ISO-NE Load Forecasting Manager Jonathan Black provided the New England Power Pool Reliability Committee last week with more details on the forecasting changes that contributed to a reduction in the installed capacity requirement (ICR) in the 2019 capacity, energy, loads and transmission (CELT) summer demand forecast.

Participants at last month’s Power Supply Planning Committee and the RC meetings requested more information on the load forecast changes, which produced a 1,250-MW reduction in net ICR for delivery year 2023/24.

The forecast cycle change (using macroeconomic assumptions from 2019 data vs. 2018) produced a reduction of 300 MW, while the use of a second weather variable (adding cooling degree days, in addition to the weighted temperature-humidity index previously used) caused an additional 855-MW drop.

The use of separate July and August peak load models rather than a combined July/August case was the only change to increase the ICR, responsible for a 45-MW boost.

Shortening the weather history period to 25 years from 40 years subtracted 140 MW. ISO-NE said it made the change primarily because wind speed data needed for the new winter demand model used for CELT 2019 was unavailable for all the years of the former 40-year period. The shorter history allows the RTO to keep a consistent historical weather period for both summer and winter monthly forecasts.

It is also more consistent with the practices of other grid operators such as NYISO (20 years) and PJM (25 years).

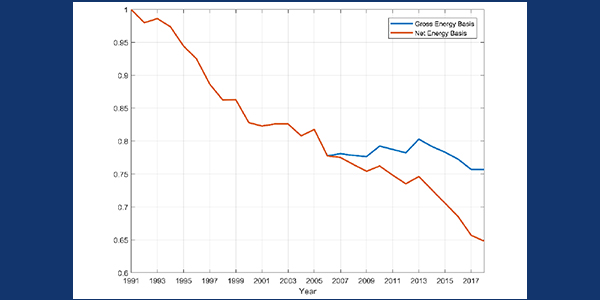

Black also discussed the reduction in the region’s energy intensity over the last two decades, largely caused by increased end-use efficiency driven by federal standards. Since 2005, he noted 45 mandatory Department of Energy efficiency standards have gone into effect.

The relationship between annual electric gigawatt-hours and regional gross state product has dropped by almost 25% since 1991 on a gross energy basis and 35% on a net energy basis, including the impact of behind-the-meter solar.

Evolving ICAP Requirements

Peter Wong, ISO-NE manager of resource studies and assessments, presented a review of the schedule for developing the “ICR-related values” for Forward Capacity Auction 14 (capacity commitment period 2023/24).

These values include the ICR; local resource adequacy requirement; transmission security analysis; and local sourcing requirement for import-constrained Southeast New England. Also included are the maximum capacity limit for the export-constrained capacity zones of Maine and Northern New England and the marginal reliability impact demand curves.

Including Mystic Units 8 and 9, the RTO has proposed an ICR of 33,431 MW and a net ICR of 32,490 MW after a 941-MW reduction for Hydro-Québec interconnection capability credits. That is a 1,260-MW reduction from the net ICR for FCA 13. (See “ICAP Requirements and Tie Benefits,” NEPOOL Reliability Committee Briefs: Aug. 20, 2019.)

If the RC approves the values Sept. 25 and the Participants Committee does on Oct. 4, the RTO plans to file the ICR-related values with FERC by Nov. 5 both including and excluding Mystic Units 8 and 9.

— Michael Kuser