The development of a single RTO covering the entire U.S. portion of the Western Interconnection could save the region $2 billion a year in energy costs by 2030, according to findings from a state-led study funded by the U.S. Department of Energy.

The study also found that a full Western RTO would be more effective at reducing renewable resource curtailments and CO2 emissions than under other configurations in which the region is broken up into two separate markets.

Initiated by Utah Gov. Spencer Cox’s Office of Energy Development in collaboration with state energy offices in Colorado, Idaho and Montana, the study is part of broader effort to analyze the impacts of different electricity market configurations on the West. States in the region have historically been reluctant to adopt a fully organized market but have largely embraced the half-measure of having their utilities join CAISO’s Western Energy Imbalance Market.

In November, the study group released findings that indicated that a single RTO could save the West $1.2 billion annually under a 2020 market scenario. (See Study: Western RTO Could Yield $1.2B in Yearly Savings.)

The more recent findings look ahead to examine the potential economic outcomes of various “market constructs” that could prevail in the West by 2030. To do that, the study overlays those constructs on four potential market footprints:

- Status Quo, in which the only formal market in the West is an EIM that consists of all members that were participating in or had committed to join the market by late 2019. In this scenario, balancing authority area boundaries are retained and there is distributed control of the transmission system.

- One Market, in which the entire U.S. portion of the Western Interconnection is participating in a single market (either an RTO or day-ahead market, depending on the scenario).

- Two Market A, in which CAISO fails to expand its footprint while the rest of the U.S. portion of the Western Interconnection forms a separate market. In this scenario, California utilities that are not currently part of CAISO are assumed to be participating in a market with the ISO.

- Two Market B, in which California and most of the U.S. portion of the Western Interconnection participate in one market, while the area covered by the Mountain West Transmission Group (MWTG) becomes its own market. (The MWTG halted its work on exploring the development of a market in 2018 when Xcel Energy pulled out of the effort.)

“None of the analysis is really dependent on what entity is operating one of these given markets,” Keegan Moyer, principal with study author Energy Strategies, said in presenting the findings during a webinar Thursday. “So, in terms of what the model sees and the cost estimating that we did for the administrative costs for these markets, it’s agnostic on who would actually be providing these market services.”

Bigger Footprint is Better

The study’s first scenario assumes that the EIM’s current real-time market (the Status Quo in the study) expands to include day-ahead trading. In that scenario, the region realizes an additional $47 million in annual adjusted production cost saving and $529 million in capacity savings, for a total gross yearly benefit of $576 million by 2030. While Washington ($163 million) and California ($143 million) claim the biggest shares, gross benefits are positive from every state. Inclusion of day-ahead trading in the EIM also reduces system emissions and renewable curtailments by 0.3% and 6%, respectively.

A second scenario compares day-ahead markets under the One Market and Two Market B footprints, finding that the annual benefits of the former configuration ($681 million) exceed those of the latter ($435 million) by $247 million. The study indicates that, because of increased load diversity, all Western states would see greater benefits from a day-ahead market construct that includes California than one that excludes the state. However, emissions and curtailments would be similar under both configurations, the study showed.

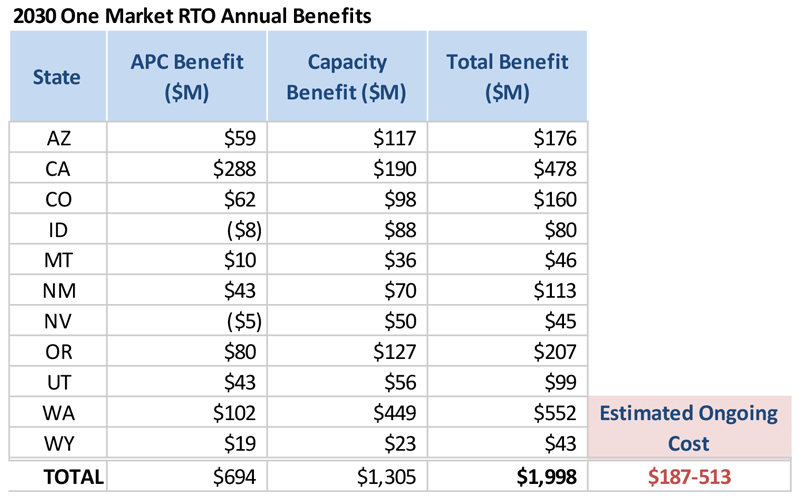

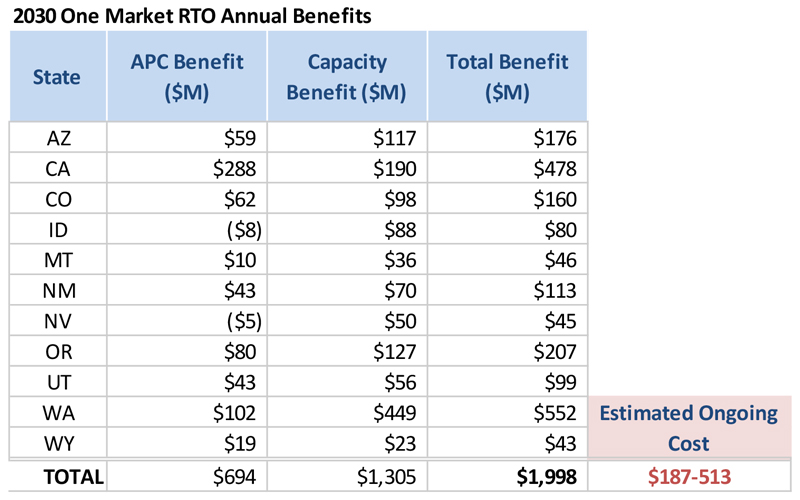

In a third scenario, the study stacks a West-wide day-ahead market against a full Western RTO that consolidates the region’s existing 39 BAAs into one, centralizing transmission planning and cost allocation as well as market operations. The study finds that, with $2 billion in savings, an RTO would yield nearly triple the benefits of the day-ahead market, reducing production and capacity costs by an additional $599 million and $718 million, respectively. When measured against the Status Quo, an RTO would also reduce renewable curtailments by 43%, versus 9% for the West-wide day-ahead market, resulting in 2.3 million tons of additional CO2 emissions reductions.

Washington again takes the lion’s share of the annual benefits at $351 million, followed by California ($319 million), Oregon ($148 million) and Arizona ($136 million). All states see benefits, though, with the smallest shares going to the least populous states.

The study also finds that by 2030, capacity savings (because of load diversity) should account for 65% of the RTO’s gross benefits, increasing from a 35% share under 2020 conditions. In contrast, operational savings are expected to decrease as load is increasingly served by zero-marginal-cost resources that offset the fuel and operational expenses that constitute dispatch savings.

“The study, I think, supports the thesis that bigger markets generally perform better. We saw higher gross benefits when we had larger footprints and more comprehensive market services. Those tend to maximize benefits for the most Western states,” Moyer said.