MISO is grappling with how many hybrid generation formats could be coming its way as it prepares a dedicated participation model.

The grid operator’s staff believe there could be a crush of hybrid resources — which MISO defines as storage paired with generation, often renewable — on the way. The RTO held a June 21 teleconference to discuss near-term market prospects for hybrid resources.

“It will be hugely helpful to MISO to know about the projects you have in your pipelines,” Wind and Solar Program Manager Laura Hannah told stakeholders.

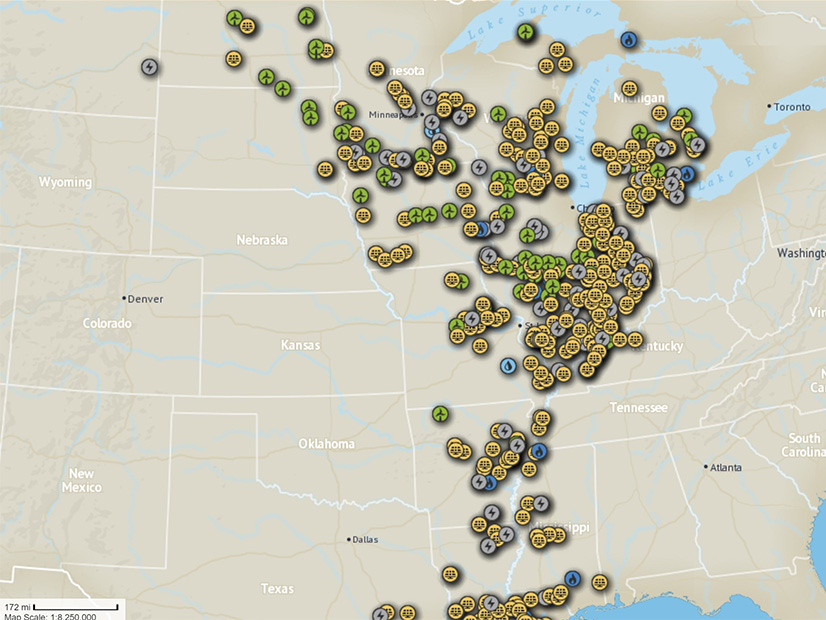

MISO’s approximately 83-GW interconnection queue contains about 5 GW of hybrid projects set to come online in 2023, mostly in the form of solar and storage. But the grid operator is bracing for more than that.

“That could be only a fraction of the projects that become hybrid,” Hannah said, explaining that interconnection customers sometimes request two separate applications for the storage and generation components, with others requesting surplus interconnection capability for storage that’s added later.

“Just glancing at the queue, it’s difficult to tell how many projects that are hybrid are coming our way,” she said.

“Hybrids are definitely a requested method of interconnection,” MISO Director of Market Design Kevin Vannoy added. He said that MISO should facilitate the entry of new generation resources to allow for “more participation and increased competition in MISO markets.”

Vannoy said MISO currently has no generation operating as a hybrid resource. It does, however, have co-located resources: multiple generators operating independently at a single point of interconnection. Unlike the co-located category, hybrid resources operate as a single asset.

Last year, stakeholders prioritized a MISO hybrid resource participation model in MISO’s Market Roadmap list of improvements.

Market Design Adviser Bill Peters said hybrid resources might be able to pursue interconnections through one of three existing options until a definition is added to the MISO tariff: the traditional generation registration, which doesn’t use fuel forecasts; as a dispatchable intermittent resource; or as a stored energy resource type II.

“We’ll have to approach this on a case-by-case basis until those lines are drawn,” Peters said.

MISO counsel Mike Blackwell said the RTO in late July will file a proposal with FERC for a hybrid resource capacity accreditation. At first, the new resource accreditation will rely on default ratings, then morph into a performance-based accreditation once enough data rolls in on the asset’s output.

Some stakeholders said MISO should consider expanding its dispatchable intermittent resource type to be more versatile, allowing hybrid assets to follow MISO wind forecasts.

Clean Grid Alliance’s Natalie McIntire said if MISO also developed forecasts for hybrid resources, it would provide more certainty for those wanting to develop them.

“Nothing today offers the full capability for hybrids to participate,” Great Plains Institute’s Matt Prorok commented. He said MISO might consider making a more general participation model that allows the full participation of more flexible resources.

Clean Grid Alliance’s Rhonda Peters said so far there doesn’t seem to be any interest among developers in interconnecting under MISO’s stored energy resource type II definition.

Prorok agreed that it has failed to attract a string of projects.

NextEra Energy Vice President of Renewable Energy Policy Mark Ahlstrom has said that there is no need for MISO to create special market definitions for hybrid storage resources because they can emulate existing, conventional generation.

“It simplifies the approach for the RTO,” Ahlstrom said last year at a MISO Market Subcommittee meeting, adding that hybrid resource can perform with the “same quality, reliability and forced outage rate” as conventional generation. Currently, MISO models hybrid resources separately for each fuel source.

“It’s the most flexible resource you can likely imagine,” he said.

Ahlstrom said capacity values could be calculated by adding the effective load carrying capability of the renewable generation plus the nameplate capacity of the battery.