The New England Power Pool Markets Committee met for three days in Meredith, N.H., last week to discuss ISO-NE’s proposed energy security improvements (ESI), continuing talks that began in April.

The MC has been adding days to its meeting schedule all summer to discuss the RTO’s long-term market proposal to address fuel supply constraints, market impacts of proposed rule changes, as well as various stakeholder concepts to achieve the same. (See “Assessing ESI Impacts,” NEPOOL Markets Committee Briefs: July 8-10, 2019.)

Options and Constraint Pricing

Ahead of a mandatory Oct. 15 FERC filing on the improvements, ISO-NE Senior Market Designer Andrew Gillespie reviewed various aspects of the RTO’s market-based design for ESI and led a discussion on the role of the forecast energy requirement (FER) and close-out parameters. [Editor’s Note: All quotes in this article were drawn from participants’ presentations or were approved by the speakers afterward.]

Slide 19 of the presentation answered a stakeholder question on whether the RTO’s day-ahead energy call option construct is a purely financial option, as compared to the physical day-ahead sale of energy.

Gillespie said physical DA energy sales and DA energy call options have the same financial and physical elements, and that a physical supply resource can cover its day-ahead position by delivering energy in real time in an amount equal to its day-ahead position.

In the Reserve Adequacy Analysis, the FER constraint is used to meet the expected real-time energy demand, which may result in additional unit commitments.

Both day-ahead energy from physical supply resources and energy call options awarded to physical supply resources would contribute to satisfying the FER demand quantity and would be paid the FER shadow price. Virtual supplies (increment offers) are not eligible.

The settlement close-out charge would equal the option award amount times the positive difference between the system real-time LMP and the system energy call option strike price.

“The thing that we set up way in the beginning, on slide 13 of the presentation, is that if you’re helping meet a constraint, you get paid the shadow price, and that same principle applies here,” Gillespie said, referring to slide 26, which explains that the shadow price is the FER price.

The RTO’s presentation described three reasons for including the FER constraint in the day-ahead market:

- Ensuring that the market produces a reliable next-day operating plan that can meet the FER;

- Improving energy security by providing physical supply that does not receive a day-ahead award but is expected to be needed to meet real-time demand; and

- Improving price formation, by preventing the impact on day-ahead market compensation to resources that clear for energy.

External Market Monitor Feedback

External Market Monitor David Patton, of Potomac Economics, said the proposed day-ahead market option products “are going to have a lot of value.”

NEPOOL Chair Nancy Chafetz, of Customized Energy Solutions, had requested his feedback on the RTO’s energy security proposal.

The RTO’s new option “products are going to eliminate what amounts to out-of-market actions being taken both by the models through physical constraints that are imposed in the day-ahead market, and by operators, and result in prices that more reasonably reflect the full set of requirements in the day-ahead,” Patton said.

“Ultimately, to the extent that we are recognizing our requirements in the day-ahead timeframe, it provides schedule and revenue certainty to resources that have to arrange fuel, so I think it does help on the fuel security side,” he said.

Patton said the other options also will be beneficial. Regarding the forecast energy option, he said “right now, to the extent that the day-ahead is under-scheduled, it puts an increased onus on the [Reserve Adequacy Analysis] process to resolve that by making out-of-market commitments, so this would help resolve that issue.”

Patton said he plans to have a fuller discussion on the ESI at the September 3-4 meeting of the MC.

ESI Impacts

Todd Schatzki of Analysis Group presented further analysis of impacts of ESI under scenarios reflecting different resource mixes, fuel resources and weather conditions.

Schatzki emphasized that the study is not a forecast or assessment of future market outcomes, but an analysis of impacts.

The impacts reflect the difference between outcomes under current market rules (CMR) and ESI, and some impacts may not be particularly sensitive to assumptions.

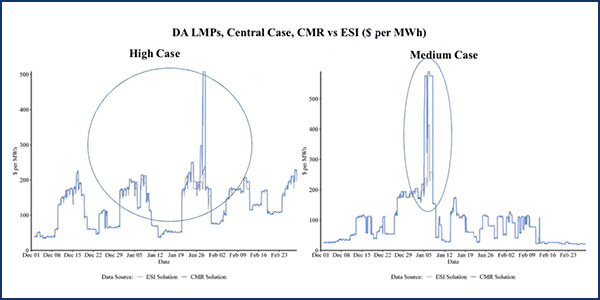

LMP reductions from incremental inventoried energy are larger in the medium case (based on winter 2017/18 with one extended cold-snap) than the high case (based on 2013/14, with multiple, shorter cold-snaps) leading to a larger reduction in total costs. | Analysis Group

Regarding the difference between medium- and high-case scenarios, Schatzki mentioned the impacts they are seeing on the energy and ancillary services markets.

