By Amanda Durish Cook

MISO on Wednesday revealed plans to rely more heavily on its own load forecasting to support long-term transmission planning, instead of primarily drawing on a combination of forecasts provided by load-serving entities.

Stakeholders were unenthusiastic about the idea, which would elevate the role of an independent long-term forecast provided by Purdue University’s State Utility Forecasting Group. MISO says stakeholder input will influence a second version of the proposal presented in December.

Under its existing planning process, MISO draws on an aggregate of about 150 LSE resource adequacy forecasts submitted under Tariff Module E to inform economic studies for its annual Transmission Expansion Plan. The LSEs currently provide 24 months of load forecasts and produce additional predictions for eight seasonal peaks to create a 10-year forecast. The RTO uses the data to extrapolate another 10 years into the future to fit its 20-year planning horizon.

MISO also consults the Purdue forecast — which relies on 20-year forecasts produced by states — but only to draw comparisons with the LSEs’ predicted growth rates. The RTO earlier this year said it was investigating ways to improve that independent forecast. (See Dynegy: MISO LSE Load Forecasts Require Tune-up.)

Blending Forecasts

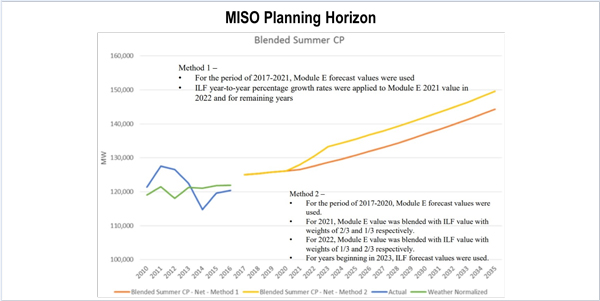

MISO is now proposing to blend the LSE and Purdue forecasts, adviser Rao Konidena said during an Oct. 18 Planning Advisory Committee meeting. Under the new approach, it would no longer extrapolate the LSEs’ predictions, instead relying on Purdue’s forecasts to predict growth rates for the second half of the planning horizon.

The RTO said it planned to use the independent forecast in part because it does not know what economic drivers underpin the LSEs’ forecasts or whether the LSEs include state renewable or efficiency mandates and emissions goals. Use of both forecasting methods will lead to “better evaluation of impacts of variations in assumed penetration levels of demand response resources, energy efficiency, and distributed energy resources,” it said.

Adam McKinnie, an economist with the Missouri Public Service Commission, asked whether MISO had faith that utilities were making thoroughly researched predictions of future load growth with their state-submitted resource adequacy plans.

“Do you ask utilities for the drivers of economic growth behind their load forecasts?” McKinnie asked. “You seem to be taking shots at the Module E forecasting,” he added.

“All I’m saying is that I don’t know what goes into the economic drivers,” Konidena responded.

Minnesota Public Utilities Commission staff member Hwikwon Ham wondered if MISO thinks it’s overbuilding or underbuilding transmission based on the use of its existing Module E process. “You have to show that there is a better process,” he said.

Konidena stressed that MISO only wants to use a forecast that’s designed with the next 20 years in mind, rather than simply extrapolating a 10-year forecast. Use of two separate forecasts for the same planning studies will lower the risk of load forecast miscalculations being compounded into “poor year-out projections,” he said. MISO has also noted that Applied Energy Group predicts that demand-side management programs will hit a saturation point in a decade, something the RTO will fail to include in its growth rate if it simply extrapolates aggregated utility forecasts.

Real Projects, Real Money

Indianapolis Power and Light’s Lin Franks said that the sample coincident peak produced by the blend is too aggressively high: It results in a 150-GW summer coincident peak by 2035, about 5 GW higher than if MISO relied on a Module E extrapolation alone.

“I’m worried about this. This is real money. These are real projects that people are going to want to build, and when we get there, those transmission lines are going to be empty,” Franks said.

WPPI Energy’s Steve Leovy says his company already forecasts 20 years in advance and said he’d be happy to share the longer forecasts with MISO.

Konidena asked stakeholders to submit suggestions on the blended approach by Nov. 17. He said MISO would continue discussing possible expanded used of the independent load forecast at the December PAC meeting.

“You’ve asked if stakeholders have ideas on how to blend the forecasts, to provide them. If we have ideas about not blending them, are you open to that too?” asked Entergy’s Yarrow Etheredge, eliciting laughter.

Konidena said he was open to such suggestions if stakeholders could make a business case for keeping the forecasts separate.