WASHINGTON — Last week’s FERC technical conference focused on tensions between state clean energy policies and RTO/ISO markets in the East. Yet witness after witness cited California to make their points — often in a context unflattering to the Golden State.

Exelon cited the closing of the San Onofre nuclear plant — and the resulting increase in carbon emissions — to defend the subsidies of its nuclear plants in New York and Illinois.

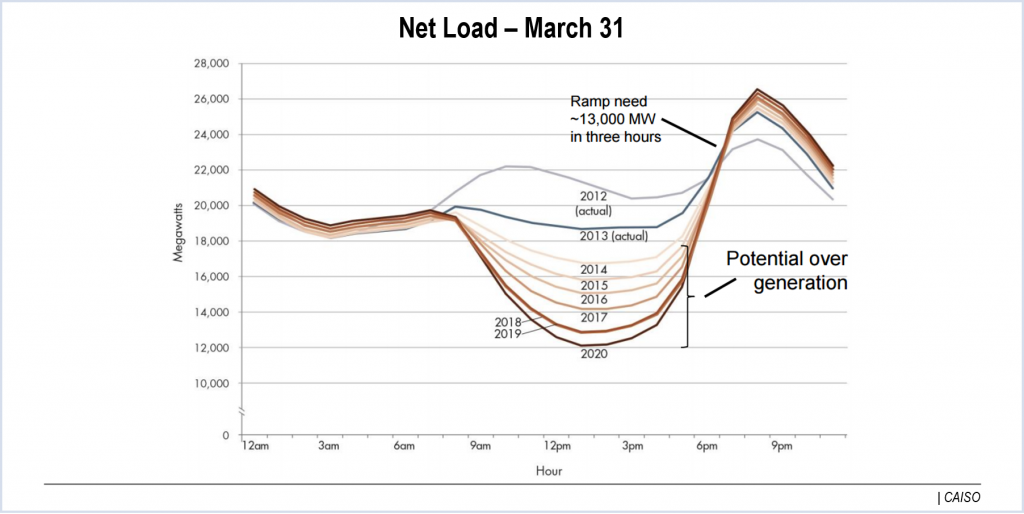

Charles River Associates consultant Robert Stoddard said California’s duck curve is the result of “a pricing failure.”

Cautionary Tale

Calpine CEO Thad Hill called California “a cautionary tale [of] high consumer costs and layered subsidies.” (See related story, RTO Markets at a Crossroads, Hobbled FERC Ponders Options.)

“Out-of-market subsidies have been growing in the East. If not addressed, these subsidies will undermine the competitive wholesale markets, turning the Eastern markets into a command-and-control structure much like California is today — i.e., the states mandate when and where new generation will be built and the technology type that will be used for that generation,” Hill said.

“In California, essentially all investment, including investment in new conventional generation, is supported by mandate-driven long-term contracting schemes. Because the policies that bring about this substantial investment are divorced from competitive wholesale markets, it has led to the paradox that while retail rates are rising rapidly to reflect the costs of mandates, wholesale prices are so low that the economic viability of the remaining generation that is dependent on competitive wholesale markets (generally existing conventional generation resources without long-term contracts, many of which are critical for reliability) is increasingly threatened. Addressing the revenue shortfall for existing units that are needed for reliability likely will entail additional out-of-market mechanisms.”

Independent consultant Roy Shanker also called out California, saying the state Public Utilities Commission has “explicitly stated that while a transparent, open and competitive central capacity market might be more efficient in the long run, it preferred to maintain a less efficient bilateral capacity market structure because of short run cost savings.”

“Similarly it expressed concerns that a centralized market under the CAISO might open the door to undesirable FERC jurisdiction and authority,” he added.

Shanker cited California’s increase in negative energy pricing, which nearly doubled to 1,000 hours in 2016 from 588 in 2015.

“In general the state subsidized or mandated units under long-term contracts participate as price takers in both energy and/or capacity markets, driving down prices, often below zero in the energy market,” he said.

Innovation

Some witnesses, however, looked to California for innovation and leadership.

PJM officials said they are considering use of a “border adjustment” similar to that approved by FERC for CAISO to add carbon constraints for states that want to pursue climate goals.

And Harvard University’s William Hogan said the success of CAISO’s Western Energy Imbalance Market in reducing curtailments of solar and wind “is a case in point that reinforces the vibrancy and the importance of real-time markets organized around the principles of economic dispatch.”

— Rich Heidorn Jr.