If you’re a regular with RTO Insider, Greentech Media and the like, you’ve likely read the accusation that PJM is screwing batteries (motive a mystery).1

Here’s the backstory. PJM has a capacity market that basically requires that a generator or equivalent resource be “on call” 24 hours a day throughout the year. This Capacity Performance construct arose after the 2014 polar vortex, when it turns out a lot of generators were getting paid for capacity that wasn’t actually available when needed.

So CP basically says you as a generator must be available 8,760 hours a year unless you’ve been preapproved for doing maintenance or refueling. FERC in 2015 found this just and reasonable “because it creates the same expectations for all Capacity Performance resources (i.e., the expectation that such resources will be available to provide energy and reserves when called upon), without regard to technology type.”2

The Big Gift Horse

Flash forward to late last year when, in a big gift horse to the battery industry, PJM proposed that batteries only must provide capacity 10 hours a day, giving them a pass on the other 14 hours in a day. In other words, batteries would have to provide capacity for less than half the time as other dispatchable resources.

Now, the battery industry didn’t take this big gift horse lying down.

No. Instead it argues that somehow PJM screwed it.

Its arguments to FERC are all over the map, but the driver is that batteries don’t make economic sense unless you require an even smaller supply/discharge obligation like four to six hours. Of course, the economics of a resource should have nothing to do with its value as a resource.3

The Latest Salvo

The battery industry’s latest salvo is a study by its consultant purporting to show that there could be up to 4,000 MW of batteries in PJM providing only four hours a day of capacity without reducing overall system reliability.4

Assuming the study is valid now and for the future, the obvious question is “so what?”

Why should only batteries get the privilege of having to provide capacity for just four hours a day and be excused from the other 20? Every generator in PJM would like to get that same privilege and avoid capacity commitment for 20 hours. It would be the height of discrimination to award that privilege to only one technology such as batteries.

By the way, the battery industry says that four hours are what batteries are “technically capable of,” invoking that phrase from FERC Order 841. Of course, batteries also are “technically capable of” a 10-hour duration, as well as a one-hour duration and, frankly, a one-minute duration.

So, should a 10-MWh battery set up to discharge in one minute be given a capacity rating of 600 MW? Nonsense.

More Problems

The problems with batteries go beyond the minimum number of commitment hours. We need to remember that this minimum is a calculation based on maximum output over the period. Maximum output assumes the battery is fully charged when emergency conditions begin.

This is an unrealistic assumption. The economics of a battery are based in part on multiple revenue sources (aka “value stacking”). If used for energy arbitrage, the battery is charging when its operator thinks prices are relatively low and discharging when its operator thinks prices are relatively high. If used for frequency regulation, the battery is charging or discharging in response to the signal (and it can never be fully charged, or it couldn’t charge in response to the signal).

The upshot of this is that a battery is seldom “full,” meaning it’s able to provide its committed capacity when called upon. So at any given time, it’s unlikely to provide its committed capacity for the supposedly committed hours.

The problem is likely to be acute during peak periods when energy prices are relatively high. Battery owners will be looking to discharge during the peak afternoon hours. And they’ll all be doing the same thing at the same time.

So if there’s an emergency later in the day, not just one battery but all of them will have no or little charge left. And if they start charging during that emergency, they will make matters worse by appearing on the system as more load to be served.

Where does that electricity come from? Cue the pixie dust.

And here’s another problem. Battery advocates assume that over any 24-hour period, batteries can recharge to be prepared for the next day. And in a 100% renewable scenario, they necessarily assume that there are solar and wind renewable resources available to do that day after day as needed.

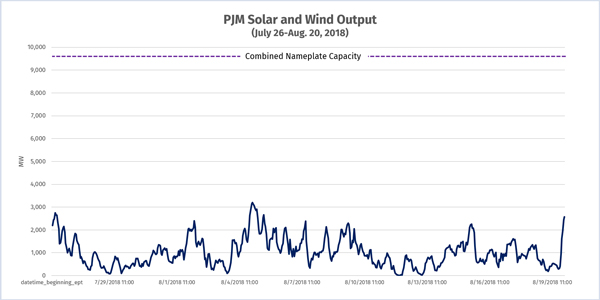

This is another unrealistic assumption. There are prolonged periods of little solar and wind generation. Last summer in PJM for example, for more than three weeks, there was relatively little solar and wind generation. Solar and wind generation averaged about 10% of their combined nameplate capacity of 9,694 MW.5 This chart shows the hourly generation:

Absent traditional resources, where does the generation come from to charge batteries every day? Cue more pixie dust.

