By Rory D. Sweeney

PJM’s Independent Market Monitor urged FERC to address longstanding concerns over demand response providers and others selling “paper capacity” to arbitrage price differences between the Base Residual and Incremental auctions.

The Monitor made its request in a Dec. 30 filing that was accompanied by a report analyzing the use of replacement capacity since 2007 (ER14-1461, EL14-48).

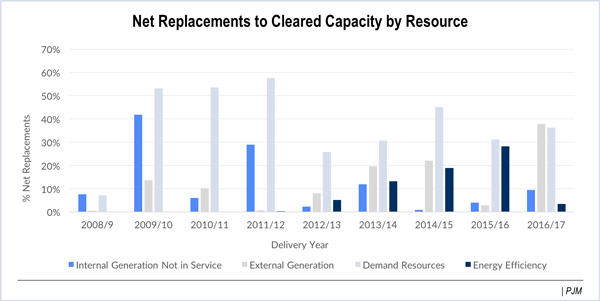

“The lack of a specific requirement that all capacity resources be demonstrably physical assets when offered into PJM capacity auctions continues to provide strong incentives to offer speculative paper capacity,” the report concludes. “The pattern of IA prices being substantially lower than BRA prices, exacerbated by PJM’s preannounced sales of capacity at low prices in IAs, continues. The pattern of consistently extraordinarily high levels of replacement by DR providers and very high levels of replacement by capacity imports and planned internal generation continues.”

PJM attempted to address the issue in 2014, but FERC rejected its proposed rule changes to curb speculation in the auction, saying it created undue barriers to entry. The commission said PJM’s proposed arbitrage fix — which the RTO proposed unilaterally after failing to obtain stakeholder consensus — “will simultaneously increase risk to suppliers and costs to load, without guaranteeing equally offsetting benefits to the PJM grid as a whole.” (See PJM Wins on DR, Loses on Arbitrage Fix in Late FERC Rulings.)

Instead, the commission said it would convene a technical conference to find a solution. But FERC has not scheduled the conference, the Monitor noted, because of PJM’s request to defer action pending implementation of Capacity Performance.

The Monitor’s Dec. 30 filing asked the commission to “proceed without further delay towards solutions to the issues.”

“Sellers of demand resources in [Reliability Pricing Model] auctions disproportionately replace those commitments on a consistent basis compared to sellers of other resource types,” the Monitor said in its report. “The risks to the markets associated with the sale of DR without any supporting information on the plausibility of the underlying assets [mean] … the system is less reliable than it might otherwise be because the full amount of DR that cleared the RPM auction is not actually available, the price to other capacity resources has been suppressed by the sale of the speculative DR, new entry of other capacity resources could have been forestalled by the sale of speculative DR and there may not be adequate replacement resources available with short notice prior to the delivery year.”

“There is no reason for further delay on this matter,” says the analysis, which updates reports from 2012 and 2013. “The evidence has been and continues to be quite clear.”

The filing comes just weeks after the Monitor teamed with PJM to reinstate capacity-replacement rules that had been stripped away in November through a stakeholder initiative to reduce the accounting reconciliation time for Incremental Auction capacity transactions. (See “PJM, IMM Win Approval for Reinstatement of Capacity-Replacement Rules,” PJM Markets and Reliability Committee Briefs.)

Both PJM and the Monitor had opposed the stakeholder proposal, and the Monitor filed a complaint with FERC that caused some stakeholders who had supported the proposal to reconsider their positions. The complaint was withdrawn after the PJM/IMM proposal was approved.

At issue was a rule implemented in May that could allow what the Monitor describes as “speculative” capacity offers to clear at BRAs and then be replaced without justification at lower prices with capacity in subsequent Incremental Auctions. The rule — meant to help participants avoid Capacity Performance penalties when legitimate bids into the BRA from participants like DR providers unexpectedly become unable to deliver — had been superseded by a pre-existing rule that required justification for replacement.

However, PJM stakeholders who provide financial services find it onerous because it requires them in certain situations to maintain collateral for positions they have sold out of, a situation Citigroup Energy’s Barry Trayers termed “double counting.”

Monitor Joe Bowring stated at the time that reinstating the rule wasn’t “optimal,” but it was better than allowing capacity replacements without justification.