By Michael Kuser

The Millstone nuclear power plant has earned at least $3 billion in profits for Dominion Energy since the company bought it and will likely earn an additional $2.2 billion in after-tax income from now through 2030, according to a study released Wednesday by opponents of legislation that could boost the plant’s finances.

Millstone Nuclear Power Plant | NRC

The Stop the Millstone Payout coalition commissioned consulting firm Energyzt to analyze the finances of Millstone, for which Dominion does not release profit or loss figures.

The coalition’s sponsors include competing New England generators Calpine, Dynegy and NRG Energy, as well as the Electric Power Supply Association, all of whom oppose Connecticut legislation that would allow Millstone to bid into the state procurement process now reserved for renewable energy resources.

Dominion indicated last month that the plant will compete in ISO-NE’s Forward Capacity Auction next year, meaning the company expects it to continue operations into at least 2022. Dominion purchased the 2,111-MW facility in 2001 for $1.28 billion. (See Millstone to Enter FCA 12; No Closure Likely Before 2022.)

Tanya Bodell, executive director of Energyzt, said that if Senate Bill 106 is enacted, “Connecticut ratepayers will be on the hook for $330 million per year, or a 15% increase in their electric rates.”

Bodell said that Dominion bought Millstone at an “opportune time” because high natural gas prices increased power prices in New England, enabling the company to earn back the purchase price in five years. The report estimated that Millstone has generated at least a 25% return on equity for Dominion’s shareholders.

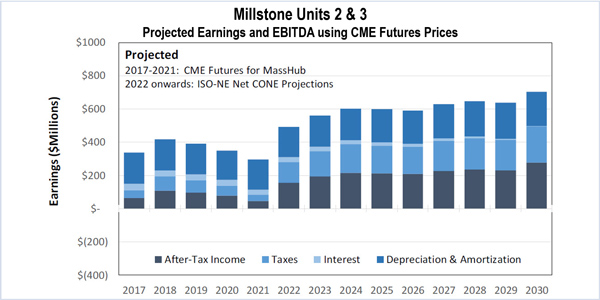

| Energyzt

The analysis used Chicago Mercantile Exchange monthly futures prices to establish base-case energy prices in assessing the financial situation of Millstone through 2021. For the nine years after 2021, she based long-term energy prices on ISO-NE’s recent FERC filing for Forward Capacity Market parameters. Under these projections, the report said Millstone can be “anticipated to earn close to $400 million in after-tax income over the next five years, or $80 million per year. Thereafter, ISO-NE’s … price projection results in closer to $200 million per year in after-tax income through 2030.”

‘Gross Assumptions and Preposterous Claims’

The legislation would make Millstone the only eligible nuclear generator in Connecticut’s competitive bidding process and award it a five-year contract if its bid is lower than competing renewable resources. The bill sets an annual limit on nuclear energy purchases at 8.3 million MWh, equivalent to half of Millstone’s output.

Dominion spokesman Ken Holt blasted the Energyzt report as “loaded with gross assumptions and preposterous claims, with no real data. They say the cost under S.B. 106 would be $85/MW, but the standard offer now is $81. Why would we bid higher when four regulators oversee the bidding, none of them with any incentive to see consumers pay higher rates?”

The study assumed a contract price of $85/MWh based on the cost of large-scale renewables procured in 2016 and estimated Millstone needs to earn $40 to $45/MWh to cover its operating costs and debt payments.

Holt added that Millstone is more expensive to operate than other two-unit nuclear plants because its two units are of different designs. “That means that an operator on one unit cannot work on the other, and that we need to have two separate training programs,” he said. “The others can benefit from economies of scale.”

EPSA said in a statement on Wednesday that the Energyzt report shows that the “intent and effect of these [legislative efforts are] to distort wholesale markets for all other power suppliers needed to provide reliable, competitively priced electricity.”