource Maintenance and Outage Scheduling) over the objections of numerous generators, including Calpine, Dynegy and FirstLight Power. The changes, which were recommended by the Reliability Committee at its July 16-17 meeting, cleared the PC with 71.6% support. (See NEPOOL RC/TC Briefs: July 16-17, 2019.)

The changes to MR 1 and OP-9 were prompted by a new Enhanced Energy Scheduling (EES) software platform scheduled for implementation by October. They also include clean-ups to remove outdated provisions relating to coordinated transaction scheduling (CTS) and dynamic scheduling.

The RTO identified four primary changes:

- Day-ahead and real-time energy offers will no longer have to be submitted with the same transaction;

- A day-ahead transaction will not be required when the interface’s import transfer capability is zero;

- Real-time transactions will no longer be required for capacity that wheels through NYISO to a CTS interface; and

- All capacity imports backed by an external resource will have the same requirements pertaining to resource outages (i.e., to notify ISO-NE of outages and comply with the requirements of the native control area).

The RTO said the revisions to OP-5 are conforming changes to align with the revised market rule language for capacity imports. They will require market participants to notify the RTO if there is a reduction in capability that impacts the capacity supply obligation of the import resource(s).

Brett Kruse, vice president of governmental and regulatory affairs for Calpine, reiterated his previous opposition.

“We do not believe that external capacity should be counted as capacity unless it’s a specific generator with some form of firm point-to-point transmission or some other firm transmission product to ensure deliverability,” Kruse said in a statement he approved for publication after the PC meeting. “So even though that’s been longstanding [policy] — we allow that kind of stuff in New England — we’ll always vote against that.”

Consent Agenda

The committee also approved several measures on its consent agenda during its meeting, which lasted less than an hour.

- Revisions to MR 1 and Tariff section 1.2.2 requiring solar resources to provide meteorological and operational data to support forecasting. It also consolidates in MR 1 the wind data forecasting requirements, which will be moved from Tariff Schedule 22.

- Revisions to OP-8 to delete obsolete NERC provisions and align the procedure with Northeast Power Coordinating Council Directory No. 5.

- Revisions to OP-13 and Appendix B to simplify references and make minor clarifications to terminology regarding under-frequency load shedding (UFLS) islands. Also clarifies compensatory load shed requirements and incorporates references to NERC’s regional reliability standard for under-frequency set points.

- Revisions to OP-16 Appendix K regarding monthly ISO-NE updates and quarterly transmission planner updates to the short-circuit base cases. Reorganizes the document regarding generators and transmission owners.

- Revisions to OP-2 Appendix C regarding the provision of contact information in requests for electronic copies of the equipment maintenance request form.

- Revisions to OP-24 reflecting the change in Appendix C. The original diagram of relay outage locations was replaced with a list of transmission facilities for which TOs are reporting protection settings, characteristics, failures or degradation.

- Revisions to OP-12 and Appendix D to clarify local control center actions for providing voltage schedules to generators.

- Revisions to section I.2.2 of the Tariff to incorporate definitions for interconnection reliability operating limit (IROL) and system operating limit (SOL).

– Rich Heidorn Jr.