CARMEL, Ind. — MISO and PJM are not optimistic that they can use common assumptions in their interregional transmission planning.

MISO engineer Adam Solomon told the Planning Subcommittee Dec. 13 that while it is possible to make joint powerflow and economic models, they would not be based on a set of common assumptions. “We think we can make assumptions from both MISO and PJM using separate sensitivities,” Solomon said during a Dec. 13 Planning Subcommittee meeting.

In an April 21 order, FERC directed MISO and PJM to explore with stakeholders the possibility of a joint model that uses identical model assumptions and criteria for regional transmission planning processes (EL13-88).

MISO has maintained that a joint model would be difficult to accomplish, as it studies two, five and 10 years into the future, while PJM studies five, seven and eight years ahead. In addition, MISO uses local balancing areas for dispatch, while PJM uses a single balancing area. PJM also does not forecast generation retirements, while MISO includes forecasted generation retirements in its futures modeling.

The RTOs’ Oct. 25 informational filing to FERC detailed their reasoning as to why a single set of assumptions was infeasible. The RTOs told FERC that “most stakeholders agree with the RTOs’ position that requiring the RTOs to adopt the same assumptions and criteria when conducting regional transmission planning would create significant challenges, including substantial revisions to each RTO’s robust regional planning processes and cost allocation methodologies.”

But Northern Indiana Public Service Co., whose complaint prompted the FERC order, said in comments to MISO that the two RTOs need a joint model because their different study processes lead to projects being categorized inconsistently (e.g., reliability, public policy or economic). “However, tests of NERC reliability thermal or voltage violations have less disparity between RTOs. Reliability models typically have similar topology, base resource modeling and demand assumptions,” the utility said.

In a Nov. 15 filing with FERC, NIPSCO accused the RTOs’ of ignoring the commission’s directives. “The pattern of behavior shown by the RTOs … demonstrates that [they] are committed to interpreting the April 21 order as empowering the RTOs to eliminate the Coordinated System Plan Study for interregional planning, which is plainly contrary to the spirit, if not the letter, of the commission’s orders,” NIPSCO said.

At the Dec. 14 Planning Advisory Committee meeting, Adam McKinnie, chief utility economist for the Missouri Public Service Commission, asked MISO to create a common interregional model before it embarks on more studies, such as the MISO-SPP joint study running through the first quarter of 2017. (See MISO-SPP Study Scope Finalized; Stakeholders Doubtful Projects will Result.)

Ameren said MISO and PJM should use the same base models for system load conditions, such as light load, summer shoulder peak, winter peak and summer peak conditions. Other members, including Great River Energy, ITC Holdings, WPPI Energy and American Transmission Co. said they understood MISO’s reluctance to adopt identical assumptions.

Retirement Risk, Deliverability Measured for MTEP 17

MISO’s deliverability analysis for the 2017 Transmission Expansion Plan will identify transmission constraints and possible violations on a five- and 10-year horizon, MISO engineer Carlos Bandak said.

Bandak said the deliverability analysis will determine whether groups of generators in an area can operate at maximum capability without being “bottled-up.” The information is used in granting or denying network resource interconnection service (NRIS).

After stakeholders expressed concerns that MISO would use historical limits for the deliverability analysis, Bandak reassured stakeholders that the RTO each year produces fresh results and does not test values from previous years, although it will not test above already-granted NRIS levels for existing generators.

Stakeholders argued that MISO might test above the approved NRIS level to a generator’s potential capability.

“We’re not going to use the deliverability study to grant incremental capability. That would be too complicated,” said MISO Director of Planning Jeff Webb, adding that the generator interconnection queue is the arena where owners should go if they want to be granted more generating capability.

“All we’re doing here is making sure that generators continue to be deliverable through their interconnection service. There’s nothing really new or strange here,” Webb said.

MISO also will incorporate a retirement sensitivity analysis in MTEP 17’s annual reliability assessment.

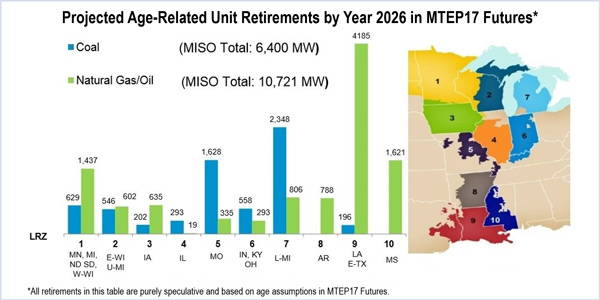

MISO will perform 10-year-out sensitivity analyses for age-based retirements modeled in MTEP 17’s “existing fleet” future. By 2027, all coal units 65 years or older and all gas and oil units 55 years or older will be assumed to have been retired.

In 10 years, the MISO footprint will contain 6.4 GW of at-risk coal generation and 10.7 GW of susceptible natural gas and oil generation. The RTO places the current average age of its coal fleet at 38 years and its natural gas and oil fleet at 22 years.

MISO engineer Anton Salib said the RTO would build models until March and test them through May, with preliminary findings released in June. A full report is expected by September.

Ginger Hodge of Customized Energy Solutions asked if results would be included in the MTEP 17 Market Congestion Planning Study. Salib said the findings may inform the study, but information from a variety of analyses would also be used.

By the end of 2016, MISO expects $2 billion more of MTEP 15’s transmission projects to be in-service. Project candidates for MTEP 17 are to be submitted by Sept. 15, 2017. Solomon said the overall scope of MTEP 17 studies will be completed by the end of this month.

In response to stakeholder feedback on the MTEP 17 scope, MISO told the Dec. 14’s Planning Advisory Committee it would consider removing independent load forecasting from the MTEP process because it is not governed by the RTO’s business practices. Purdue University’s State Utility Forecasting Group currently estimates MISO’s power demand. The PAC could weigh in on the future of the forecasting after the new year.

— Amanda Durish Cook