Hawaiian Punch

We got a little taste of the problems from Hawaii last month. Here’s the headline:6

“Island-wide outage on Kaua’i: Clouds block solar recovery after generator’s cable failure”

Basically, with clouds blocking the sun, the Kaua’i Island Utility Cooperative had to rely on its battery systems, but doing that discharged the batteries in the afternoon, so they weren’t available in the evening, when of course solar generation wasn’t available either. Rolling blackouts were necessary.

This is not to knock the cooperative, but rather to show that increasing reliance on renewable resources and batteries presents new challenges.

Media Fantasies

Misleading information is rampant in the media. Just yesterday, The Wall Street Journal ran a story “Giant Batteries Boost Wind and Solar Plans,” including a statement that the utility ScottishPower generates “all of its power from renewable sources after selling its last fossil fuel assets in January.” The implication is that this utility is reliably serving its customers exclusively with renewable sources.

The reality is that ScottishPower’s generation unit has sold off non-renewable assets. ScottishPower continues to serve its retail customers by purchasing capacity and energy from others. For example, in the referenced January asset sale, ScottishPower is purchasing natural gas capacity back from the asset buyer.7 The last reported fuel mix for ScottishPower’s retail sales shows that 73% of its supply is coal and natural gas, 10% is nuclear and only 15% is renewable.8

A Dose of Reality from MIT

NPR recently ran an interview with Yet-Ming Chiang, professor of materials science and engineering at MIT, who founded several battery companies. This part of the interview is especially instructive:9

“SHAPIRO [NPR]: I know the cost [of batteries] has been prohibitive for a long time, and it’s been coming down recently. When do you think this technology will actually be reasonably affordable in a lot of places?

CHIANG: Yes, I think the answer to that question really depends on what the variability in the electricity generation is that we need to cover. Is it just a few hours of the day, for instance in Arizona, or is it a few days or up to a week, right? Today, an electric vehicle battery pack using lithium-ion batteries costs us about $200/kWh. Over time, we can see that dropping to 100 or somewhat less than that.

But with lithium-ion batteries, it’s difficult for me to imagine the cost getting down to, let’s say $10 or $20/kWh. It turns out that’s the price range we need for storing electricity for the grid over several days. And in order to accomplish that, we really need to look at other battery materials other than lithium-ion batteries.”

So the key takeaway, from this MIT battery expert, is that we don’t know, at present, how to economically and reliably replace traditional resources.

The Answer isn’t Special Treatment

The answer isn’t to give batteries a pass on reliability criteria because they facilitate green energy. Support for green energy ends when blackouts begin. That’s when the torches and pitchforks come out.

1- https://rtoinsider.com/study-challenges-pjm-energy-storage-rule-140531/; https://pv-magazine-usa.com/2019/07/17/pjms-proposed-10-hour-storage-minimum-debunked/; https://energynews.us/2019/07/30/southeast/with-new-study-critics-push-back-on-pjms-proposed-10-hour-storage-rule/.

2- PJM Interconnection, L.L.C., 151 FERC ¶ 61,208, at P 99 (2015) (emphasis added).

3- I’ve written about the overall battery value proposition before, here http://energy-counsel.com/docs/Grid-Batteries-Kool-Aid-Once-More-with-Feeling-RTO-Insider-12-5-17.pdf, and here http://energy-counsel.com/docs/Battery-Storage-Drinking-the-Electric-Kool-Aid-Fortnightly-January-2016.pdf.

4-http://energystorage.org/system/files/resources/astrape_study_on_pjm_capacity_value_of_storage.pdf.

5- Solar and wind generation is from PJM’s Data Miner 2 here, http://dataminer2.pjm.com/feed/gen_by_fuel (average hourly generation in the chart period was 1,018 MW). Solar and wind nameplate capacity is here, http://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2018/2018q2-som-pjm-sec8.pdf (page 348).

7- https://www.drax.com/investors/acquisition-agreement-amended-mitigate-risk-2019-capacity-payments/.

8- https://www.scottishpower.co.uk/about-us/performance/fuel-mix.

9- https://www.npr.org/2019/07/22/744206049/a-new-battery-could-be-key-to-cutting-carbon-emissions-slowing-climate-change (emphasis added).