VALLEY FORGE, Pa. — PJM’s Jen Tribulski explained the rulemaking implications of FERC’s lack of quorum at Wednesday’s Market Implementation Committee meeting, using the RTO’s seasonal capacity proposal as an example.

In January, PJM filed a response to questions from the commission. “The response resets the 60-day time clock for that proceeding,” Tribulski said.

If FERC doesn’t act by March 24, the proposal will go into effect and be implemented for the Base Residual Auction in May. The commission, which was already shorthanded with two open seats, lost its quorum when former Chairman Norman Bay resigned Feb. 3. However, in one of their last actions before Bay left, the commissioners issued delegation authority to staff.

That gives staff several alternatives “to keep that rate before the commission review instead of letting it go into effect by law,” Tribulski explained. One of those options is letting the rules go into effect but suspending their implementation, she said. That suspension can last up to five months.

Later, staff gave updates on several other FERC matters impacted by Bay’s resignation, including a Notice of Proposed Rulemaking on uplift, implementation of Order 831, which doubles the “hard” offer cap for day-ahead and real-time markets to $2,000/MWh, and the commission’s rulings on fuel-cost policies and financial transmission rights allocations and forfeitures.

Meter Correction Initiative OK’d

Stakeholders approved by acclamation a problem statement and issue charge proposed by the North Carolina Electric Membership Corp. that could result in a monthly meter correction for pseudo-tied generation and dynamic schedules. The intent is to develop a process through which the unit owner’s calculation for the amount of power that flows over its pseudo-tie can be aligned with PJM’s calculation every month.

Unlike generators connected directly to the PJM system, there is no mechanism for meter correction at the end of the month for pseudo-tied generators and dynamic schedules, creating the risk of incorrect compensation, NCEMC said.

The proposal that had initially been introduced focused only on pseudo-tied generation, so American Municipal Power’s Ed Tatum questioned how dynamic schedules would be treated. “Is there a thought we’d be treating dynamic schedules like pseudo-ties?” he asked.

PJM’s Ray Fernandez acknowledged that the RTO is “trying to treat them in a manner as pseudo-ties” but said it was seeking the approval so the Market Settlement Subcommittee could begin analyzing it.

PJM Looking to Avoid Lump-Sum Billing on New Black Start Units

The RTO is working with the Independent Market Monitor to develop a consensus proposal on annual revenue requirements for new black start units, PJM’s Tom Hauske said.

“The whole intent here is we’re trying to minimize the billing impact on the load from having this new unit come in,” he said.

The collaboration received support from members. “I like when you guys get together and talk, so thanks,” Old Dominion Electric Cooperative’s Steve Lieberman said.

“As [a load-serving entity], our guys are getting tired of getting hit with these big lump sums,” Tatum said.

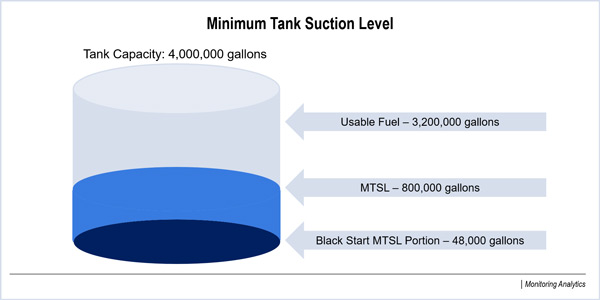

The collaboration has resulted in the addition of a new design criteria concerning fuel tanks at the request of Monitor Joe Bowring. All oil-fired generating units have a “minimum tank suction level”. PJM’s accounting method would allow for recovery of fuel storage costs for the full tank’s minimum suction level, but the black-start unit only requires a small fraction of that. Bowring’s proposal would be to reduce the cost recovery to just the amount needed for the black start unit.

GT Power Group’s Dave Pratzon argued that discussion was out of the scope of the revenue requirements. “We’re not talking about changing the cost components,” he said. “It’s totally worthy of discussion, but it shouldn’t be in this because it’s going to delay customers getting the black start they need.”

Calpine’s Dave “Scarp” Scarpignato agreed.

Reviewing new black start unit revenue requirements is an annual process that happens every May, Hauske said. The determinations go into effect on June 1. There’s only one unit currently having its costs reviewed, he said, but PJM plans to offer an RTO-wide request for proposals for new units at the end of the year. The last such RFP added 20 units, he said, but PJM expects about three this time. (See PJM: Black Start Sources Ready to Replace Retiring Coal.)

No New IARRs this Year, but Con Ed’s to be Redistributed

PJM’s annual analysis found that there are no incremental auction revenue rights to be awarded this year, PJM’s Xu Xu said. However, with Consolidated Edison terminating its PJM membership, the company’s IARRs need to be reallocated by May 1.

IARRs are awarded when regional or lower-voltage facilities are upgraded after the annual ARR process is completed.

PJM’s Tim Horger said the reallocation of Con Ed’s IARRs will be based on the Schedule 12 regional cost allocation process. “It will be a small value, but it’s a value that has to be reallocated,” he said. “Everyone will automatically get another slice of the ARRs with Con Ed gone.”

– Rory D. Sweeney