By Tom Kleckner

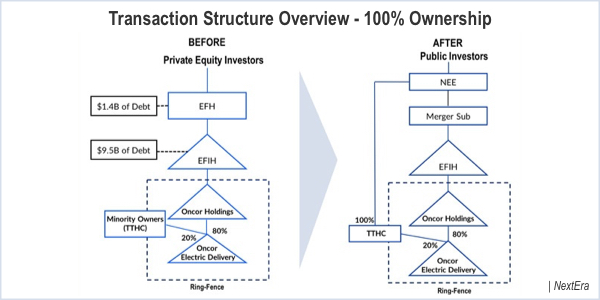

NextEra Energy, which received FERC approval of its $21 billion bid to acquire Oncor earlier this month, is still facing questions on the deal from Texas regulators and calls for more protections from stakeholders.

The Public Utility Commission of Texas, which is scheduled to hold a hearing on the merits of the proposed acquisition Feb. 21, issued a seventh set of questions to the companies Jan. 11. The commission must render a decision by April 29 (Docket No. 46238). (See Texas PUC Sets Questions in NextEra-Oncor Merger.)

The PUCT staff’s latest questions focus on credit ratings and NextEra’s funding plan for the acquisition.

Several stakeholders also filed comments on the acquisition last week. The Texas Energy Association for Marketers urged the commission “to ensure that there are no impediments to competition and no cross-subsidization from the transmission and distribution utility to competitive affiliates of the utility.” It asked the commission to change a commitment prohibiting co-branding of the utility with a competitive affiliate to improve its “clarity [and] enforceability.”

NRG Energy called on the commission to “expand the protections that have been in place since 2008 in recognition of the greater challenges posed by the conflicts and incentives created by” NextEra’s proposed corporate structure.

It said the commission should prohibit NextEra from connecting generation to the Oncor transmission system and require NextEra to divest its retail electric providers to ensure it does not favor them over competitors.

NRG also asked regulators to require transmission and other capital projects above a certain cost threshold — NRG proposed $50 million — be approved by the commission, with cost caps and post-completion prudency reviews.

“This requirement is especially important given the potential that Oncor would have competitive generation affiliates and the fact that Oncor would be inherently incented to build transmission to optimize the delivery of power from its affiliated wind resources from neighboring transmission systems,” NRG said.

The PUC last year scuttled Hunt Consolidated’s attempt to acquire Oncor — the transmission and distribution subsidiary of bankrupt Energy Future Holdings (now Vistra Energy) — when it imposed conditions that caused Hunt to back away from its proposal. (See Texas PUC Denies Rehearing on Oncor Sale, Ends Hunt Bid.)

NextEra had no comment on the impending hearings or FERC’s approval. The commission’s Jan. 5 order found the Florida-based company’s proposed deal in the public interest (EC17-23).

While Oncor operates within ERCOT, it owns a 100-MW interest in a HVDC tie between the Texas ISO and SPP. Oncor also provides transmission service over ERCOT’s North and East interconnections and the Rio Grande Valley interconnection under a FERC tariff.

FERC accepted the companies’ assertions that the acquisition would not incent NextEra to exercise market power and that Oncor’s facilities are subject to FERC open access rules.