By Rich Heidorn Jr.

NERC released its annual Long-Term Reliability Assessment on Thursday, calling for more efforts to preserve “essential reliability services” provided by coal and nuclear plants but saying it is agnostic as to how FERC and regional grid operators do so.

“FERC should consider the reliability and resilience attributes provided by coal and nuclear generation to ensure that the generation resource mix continues evolving in a manner that maintains a reliable and resilient” bulk power system (BPS), the 2017 report said.

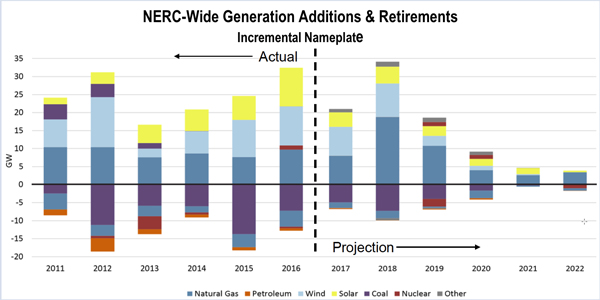

NERC’s concerns that the increase in natural gas and renewable generation could endanger grid resilience puts it squarely in the middle of the debates over state nuclear subsidies and Energy Secretary Rick Perry’s call for price supports for coal and nuclear plants in organized markets.

“The changing composition of the North American resource mix calls for more robust planning approaches to ensure adequate essential reliability services and fuel assurance,” the report said, calling for new metrics to supplement reserve margins and requirements that all new generation provide voltage support and frequency response.

But NERC said it would limit its advice on the contentious issue, which is now before FERC. (See McIntyre Takes FERC Chair; Wins Delay on NOPR.)

Moura

“What would be a bad thing is if we bring on a lot more gas-fired generation but all that gas-fired generation … can be interrupted, especially during winter peak times,” John Moura, NERC’s director of reliability assessment and system analysis, said during a media briefing on the report. “We replaced coal and nuclear that has some resilience to extreme weather and they’re going to be there, with resources that don’t have that. That’s our responsibility to look at and call out but … we do not have the authority or really the view as to how the market should address that.”

Recommendations

The report said:

- FERC should support new products and revised market rules to ensure “essential reliability services” including frequency response and ramping.

- State, federal and provincial regulators must recognize the long lead times for generation, transmission and natural gas infrastructure and the difference between regulated areas with long-term integrated resource plans and organized markets that can lose a generator with as little as 60 days’ notice.

- State and federal policymakers, including the Department of Energy and FERC, should consider the impact of natural gas disruptions on the BPS when evaluating infrastructure requirements. Transmission planners and operators should identify reliability concerns resulting when a large share of gas generators rely on interruptible fuel contracts.

- System operators and planners should gather more data on the “aggregate technical specifications” of distributed energy resources on local distribution grids to ensure accurate planning models, coordination of system protection and real-time situational awareness. Moura said the aggregate amount of behind-the-meter resources “is generally well known,” but that bus locations and technical specifications such as protection settings and voltage operating ranges are not.

In addition, NERC said it would conduct a “comprehensive evaluation” of its reliability standards to ensure their compatibility with nonsynchronous and distributed resources. “A lot of our standards were written largely for conventional generation, and words like ‘tripping’ or ‘spinning’ that are … well known when we’re talking about conventional generation don’t completely translate when we’re talking about asynchronous machines and inverters,” Moura said. “And so, we really need to look at our standards to make sure we’re not missing anything when we have more nonsynchronous machines on the system.”

| NERC

NERC also said it will monitor reserve margins, citing projected shortfalls in ERCOT and the SERC Reliability region. The reserve margin in SERC-E, which comprises utilities in the Carolinas that aren’t part of PJM, is expected to fall below the reference margin level beginning in 2020 because of the canceled expansion of the V.C. Summer nuclear power plant. The announcement of 4,600 MW of coal and gas retirements this fall means ERCOT reserve margins will fall below targets by summer 2018.

Higher Reserve Margins, Additional Metrics Needed

“As we see the resource mix change, we’re really making a call to action to industry and regulators to increase the robustness of the planning approaches,” Moura said.

In the past, he said, planners assumed fuel would be available and that there would be generators with sufficient inertia to control frequency response. Neither is a given, he said, as the mix changes to more gas and renewable generation.

The report said increasing variable generation may require more planning reserves to maintain the one-day-in-10-years loss-of-load-expectation, boosting target reference margin levels to 17% from 15%.

Since 2008, all but one of nine regions increased their reserve margins by about 2 percentage points. The exception was SPP, which has seen its reserve margin drop from 13% to about 12% over 10 years. ERCOT and Quebec are currently below 15%, although they have increased over the last decade.

Essential Reliability Services

Moura acknowledged that NERC has made the recommendation for preserving reliability services before. “But we wanted to reiterate it here: that all new resources, no matter the fuel, need to have the capability to support voltage and frequency response.”

He said FERC’s November 2016 rulemaking proposing changes to its pro forma generator interconnection agreements seeks to address the frequency response issue but said it’s up to states to implement the interconnection requirements. And even that, he said, is not sufficient. (See FERC Has More Questions on Frequency Response NOPR.)

Interconnection requirements don’t “guarantee any performance,” he said. “It requires them to have the capability and the [ability] to provide it, but in market areas, if they’re not bidding in and being incentivized to provide that frequency response, they don’t.

“We’re not in trouble right yet with frequency response,” he added. “But we see it on the horizon.”

Similarly, he said ERCOT’s establishment of a “critical inertia” level of 100 GW/s is “a really good approach to manage this. But a long-term mechanism will be needed as even more … wind will be coming on to their system.”

Gas Supply

The report notes that on-peak natural gas capacity has increased from 280 GW in 2009 to 442 GW today, with another 32 GW of gas capacity planned for the next 10 years. It projects the Florida Reliability Coordinating Council assessment area will rely on gas for 78% of its power by 2022.

“Areas can have and can rely on large amounts of natural gas as long as they have fuel assurance mechanisms, and Florida does that very well,” Moura said. “They have dual-fuel requirements as well as firm transportation … and the pipeline was really built for the natural gas generation in that area.”

Moura also said PJM’s Capacity Performance requirements and ISO-NE’s Pay-for-Performance program is “exactly what we’re looking for.”

“But the jury’s still out as to whether or not those penalties for nonperformance will compel generators to get dual fuel. … At least in New England, states have been very clear that new natural gas pipelines aren’t wanted.”

| NERC

The report also pointed out that the 0.61% (summer) and 0.6% (winter) 10-year annual demand growth rate for North America is the lowest on record. Despite flat loads, it noted grid operators added more transmission during 2006-2015 compared to 1991-2005.