By Rich Heidorn Jr.

ERCOT will face higher prices and lower capacity margins following Vistra Energy’s retirement of 4,100 MW of coal-fired generation, Independent Market Monitor Beth Garza told the ISO’s Board of Directors on Tuesday.

Assuming ERCOT’s analysis of the pending retirements doesn’t identify local reliability concerns that would result in reliability-must-run contracts for any of the units, Garza said, “We’re looking at a much different situation going into the summer of 2018 than the fat and happy times … of the last couple of years.

“We’ve had really two years of clearly unsustainably low prices with high reserve margins,” she continued. “I think I’ve been saying it in those terms for the last couple of years, and I think we’re now seeing evidence of that unsustainability.”

Since Oct. 6, Vistra Energy’s Luminant unit has announced retirements of the two-unit Big Brown generator north of Houston (1,150 MW); the two-unit Sandow, northeast of Austin (1,137 MW); and its three-unit Monticello plant in East Texas (1,800 MW). The retirements will leave the company with just two coal plants totaling 3,850 MW. (See Vistra Energy to Close 2 More Coal Plants.)

In addition, the Texas Municipal Power Agency announced in July that it will put its 470-MW Gibbons Creek unit in seasonal mothball status, operating only from June through September.

Garza said the announcements were no surprise given that coal units’ fuel costs have been consistently above combined cycle gas units since the beginning of 2015 and coal units were likely unprofitable in 2016.

Although the trends have been clear for some time, Garza said the timing of the Luminant announcements forced her to revise her presentation to the board.

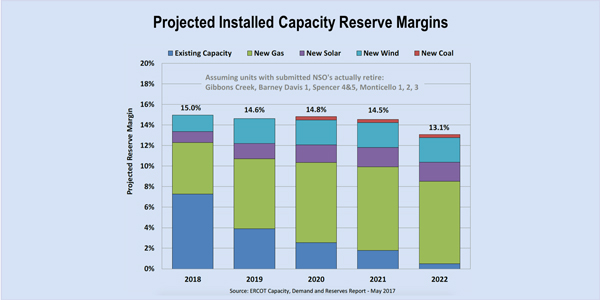

Her presentation showed a 15% reserve margin for 2018. But that could fall to 12% because of the new retirements, she said. She cautioned that her data did not reflect changes in the interconnection queue since ERCOT’s last Capacity, Demand and Reserves report in May.

“It seems to me like the market’s working and folks are responding to appropriate market incentives,” said Director Peter Cramton. “And now it’s time for us to let the market work.”

“I would echo that,” Garza responded. “Generators have a fairly low barrier to entry to the market. Along with that, I think it’s important to have an easy exit as well.”

“You’ve been rubbing the dark side of your crystal ball here pretty good,” Director Karl Pfirrmann pressed Garza. “Now let’s start rubbing the other side a little bit. Tell me, what is it in our marketplace that’s going to correct this problem?”

Garza said the retirements are likely to push forward prices higher, creating pressure for load-serving entities. “If I were a load-serving entity, I would be a little more anxious about the surety of supply going into the forward years than I am right now,” she said. “So, you might see contracting opportunities for new generators that haven’t been there in the past.

“I’m hopeful … that we won’t try to keep units in the market longer than they would like to be there,” she continued. “We just have to be comfortable with what that means — likely higher, more volatile prices going forward than what we’ve experienced in the last couple of years.”

Cramton, an economist at the University of Maryland, agreed. “If we let the market work, it will be a higher forward price — and especially the forward prices many years out. There’ll be pressure on the demand side.”

But he said he feared the transition could be interrupted by “regulatory uncertainty around large subsidies for keeping guys in the market that shouldn’t be there.” It was an apparent reference to Energy Secretary Rick Perry’s call for price supports for coal and nuclear units, although his proposal is limited to FERC-jurisdictional RTOs and ISOs.

“That’s what’s going to damage the market,” Cramton added. “So, I would urge everyone to tell their congressmen to stop that.”