MISO said it’s poised for a slightly sunnier supply picture after tabulating this year’s resource adequacy survey in partnership with the Organization of MISO States.

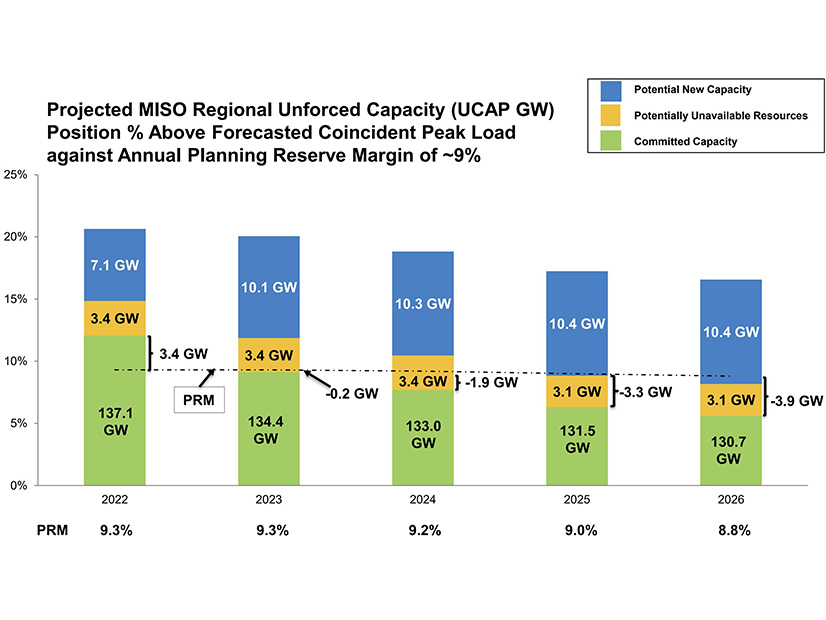

In the next five years, OMS and MISO said the footprint could experience deficits as steep as 4 GW or surpluses nearing 14 GW.

The OMS-MISO survey showed that all local resource zones appear to be in good shape for 2022 on a committed capacity basis and that potential shortfall estimates across all five years are much shallower than in past years. The two said the grid operator should have anywhere from 3.4 to 13.9 GW of extra unforced capacity beyond its 2022 summer peak planning reserve margin requirement.

Other survey years showed anywhere from a 0.2-GW shortfall or 13.3 GW in excess of the planning requirement in 2023; a 1.9-GW shortfall or 11.8-GW surplus in 2024; and a 3.3-GW shortage or 10.2-GW surplus in 2025. MISO used an approximate 9% unforced capacity planning reserve margin requirement for reference in all years.

It’s not until 2026 where MISO could see an almost 4-GW systemwide shortfall, with four out of the 10 local resource zones potentially needing help from other zones. At that point, there might not be enough supply to go around.

“It puts more emphasis on putting more potential capacity online as well as retaining some uncertain capacity,” MISO Executive Director of Market Operations Shawn McFarlane told stakeholders at a special teleconference Friday to discuss the survey.

Last year’s survey indicated that MISO could face a 400-MW capacity shortfall as early as 2022, and the next five years could contain surpluses as high as 12.5 GW or shortfalls that could dip to 6.8 GW. (See OMS-MISO Survey Sees Uncertain Supply Future.) In 2018, the survey predicted anywhere from a 2.3-GW shortfall to a 7.5-GW surplus in 2022.

McFarlane said this year’s survey shows that there could be a “fairly healthy” 10 GW in resource additions annually over the next four years. In the past two years, MISO interconnected the most generation it ever has, with 10.8 GW in 2019 and 9.9 GW in 2020.

MISO said this year’s less risky supply picture can be attributed to lackluster load. McFarlane said forecasted load for 2022 dropped 3.6 GW between this year’s survey and the last, mostly owing to the COVID-19 pandemic.

In the survey’s ensuing years, MISO and OMS continued to include the load decrease and used a 0.3% demand growth rate on a year-to-year basis between 2022 and 2026.

“Once again, the survey shows an uncertain year has evolved into a more certain year,” North Dakota Public Service Commission Chair and OMS President Julie Fedorchak said of 2022.

“The outlook is modestly better,” McFarlane agreed. “In 2023 and beyond, the resource picture is a little less certain.”

McFarlane said more generation retirements and livelier demand growth could make reality more dire than the survey’s predictions. He said a robust pandemic recovery with more energy demand could wipe out the moderate capacity gains.

However, McFarlane said that states and load-serving entities and state regulators will use this year’s OMS-MISO survey results to guide new resource decisions.

Fedorchak said even though some local resource zones might come up short in future years, they could lean on supply from other flush zones. She also said it’s imperative that generation projects be able to complete MISO’s interconnection queue.

“We’re aware of those projects and need to ensure that the portions of those needed for resource adequacy are able to interconnect,” she said.

MISO singled out Wisconsin and the Upper Peninsula’s Zone 2, Southern Illinois’ Zone 4, and Indiana and Western Kentucky’s Zone 6 as being most at risk of needing to rely on imports over the next five years.

Survey results are based on responses from more than 97% of LSEs and other non-LSE market participants.

As with past surveys, MISO hasn’t assumed that all of the proposed generation in its interconnection queue reaches commercial operation and can help mitigate capacity needs.

MISO gave a 75% probability of completion to conventional generation projects in phase 2 of the three-phase interconnection queue and a 50% probability for intermittent generation projects at the same point. Projects that have scaled the three definitive planning phases and are executing generator interconnection agreements received a 90% certainty. For projects that have applied but not yet entered the queue, MISO assigned a 10% weight.

McFarlane also warned that next year’s survey result might slide again into pessimism, considering that MISO is preparing to introduce a stricter and seasonally based capacity resource accreditation. “We need to approach OMS about how we approach the survey in a seasonal capacity construct,” he said.