By Robert Mullin

CAISO’s first pass at soliciting stakeholder input on its primary frequency response product initiative generated a wide-ranging discussion about an obscure but increasingly important aspect of the ISO’s operations.

“We know that [primary frequency response] is important to your fundamental role as a balancing authority, and currently there are no financial incentives to provide this critical service,” Alex Morris, director of policy and regulatory affairs at the California Energy Storage Association (CESA), said during a Feb. 9 presentation to a stakeholder working group convened to lay the foundation for a market proposal.

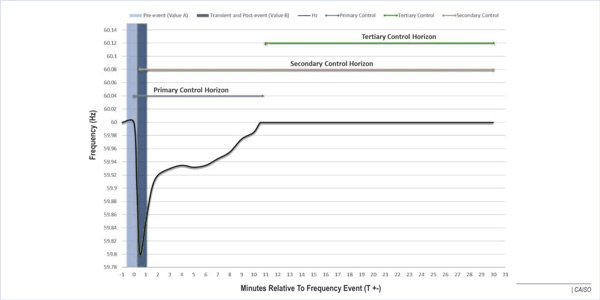

CAISO is seeking to develop a market mechanism to compensate resources for responding to frequency dips during the “primary” control horizon — just moments after the onset of the event.

“And I don’t mean to be trite, but what we’re seeing from the data is that it’s no longer workable to assume the primary frequency response service will be provided — quote — ‘for free,’” he added.

Inertial Response

By “free,” Morris was referring to the fact that grid operators have benefited from the “inertial” frequency response capability inherent in the operation of most conventional generators, which can automatically vary their turbines’ rotational speed and output based on the pull of load, functioning as a damper for frequency excursions on the grid.

Nonconventional technologies such as wind and solar resources have little or no inertial response to momentary changes on the grid. Late last year, FERC proposed revising pro forma generator interconnection agreements to require all newly interconnecting facilities, including renewable generators, to have primary frequency response capability (RM16-6). (See FERC: Renewables Must Provide Frequency Response.)

“It’s probably been great that for many decades [frequency response] came along as part of the generation fleet for free and that’s how it worked, but unfortunately we’re in a different era with a different grid and we need to wrestle with this problem,” Morris said.

NERC reliability standard BAL-003-1.1, which was phased in between November 2015 and last April, requires each balancing authority area (BAA) to carry sufficient capability to respond to a frequency event. Meeting that requirement will become increasingly difficult as California’s 50%-by-2030 renewable portfolio standard drives increased penetration of renewable resources.

The NERC rule requires BAAs to respond to a deviation within about 20 to 52 seconds of occurrence. That rapid reaction requires a resource to automatically detect under-frequency and autonomously ramp its output without receiving a market signal or manual instructions from the ISO.

Procurement Needed

An issue paper published by CAISO in December laid out the ISO’s deteriorating frequency response performance in recent years and raised the alarm of further declines. (See CAISO Seeks Primary Frequency Response Market.)

“Without explicit procurement of primary frequency response, the ISO cannot position our fleet in a way that will provide sufficient frequency response,” said Cathleen Colbert, senior market design and regulatory policy developer at CAISO. “We need to also mitigate the risk of noncompliance” with the NERC standard.

For the current compliance period, the ISO issued a competitive solicitation to external BAAs to essentially procure an adjustment on its frequency response reporting. (See FERC Accepts CAISO Contracts for Imported Frequency Response.)

“We’re concerned about continuing to rely solely on procuring this adjustment in the long term,” Colbert said. Instead, CAISO seeks to provide internal generators with the ability to compete against external BAAs to provide the service.

In his presentation to the working group, Morris sketched out a preliminary proposal in which the ISO would develop a product that would incentivize frequency response capability and performance while compensating resources for their opportunity costs — for example, forgone energy market revenues.

Under the plan, the CAISO day-ahead and real-time markets would solve for current constraints and products while also reserving capacity from resources capable of providing primary frequency response. The market would compensate those resources for the service, as well as the energy injected during a frequency deviation event, similar to the energy settlement for regulation service resources that follow a dispatch order.

