By Amanda Durish Cook

MISO’s 2017 will likely be filled with capacity auction changes, cost allocation debates, an updated interconnection queue and multiple transmission studies.

The RTO filed its proposed forward capacity auction for its retail-choice areas Nov. 1 and requested a March 1 effective date (ER17-284). (See MISO Files Forward Capacity Auction Plan with FERC.)

MISO spent much of 2016 reconciling the forward capacity market with the existing prompt capacity auction and utilities’ forward resource adequacy plans and bilateral contracts. “There was a rush to the finish line to file the Competitive Retail Solution,” Resource Adequacy Subcommittee Chair Gary Mathis said. “We’ll hopefully find out in early springtime” if the proposal passed FERC’s muster.

Assuming FERC approval, work to implement the forward auction alongside the prompt auction will continue through 2017 before the first bifurcated auction in April 2018 for the 2018/19 planning year.

Interconnection Queue Changes

MISO expects a FERC decision any day on its second attempt to reduce uncertainty and the amount of time it takes for projects to clear the interconnection queue. The late October filing proposes fewer restudies, optional “off-ramps” with fee refunds for withdrawing projects, a smaller initial milestone payment and subsequent milestone payments based on a percentage of upgrade costs. “It’s currently a two- to three-year process and is challenged by restudies,” said Jennifer Curran, MISO vice president of system planning and seams coordination.

If all goes as planned, queue changes will take effect in January. Although the new process has yet to be approved, MISO has begun to prepare for the transition, with all projects expected to follow the new rules after February 2017’s batch of interconnection applicants.

FERC rejected MISO’s first proposal in spring, telling the RTO it placed too much blame for the queue’s bottleneck on “speculative” projects and said its proposed milestone payments to move along the queue were prohibitively high (ER16-675).

Cost Allocation

MISO also will set aside some of 2017 to revise its cost allocation formulas for market efficiency projects and sub-345-kV economic projects. The RTO hopes to complete the revisions in 2017 and implement them by 2018, when Entergy’s integration transition period, which limits cost sharing in MISO South, expires. (See MISO Stakeholders Propose Changes to Market Efficiency Cost Allocation Process.)

“We all know cost allocation is a money issue where consensus is not likely to spring up like a flower,” outgoing MISO Director Judy Walsh said at the December Advisory Committee meeting.

“I think we’ve seen a lot of movement; no one is going to get what they want, but we are on a path,” Xcel Energy’s Carolyn Wetterlin replied.

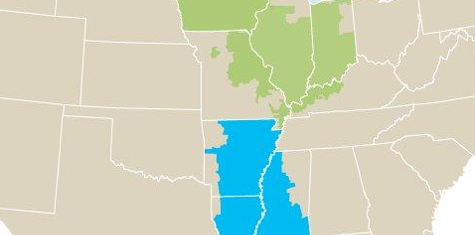

North-South Bottleneck

MISO is also planning a study that will examine the benefits of building new transmission to supplement the constrained transmission interface linking the RTO’s North/Central and South regions. In January, FERC approved a seven-year settlement that stipulates MISO’s north-to-south flows using SPP’s transmission be restricted to 3,000 MW and 2,500 MW south to north. (See MISO Proposes Study to Measure Benefits of New North-South Tx.)

There’s “nothing so stark as the North-South constraint” to MISO system planners, Curran told the Markets Committee of the Board of Directors last spring.

The RTO will also embark on an ambitious long-term transmission overlay study looking at system needs under three future scenarios, with varying assumptions on carbon reduction targets, natural gas prices, coal generator retirements and renewables growth.

Beginning Jan. 31, the Economic Planning Users Group will review an initial set of transmission needs to design preliminary overlays, said Lynn Hecker, MISO manager of expansion planning. Long-term transmission needs are expected to be identified at the end of 2017. (See “Long-Term Overlay Study Scoped; MISO Asks for More Responses,” MISO Planning Advisory Committee Briefs.)

Competitive Transmission Development

Late last month, MISO selected LS Power subsidiary Republic Transmission over 10 other bids to build the Duff-Coleman 345-kV transmission project, the RTO’s first competitive project under FERC Order 1000. The work in Southern Indiana and Western Kentucky includes the construction of two substations and a 28.5-mile line connecting them. Republic will be delivering quarterly updates to MISO throughout 2017 on the $49.8 million project. (See LS Power Unit Wins MISO’s First Competitive Project.)

While that work progresses, the RTO’s stakeholders are expected to spend the first half of 2017 identifying improvements to the RTO’s competitive developer selection process.

IT Refresh Coming

MISO, which estimates it will spend about $1.1 billion on information technology between 2015 and 2019, has hired consultants for another study to assess its aging system software. Results of the study will be reveal how well the RTO’s software can accommodate the effects of a changing resource mix, increased intermittent and behind-the-meter generation and increased combined cycle units.

The RTO also plans to begin work on six projects in 2017 to improve its market systems in its ongoing Market Roadmap process. (See MISO to Study Aging Software; Market Improvements Planned for 2017.)

MISO Looks Back at 15

MISO took time last month to reflect on its 15th anniversary of becoming an RTO. At the December board meeting, CEO John Bear noted that the RTO has grown from 21 employees in 2000 to about 900 in 2016.

“The beginning tested our tolerances. Without regular money coming in, it’s hard to see a path forward,” said Steve Kozey, senior vice president of compliance services and one of those hired in 2000. “In February 2002, when FERC approved our Tariff and MISO could start recovering costs on a regular basis, employees let out a sigh of relief because they knew from then on out, they could count on a paycheck each month.”