Generators said yesterday that PJM’s expectations for its Capacity Performance product are unrealistic and its proposed penalties unduly punitive.

The remarks came during a nearly four-hour meeting in which PJM staff answered stakeholders’ questions and Market Monitor Joe Bowring provided details on the sensitivity analyses the Monitor is conducting on the proposal.

Capacity Performance resources would be required to guarantee their availability during Hot and Cold Weather Alerts and Maximum Emergency Generation Alerts. The resources would need to demonstrate they can produce their committed installed capacity for 16 hours for each of three consecutive days.

Resources would be allowed to include in their offers a risk premium based on the 7% pool-wide EFORd.

“To allow a premium above that would undo the incentives,” Chief Economist Paul Sotkiewicz explained. “There would be no incentive for [generator owners] to do anything [to improve performance]. They would just take a flier and hope they don’t get called.”

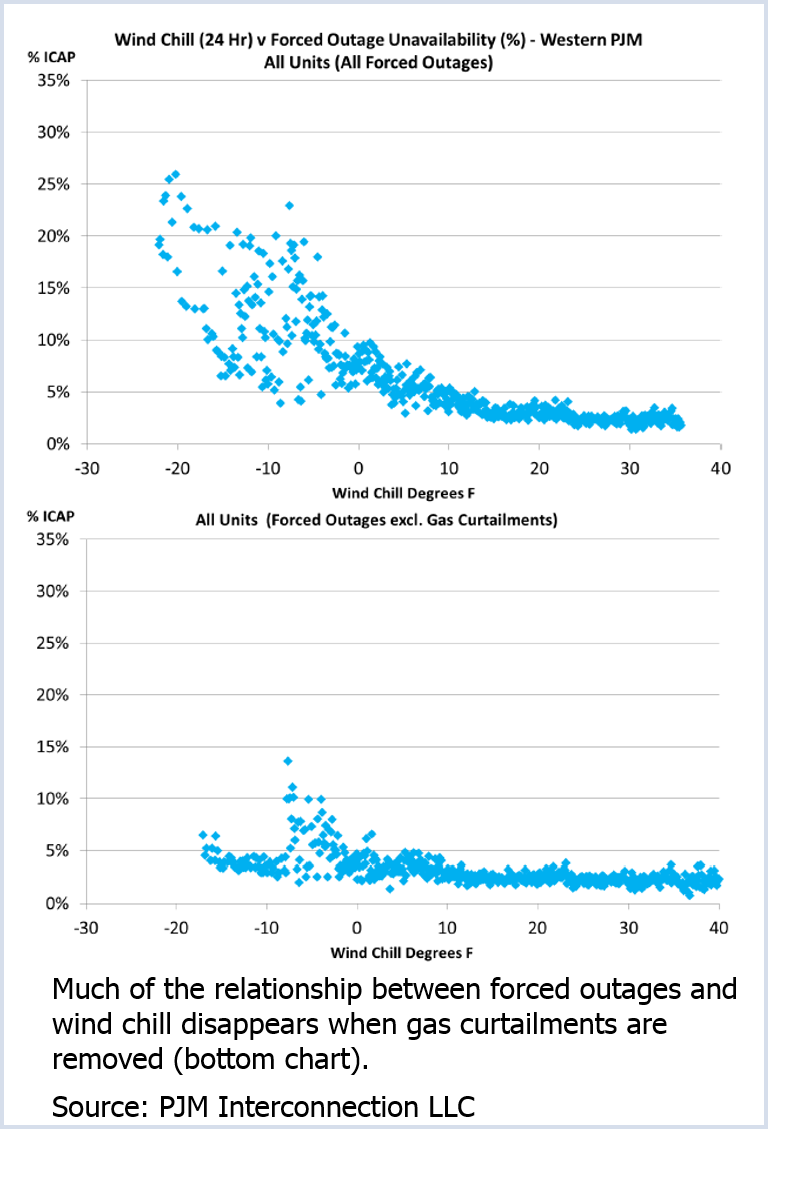

Jason Cox of Dynegy said PJM is attempting to make generators shoulder all risks, despite widely acknowledged challenges to obtaining gas during the coldest days of the winter.

“It sounds like PJM is not asking for a 7% EFORd unit, they’re requiring a 0% EFORd unit,” said Cox, citing the requirement that units be able to refill oil tanks during a polar vortex. “That seems unrealistic to me.”

PJM officials said they are taking steps to improve gas-electric coordination. PJM’s Chantal Hendrzak said staff is considering allowing generators to make intra-day changes in cost-based schedules to protect generators from having to accept the risk of gas-price volatility. Stakeholders also are considering changes in the $1,000/MWh offer cap, which some generators said their costs exceeded in January.

Non-performance Penalties

Capacity Performance resources that fail to deliver during the alerts would face a penalty based on the hourly LMP and the size of their shortfall. PJM proposed capping the penalties at 2.5 times the resource’s capacity revenues for the year.

PJM wants 85% of the summer peak demand met by Capacity Performance, with the remainder coming from existing Annual Capacity (renamed “Base Capacity”), Extended Summer and Limited Demand Response offerings.

Jason Minalga of Invenergy said generators unwilling to assume the risk of non-performance as a Capacity Performance resource would be “crowded out” of the market because of the 15% cap on non-Capacity Performance resources.

“Correct,” replied Andy Ott, PJM executive vice president for markets. “That’s an incentive to become Capacity Performance.”

“This is completely asymmetric,” responded Minalga, citing what he called the “heavy administrative” role of the RTO and Market Monitor in approving capacity auction offers.

James Wilson, consultant to state consumer advocates, said PJM’s assumption that no Base Capacity would be available during the winter peak was “overly conservative” and would result in excessive costs to load.

“We know [that assumption is] not right,” Wilson said. He suggested the use of a probabilistic analysis to estimate how much would be available.

PJM’s Tom Falin said the assumption was based on the risk at the 95% percentile of load. ”That’s the only level at which risk occurs,” he said.

Monitor’s Analysis

Bowring said he hopes to provide stakeholders next week with results from sensitivity analyses on how PJM’s proposal might affect clearing prices and quantities.

The Monitor said the analysis will look at three ways generators might improve their performance to meet PJM’s requirements:

- Securing firm gas service (estimated at $180/MW-day)

- Having dual-fuel capability with five days’ storage capacity ($48 to $165/MW-day)

- Five-day firm no-notice gas service ($10/MW-day, annualized)

To address withholding concerns, Bowring recommended capacity providers be required to submit “coupled” offers with different prices for Performance and Base products.

Schedule

Stakeholders will have until Sept. 17 to submit written comments on the proposal. The next meeting on the initiative is scheduled for Sept. 24.