By Robert Mullin

CAISO’s Board of Governors last week approved an ISO request to designate two Calpine natural gas-fired plants in Northern California as reliability-must-run despite criticism from several stakeholders. Acknowledging concerns, ISO officials pledged to avoid “case-by-case” designations in the future.

At the board’s March 15 meeting, Carrie Bentley, a consultant speaking on behalf of the Western Power Trading Forum (WPTF), said the organization “does not at all oppose” designating the units as RMR.

“Obviously, though, after years of the ISO saying they’re not going to use the RMR Tariff authority anymore — and that they’re going to rely on the capacity procurement mechanism — we were really surprised,” Bentley said.

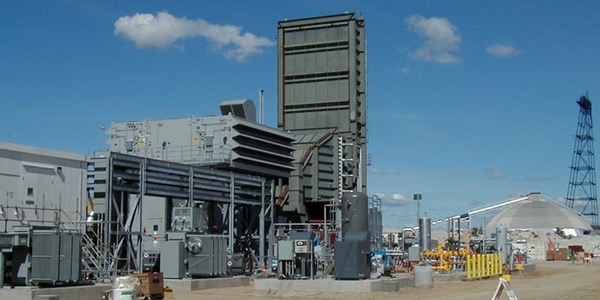

CAISO sought RMR designations for Calpine’s Yuba City and Feather River plants after determining that both 47-MW peaking facilities would be needed to support local grid reliability after they fall off their current contracts with Pacific Gas and Electric at the end of the year. (See CAISO Seeks Reliability Designations for Calpine Peakers.)

Calpine had informed CAISO in November that capital planning requirements required that it be apprised of any reliability need for the plants before this fall, when the ISO releases its 2018 resource adequacy (RA) assessment. The assessment will determine what plants would be eligible for longer-term resource adequacy payments under CAISO’s capacity procurement mechanism (CPM).

‘Purgatory’

“When a unit is facing retirement, or a continued need for operation, we’re in a state of purgatory,” Mark Smith, Calpine vice president of government of regulatory affairs, told the board. “We’re in a position where we can’t make investments that we know that we will never recover and we may not be able to take actions to redeploy those assets elsewhere where they might be more valuable.”

Neil Millar, CAISO executive director of infrastructure development, emphasized that the ISO would seek to implement the RMR contract for Yuba City only if it is not shifted into the CPM program following the assessment.

Feather River will not be eligible for a CPM designation because it is not needed for capacity but to provide voltage support for its local area by absorbing reactive power from the system. Millar said the ISO is working with PG&E to develop “longer-term mitigations” on both the transmission and distribution to come up with a way to reduce reliance on gas-fired generation for voltage control in the area.

“We do need a better process moving forward than bringing these [RMR proposals] forward on a case-by-case, one-off basis,” Millar said.

Bentley recounted recent steps taken by CAISO that should support RA prices, including submitting comments to the California Public Utilities Commission supporting a reduction in the amount of wind and solar that can count as RA and a 2018 local capacity requirements study showing increased capacity needs in some local areas.

“WPTF therefore encourages the board and ISO leadership to take this as an opportunity to step back and ask if there’s anything else the ISO already has Tariff authority to do to help orderly economic retirement and support the RA bilateral market prices,” Bentley said. “A turnaround in prices can only occur in a functioning bilateral RA market.”

‘Sufficiently Visible’

For “sufficient prices” to materialize, Bentley contended, market signals must be “sufficiently visible” to both suppliers and load-serving entities.

Eric Eisenman, director of ISO relations and FERC policy at PG&E, agreed that there was a reliability need for the two plants and that the ISO was the “appropriate venue” for addressing the matter.

“With that said, PG&E encourages the ISO to work with stakeholders [and] PG&E to enhance and improve the process for analyzing and reviewing risk-of-retirement issues for generation,” Eisenman said. “The expedited process of the last two weeks was, quite frankly, not ideal. We all need to do a better job at that.”

Eisenman said his company wants to more closely examine the trade-offs between the CPM and RMR processes.

“I’m actually encouraged by what I’ve heard here today — to some extent,” said Jan Strack, transmission planning manager at San Diego Gas and Electric, adding that the RMR matter was something warranting a deeper look.

Strack noted that the ISO has a lot of aging gas-fired generation. “We’ve got to figure out a way to let that stuff go,” he said, adding that RMR contracts should be “a measure of last resort.”

“In the current instance, I think we feel there has not been enough light shined on all the various alternatives that could be looked at, rather than just going into an RMR contract,” Strack said.

Millar called the Feather River decision “strictly a matter of timing,” with the RMR providing CAISO time to determine the best solution for local voltage support.

“Putting it bluntly, three months with no opportunity for any stakeholder process doesn’t give us that time,” Millar said, referring to the “compressed timeline” in which the ISO needed to notify Calpine about the RMR decisions. The company had requested a decision by the end of March in order to have adequate time to draw up a cost-of-service proposal and perform the required capital maintenance.

Signs of Market Failure

Governor Ashutosh Bhagwat wondered if there were any other ISO mechanisms available to ensure the plants’ availability other than RMR.

Keith Casey, CAISO vice president of market and infrastructure development, said the RMR option provided CAISO more flexibility in dealing with Calpine’s near-term need to make capital investments than the CPM, which functions as the ISO’s standard “backstop” for needed plants at risk of retirement. Still, Casey said it would be “unfortunate” for the ISO to find itself facing a “proliferation” of RMR agreements.

“If we now find ourselves ramping up in that, that’s a sign we have a market failure,” Casey said.

CAISO CEO Steve Berberich said the RMR issue was “symptomatic” of the fact that the RA processes that both the ISO and PUC have in place “are starting to fray at the edges a little bit.”

“Of course, the ISO has advocated for a longer-term resource adequacy program so that we don’t have this year-by-year emergency situation that we always have to go through,” Berberich said.

Berberich pointed out that the current RMR issue is part of an “evolving grid.”

“Take a step back — why is voltage high at Feather River?” Berberich asked rhetorically. “The voltage is high because of light-load conditions. We have substantial distributed generation on the system.”

He suggested that the voltage issue — rooted in distribution-level changes that are affecting the low-voltage network — could possibly be better managed by a distribution-level solution rather than a transmission-connected resource such as the Feather River unit.

“This is a very complicated issue,” Berberich said. “I’d like to tell you that this is the last time we’re going to talk about RMR, but I don’t think that’s going to be the case.”