By Robert Mullin

CAISO market operators are preparing to deal with an inevitable flood of energy oversupply this spring, when unusually high levels of hydroelectric output are expected to compound the impact of growing solar penetration on the California grid.

One likely outcome: forced reductions in self-scheduled power deliveries throughout the season.

The ISO is already experiencing the effects of oversupply — in the form of economic curtailments — months ahead of the spring melt in the Sierra Nevada mountains, where snowpack in some areas stands at more than 175% of normal, according to the California Department of Water Resources.

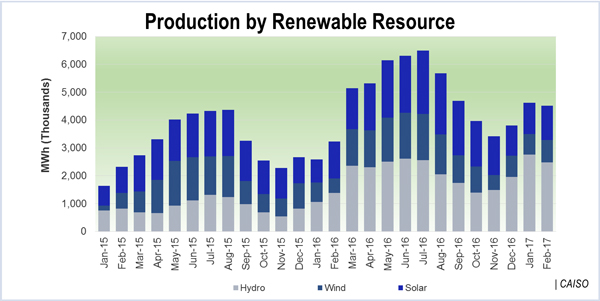

“Altogether, [we] can see that wind, solar and hydro are making up a lot of generation in the first two months of the year,” Guillermo Bautista Alderete, CAISO director of market analysis and forecasting, said during a March 14 Market Performance and Planning Forum (see graph).

“If you just compare against the same profile for one year ago, you can see that we are well over the historical levels [for hydro] — and this is just January and February,” Bautista Alderete said.

And while hydro has so far been the biggest contributor to the mix, solar output will become an increasing factor, with the longer days and more intense periods of sunlight in spring and summer.

“The big story here is the year-over-year change that we’ve seen going back to 2013, when we didn’t have a lot of solar on the system,” said Gabe Murtaugh, a senior analyst with the ISO’s Department of Market Monitoring.

Murtaugh pointed out that 2015 was the first year in which large-scale solar became the most significant source of renewable power on the ISO system — with output last year surging again by 33% to more than 20,000 GWh as installed capacity climbed to about 9 GW.

That capacity figure doesn’t include rooftop installations, which the ISO estimates stand at 5 to 6 GW — or about 12 to 15% of average system load, according to Amber Motley, CAISO’s manager of short-term forecasting.

“Current solar capacity is capable of increasing oversupply risk without factoring in wind and hydro,” Motley noted in her presentation to the forum.

Based on that risk, the excessive solar, wind and hydro output on the horizon will translate into a significant number of curtailments by the ISO this spring. (See High Hydro, Increased Solar Point to Spring Curtailments for CAISO.)

The evidence is already coming in. Curtailments have been on the rise this winter, with about 60,000 MWh of solar output being cut off in February — the largest amount for any month since the beginning of 2016.

Bautista Alderete explained that, under its current staged approach to oversupply, CAISO first exhausts its regulation service, which ramps down output from participating resources, followed by economic curtailment of price takers in the market.

“You keep going through the bid stack to the point until you find the balance of supply and demand,” he said.

Once economic bids are spent, the ISO begins to curtail self-scheduled energy deliveries.

“So you exhaust your regulation before you cut into the self-schedules?” asked Seth Cochran, manager of market affairs and origination at DC Energy.

“This is something we’re going to revisit,” responded Mark Rothleder, CAISO vice president of market quality and renewable integration. “If, for short periods of time, we’re going into the regulation stack, it’s OK. If we’re persistently going into the regulation stack, that’s a problem.”

He said the ISO is considering reducing its reliance on regulation during oversupply periods, a move that would require more frequent curtailment of self-schedules.

Rothleder speculated that on a warm, sunny and breezy weekend day in the spring when hydro is spilling at a high rate, CAISO would move quickly through its bid stack of an estimated 1,500 to 2,000 MW of curtailable renewables and begin to confront reductions in self-schedules.

“The next question is: How far?” he said.

To illustrate the potential scope of reductions, Rothleder highlighted system conditions on the previous Sunday, March 12, when the ISO saw its net load (which represents total system load minus output for variable renewable generation) fall to about 10.9 GW with 15 GW of available generation. With a maximum of 2 GW of economic bids poised for curtailment, the balance, he said, would come from self-schedules.

Bautista Alderete said CAISO is seeking to be “proactive” in alleviating the oversupply problem, pointing to Motley’s work to improve short-term forecasting of oversupply conditions.

Motley has been seeking to discern indicators of potential oversupply in the day-ahead market.

One such indicator: negative pricing in the energy component of the LMP.

Another: a forecast of about 5 GW of renewable generation paired with a load forecast of about 25 GW — an average for this time of year — leaving a net load of 20 GW.

Even with no wind output, the 9 GW of solar on the system has the potential to push the system into oversupply under those load conditions.

Motley said historical hydro schedules, while factored into the forecast, will not be the most reliable indicators of oversupply because of the year-to-year difference in hydro conditions. Hydro operators are likely to have less flexibility to ramp down output this spring with increased flows.

The forecasts might occasionally compel the ISO to reach out to market participants outside normal market channels.

“On days when we go below 20,000 MW [in net load] on average, we may have a phone call [with scheduling coordinators] … to state our oversupply risks,” Motley said. “We don’t want to use those all the time, because some of these factors are going to be there every weekend, but when we see more extremes, we may use that coordination phone call.”