A slide on LMP prices showed what appears to be the major driver of the difference between these cases, he said.

“If one looks at the high case, there are periods of particularly high prices, but in general what we see in terms of reductions in LMPs, with ESI as compared with CMR, those tend to be relatively smaller impacts that occur erratically across the winter given different substitutions or different availability of inventory,” Schatzki said.

“By contrast, in the medium case, where we see particularly high prices in certain hours under the current market rules, and those prices are really tamped down under ESI — and what exactly are the drivers of that we have not quite dove into … but we’re going to see different impacts across different cases and that impacts are really going to depend on the particulars of the market clearing in different hours,” he said.

Market Concepts

Michelle Gardner of NextEra Energy Resources presented proposed replacement energy reserve (RER) and generation contingency reserve (GCR) products, saying the core design was complete, but the company was still open to feedback.

“The real value in our mind is that this product is creating price signals in the real-time market, because it’s when we’re deploying SOR [strategic operating reserves] and using SOR that we then create a shortage, and that’s when we start to see higher prices translated in the real-time market,” Gardner said.

“Because we are re-optimizing in the real-time market and deploying SOR if needed to meet that higher value energy and operating reserve … that’s where we see the value in the pricing, because it is showing when those resources are needed,” she said.

Rebecca Hunter presented Calpine’s forward enhanced reserves market (FERM) proposal, which she said would properly value existing fuel-secure resources in the region and provide a forward price signal that incentivizes fuel supply arrangements or investments.

NextEra Energy proposed creating a strategic operating reserve (SOR) demand curve, which it said would address lumpiness issues and create a strong price signal. | NextEra Energy

FERM would procure fuel-secure megawatt-hours from Dec. 1 through March 15, three years prior to the obligation year, which “aligns it with the capacity market and the decision for when a resource would be leaving the market,” Hunter said.

The RTO would then need to procure a set amount of firm supply to back up the loss of that resource, she said.

There would be two auctions under the proposal: the first one year prior to the obligation start, and the second after the contract verification period of Oct. 1 in the prompt delivery year.

“So, there’s also an auction one year prior, recognizing the fact that the risk might have actually decreased for an uncleared FERM resource, and they’re now eligible to try and take on that [capacity supply] obligation,” Hunter said.

FERM would procure a diverse pool of megawatt-hours and tie the obligation to offering the stored energy under Operating Procedure 21 (subject to penalty), which is activated when the RTO declares an energy emergency event.

Hunter said that FERM tries to bridge a gap in today’s existing products by providing the RTO’s operations group with appropriate in-market tools to manage the grid reliably around forecasted fuel system constraints.

Jeffrey Bentz, New England States Committee on Electricity (NESCOE) director of analysis, reiterated the group’s doubts about the RTO trying to do “too much, too fast” on the fuel security issue.

One issue for NESCOE is that an option will get exercised at times when energy security is not an issue, which they say creates option risk for providers.

A potential solution, but not a NESCOE position at this time, would be to increase the strike price by 20%. “We think at this 20% level, there’s really minor, if any, decrease in incentive for resources to invest if they get the option,” Bentz said.

A higher strike price would shrink the option close-out value, and because offers reflect this settlement, a higher strike price would reduce offer prices and clearing prices. Furthermore, it would reduce the number of market participants whose marginal cost is greater than the strike price, which may make participation somewhat more attractive to these market participants, NESCOE said.

End Notes

The RTO’s director of NEPOOL relations, Allison DiGrande, and its assistant general counsel, Christopher Hamlen, repeated a presentation on proposed Tariff changes to clarify that a resource retained for fuel security will only be retained until the end of the fuel security need, and no longer than the two-year period allowed by FERC. (See “Time Limit on Fuel-security Resources,” NEPOOL Markets Committee Briefs: July 30, 2019.)

The MC will vote on the issue at its Sept. 3-4 meeting.

In addition, the committee referred a request to add search and sort functionality to public reports produced in the Generation Information System (GIS) to the GIS Operating Rules Working Group.

– Michael Kuser