MISO and IPPs asked FERC to dismiss a complaint by transmission customers seeking to overturn the results of the 2016/17 capacity auction.

By Amanda Durish Cook

MISO and independent power producers asked FERC on Wednesday to dismiss a complaint by transmission customers seeking to overturn the results of the RTO’s 2016/17 Planning Resource Auction (PRA).

The Sept. 8 complaint by the Coalition of MISO Transmission Customers claims MISO misapplied its Tariff, causing the South-North transfer limit to bind sooner that it should have, driving up prices in MISO North (EL16-112).

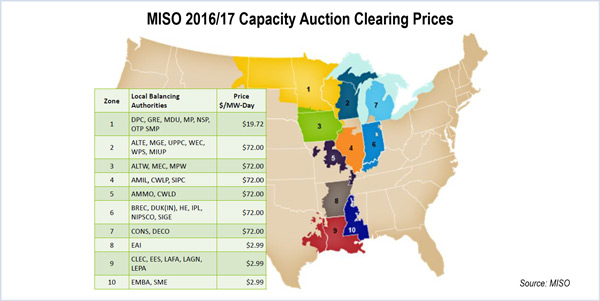

Prices in Zone 1 cleared at $19.72/MW-day and Zones 2, 3, 4, 5, 6 and 7 each cleared at $72/MW-day after MISO limited capacity imports from MISO South to 876 MW. MISO South cleared at $2.99/MW-day. (See MISO’s 4th Capacity Auction Results in Disparity.)

On Wednesday, MISO responded to the complaint, saying it is a “several-month-late challenge … and fails to demonstrate any Tariff violation.” MISO said it calculated the constraint properly and that the coalition raised no objections when the results were shared with stakeholders nearly a month before the auction.

The Independent Market Monitor filed comments backing MISO, saying the customers failed “to identify a single provision of the Tariff that MISO failed to abide by when MISO calculated” the constraint.

The Electric Power Supply Association filed a protest saying the complaint should be dismissed because it is based solely on the 2016/17 PRA results. “The [coalition] has not demonstrated any violation or wrongdoing as required under FERC Rule 206 that would support its request to unwind the results of the 2016/17 PRA,” the group wrote.

Dynegy also called for FERC to reject the complaint, which it said “ignores express provisions of the Tariff and the settlement” between MISO and SPP over the transfer limit.

Illinois Attorney General Lisa Madigan filed comments supporting the complaint. Eight state regulatory bodies are among the more than 35 intervenors as of this week. The Organization of MISO States also filed to intervene.

Excess Capacity Trapped?

The complaint was filed by McNees Wallace & Nurick, which represents industrial customers. The coalition said it is an ad hoc association of large industrial customers that consume more than 8 billion kWh of electricity annually.

The customers claim Entergy’s territories in Zones 8, 9 and 10 had excess capacity, but MISO’s transfer limit caused it to become trapped in the South, leading to the higher prices in the Northern zones. They argue the limit should have been increased by at least 206 MW, which would have led to north prices clearing at just $20/MW-day.

The coalition asked FERC to reset Northern clearing prices to $20/MW-day and order MISO to issue refunds from June 1, the beginning of the planning year. The customers also asked that FERC conduct an audit of the Monitor’s approval of offers in the PRA, alleging that the Monitor did not rein in unreasonably high going-forward costs.

Currently, MISO subtracts firm reservations from the 2,500-MW South-North limit negotiated with SPP. The customers argue those firm reservations are never going to be used in full.

“The firm transmission service reservations of 1,624 MW that MISO deducted from the available system capacity usage of 2,500 MW do not reflect actual power transfers from the MISO South to MISO Midwest region. Rather, the deductions reflect firm service that MISO has agreed to provide NRG Energy Inc. in order to allow NRG capacity resources located in the MISO South region to qualify as a capacity resource in PJM,” the complaint said. “There is no evidence that NRG is, in fact, using this firm transmission reservation during the 2016/17 planning year to actually flow energy from MISO South to MISO Midwest in such a way that NRG’s full transmission reservation should be deducted from the 2,500 MW total.”

The complainants say MISO “overstates the impact of firm transmission reservations” and does not consider “the actual or reasonably likely use of the firm transmission reservation.” The customers said the transfer limit problem was recognized in the IMM’s 2015 State of the Market report.

In its own filing Wednesday, NRG said that while “the MISO Tariff should expressly address how internal transmission constraints should be modeled, there is no evidence that MISO violated its existing Tariff.” If the commission grants the coalition’s request for relief, NRG said, it should require MISO to calculate the sub-regional constraints by only deducting pseudo-ties from the 2,500-MW limit.

The coalition asked FERC to fast-track its complaint, saying it wants a decision in time to implement changes before next year’s PRA.

Changes Being Discussed

MISO is already considering adjusting the South-North transfer limit in planning for next year’s auction. A draft proposal on the 2017/18 sub-regional limit is on the agenda for the Oct. 5 Resource Adequacy Subcommittee meeting. (See MISO Proposes Study to Measure Benefits of New North-South Tx.)

In its response to FERC, MISO said the “complaint raises more problems than it alleges to solve.”

“It also requires the assumption that market participants will act against their own economic interest in scheduling transmission,” the RTO said.