Regulation Service

“I thought that regulation was simply a zero-energy service,” said Mark Smith, vice president of government and regulatory affairs at Calpine.

George Angelidis, a principal at CAISO, explained that the energy a regulation service provider gives and takes from the grid should, in theory, sum up to zero, which is why regulation is considered a control service rather than an energy service.

“But there’s a capacity behind it, and through the energy provision, you provide the control service, but the expectation is that over a long period of time it’s more or less a zero-energy service,” Angelidis said.

“The general high-level view is that this resource is sitting at the ready — [and] frequency drops,” Morris continued. “The resource autonomously bursts out energy to provide the primary frequency response. In so doing, it’s giving energy to the grid. It may be appropriate to compensate [the resource] for the energy it gave to the grid.”

Biddable or Not?

Morris acknowledged that he avoided taking a position on whether frequency response provision should be biddable in the market on a standalone basis.

“I think as long as it’s being solved for inside the market — it’s co-optimized among the many other constraints in the market — then the opportunity cost of providing this service is then reflected,” Morris said. “So there would be some element of payment for providing this service, whether that’s just an opportunity cost, if any, or not.”

Jan Strack of San Diego Gas & Electric questioned the effectiveness of a “non-biddable” solution.

“The issue is, if you don’t have a bid, I think the market has no ability to select,” Strack said. “Which [resource] would it select? There’s no way to know. So I think you inevitably end up with a capacity offer situation just like you do with regulation.”

“I hear you,” Morris responded. “But I also think just the information about the energy costs will inform the optimization, similar to how with the [CAISO] flexible ramping product you can bid your flexible ramping capability for zero dollars, but you also have an energy bid, so [the market] knows if you have an opportunity cost.”

Smith wondered whether a generator that did not receive an award would be allowed to disable its frequency response capability, as it would automatically respond to an event.

“Basically, we make sure that you provide the service all the time, but if while you provide the service you suffer a lost opportunity cost for it, then you will be compensated adequately for it,” Angelidis said, adding that disabling that capability could run “contrary” to a generator’s interconnection agreement.

In comments filed with CAISO, Seattle City Light — which currently provides the ISO with transferred frequency response under a yearlong contract — said it hoped the ISO would develop a market mechanism that would allow transferred capability to compete with internal resources.

Mike Benn, energy trade policy analyst at Powerex, backed up City Light’s position.

“We’re supportive of what CESA said to co-optimize the procurement of frequency response in real time, but we think there would be a gap there and we’d like a forward procurement mechanism as well, similar to the [resource adequacy] construct,” Benn said. “So you could go out and procure on a year-ahead basis, and then they could procure from internal [resources], or they could also go and procure from external BAs.”

The “gap,” according to Benn, stems from the fact that short-term procurement of frequency response won’t guarantee resources will be available on a given day and might be insufficient to spur development.

“The transferred response from external BAs is a yearly product,” Benn said. “So in that way, when you get to real time, you’ve guaranteed that the resources are available.”

Benn pointed out that the absence of a forward procurement option would exclude the participation of external resources because NERC’s frequency response reporting requirement is based on an annual obligation that cannot be transferred on a daily basis. FERC recognized this fact on Feb. 2, when it approved the terms of CAISO’s transferred frequency response contracts with City Light and the Bonneville Power Administration. (See FERC OKs CAISO Frequency Response Contract Terms.)

“I think the two processes — a market mechanism and a transferred frequency response mechanism — aren’t mutually exclusive, and it’s probably good to think about them in that sense,” said Andrew Ulmer, CAISO director of federal regulatory affairs. “From a relatively non-engineering, non-market design perspective, I think of both as insurance mechanisms.”

CAISO has asked stakeholders to submit comments on the primary frequency response initiative by Feb. 23. A second working group meeting on the issue will be held on a date yet to be determined.