By Rich Heidorn Jr.

The nuclear industry hopes the grid study released by the U.S. Energy Department last week will accelerate RTO price formation efforts valuing baseload generation and that the federal government will begin purchasing nuclear power.

But states are still the first line of defense against premature plant closures, the Nuclear Energy Institute said at a press conference Thursday.

“We see the nearest-term opportunities for action to be at the state level while the RTOs and FERC [are] a little bit further out,” said John Kotek, NEI’s vice president for policy development and public affairs.

Kotek, a former DOE official, praised his former colleagues for what he called a “solid, fact-based, dispassionate analysis of the issues facing today’s electric grid.” (See Perry Grid Study Seeks to Aid Coal, Nuclear Generation.)

“We know that states are more nimble in their ability to respond to the challenges immediately in front of them,” agreed Matt Crozat, NEI senior director of policy development and another ex-DOE staffer.

He also urged Congress to exercise its oversight authority to ensure prompt action by FERC and RTOs on price formation rules.

“I think FERC can create the requirement to demonstrate how the [RTO] tariffs reflect these attributes that are important to the system,” he said, adding, “I’ll be watching closely to see how FERC begins to frame the question for itself.”

“Based on what we’ve heard out of FERC leadership, it does sound like they’re poised — it sounds like the system operators are poised — to actually move out fairly smartly on these things,” Kotek said.

In a podcast interview with FERC’s chief spokeswoman earlier this month, acting FERC Chair Neil Chatterjee said, “Baseload power … including our existing coal and nuclear fleet, need to be properly compensated to recognize the value they provide to the system.” He cited their value to “resilience and reliability.”

NEI also noted the DOE report’s reference to the “important nonproliferation” implications of allowing the industry to decline.

DOE quoted Michael Webber, deputy director of the University of Texas’ Energy Institute, who cited the risk to “our most important anti-proliferation asset: a bunch of smart nuclear scientists and engineers…. The loss of expertise from a declining domestic nuclear workforce makes it hard for Americans to conduct the inspections that help keep the world safe from nuclear weapons.”

NEI officials saod they hope federal officials will consider making power purchase agreements from nuclear plants like the ones military bases with renewable power developers during the Obama administration.

“Those types of arrangements were clearly struck both to meet electric demand but also to promote, in this case, the growth of renewable energy deployment across the United States,” Kotek said. “If we as a nation determine that the national security benefit of a strong domestic nuclear industry, along with the clean air benefits and the resiliency and reliability of nuclear plants are worth keeping around, then that’s one avenue you could pursue in the effort to ensure we retain the plants that we’ve got.

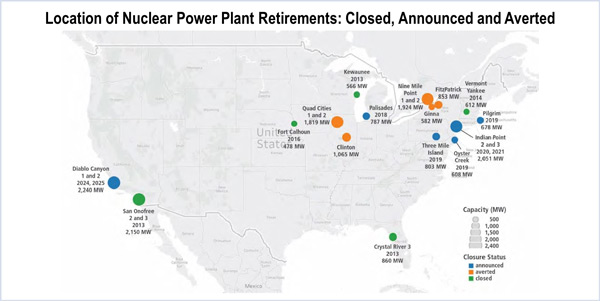

| Department of Energy, Staff Report to the Secretary on Electricity Markets and Reliability, August 23, 2017

“And it’s a potential means for building new [plants],” Kotek continued. “You may know [that] the sustainability order that was put in place by the last administration included small modular reactors, for example, as a technology that would qualify as meeting clean energy demand going forward. It’s one … potential tool in the tool box.”

The officials cautioned against attempting to precisely price resiliency attributes into wholesale power markets.

“I think there are more expansive ways to go at this question without having to necessarily settle on ‘Reliability is worth $4/MWh’ or something like that,” Crozat said. “That’s going to be a difficult calculation to derive.”

Crozat said he was encouraged by PJM’s June report proposing to allow nuclear and coal plants needed for reliability to set clearing prices based on their marginal costs. This would be particularly helpful in addressing negative clearing prices in off-peak hours, he said. (See PJM Making Moves to Preserve Market Integrity.)

“If I know I have units that are going to be needed for reliability, I’ll ensure that the prices are being set in a way that recognized the cost of those units,” he explained. “It just changes slightly the economic logic of who’s allowed to set prices and who isn’t.”

Exelon, the nation’s largest nuclear operator, said it was encouraged by the Energy Department’s recommendation that FERC “expedite” its efforts to improve energy price formation in organized wholesale markets. The company is defending zero-emission credits for its plants in New York and Illinois.

| Department of Energy, Staff Report to the Secretary on Electricity Markets and Reliability, August 23, 2017

“These reforms will help preserve clean energy sources and ensure critical American assets remain part of the mix, including baseload nuclear plants that provide more than 60% of our nation’s emissions-free energy,” the company said in a statement. “We applaud the Department of Energy for their work, and urge FERC and the RTOs to swiftly enact common-sense reforms that will help safeguard the reliability, resilience, diversity and affordability of our supply of electricity.”

NRG Energy, one of the independent power producers that have fought ZECs, also urged FERC to act on price formation and provide fuel- and technology-neutral ways to value reliability services.

“These efforts — and not expensive and market-destroying state subsidy programs to benefit particular generating facilities — would do more than anything else to ensure resiliency and reliability in an environmentally responsible and consumer-friendly way,” the company said in a statement.