Markets and Reliability Committee

Non-firm Transmission Service Pre-emption Endorsed

PJM stakeholders last week endorsed tariff language revisions to exclude the right of first refusal (ROFR) process from the evaluation of non-firm transmission service requests. The changes were driven by the RTO’s concerns around new federal standard requirements.

One member objected to the revisions in an acclamation vote held at Wednesday’s Markets and Reliability Committee meeting, while the tariff language was approved on the consent agenda at the Members Committee meeting held later in the afternoon. The revisions were originally approved at the July Operating Committee meeting. (See “Non-firm Transmission Service Pre-emption,” PJM Operating Committee Briefs: July 15, 2021.)

Jeffrey McLaughlin, senior lead engineer in PJM’s transmission service department, reviewed the “quick fix” problem statement and issue charge to modify language in section 14.2 of the tariff related to pre-emption of non-firm transmission service.

McLaughlin said the quick fix was necessary because of compliance requirement changes within version 3.2 of the North American Energy Standards Board’s (NAESB) Business Practice Standards, which FERC adopted in January 2020 and becomes enforceable on Oct. 27. (See FERC Adopts NAESB Business, Communication Rules.)

McLaughlin said an accelerated timeline in the stakeholder process was necessary to ensure FERC responds to PJM’s proposed filing under Federal Power Act Section 205 prior to the October enforcement date. Because the MC has no meeting scheduled for August, McLaughlin said, the vote needed to take place in July to allow for a 60-day window for a FERC ruling.

“We do understand this is an aggressive timeline,” McLaughlin said. “We didn’t take the decision to move forward with it lightly.”

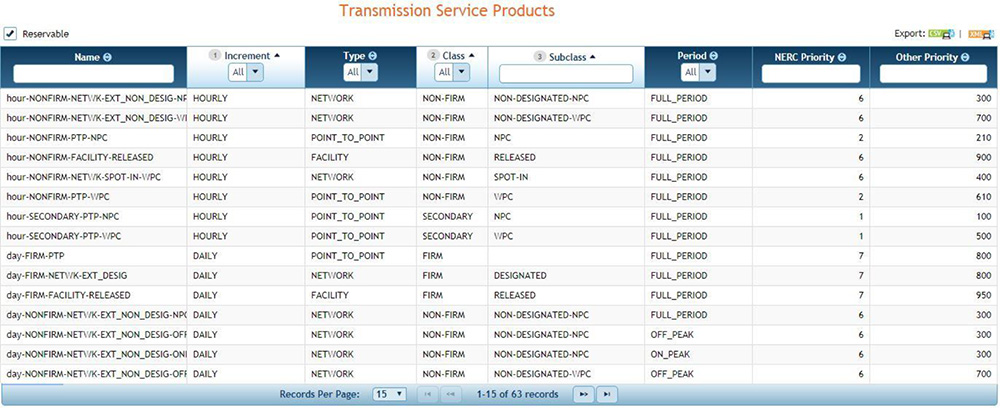

McLaughlin said PJM staff determined that the changes to the ROFR process caused by the NAESB standards could cause significant problems for the RTO’s non-firm transmission service processes and OASIS customers. He said the changes could create uncertainty for the most frequently used transmission products and have detrimental impacts on the day-head and real-time energy markets.

PJM employs an automated engine for processing non-firm transmission service requests where customers receive instantaneous evaluations, McLaughlin said, but the pre-emption established by the NAESB standards introduces “significant delays” to the process through “back-and-forth negotiation” involved in the evaluations.

McLaughlin said the NAESB changes could result in more than two-hour delays for hourly challenger requests and more than 24-hour delays for daily challenger requests depending on the specific scenario being evaluated.

He added that PJM staff were also concerned that transmission service reservations procured in smaller increments — such as hourly and daily reservations — could be at greatest risk for pre-emption. Most of PJM’s service requests fall into this high-risk category, he said, with more than 90% of the 45,000 confirmed requests in 2020 consisting of hourly or daily service granted within 24 hours of the service start time.

“Unfortunately, because hourly is the shortest in duration, it’s also at the highest risk of being pre-empted,” McLaughlin said. “It leaves customers with little time to react and to make alternate arrangements.”

PJM’s proposal included using section 13.2 of the tariff, which already contains language to exclude pre-emption from the evaluation of short-term firm transmission service. McLaughlin said the revisions extend similar language to section 14.2 of the tariff, excluding pre-emption from non-firm request evaluation.

He said the tariff revision will prevent processing delays, minimize “unnecessary customer uncertainty for little benefit,” and avoid impacts to the day-ahead and real-time markets.

PJM will make a Section 205 filing this month to get a ruling before the October implementation of the NAESB standards, McLaughlin said. The RTO made a separate compliance filing with the commission on July 27 to comply with the NAESB standards and to request a continued waiver of certain standards.

“We feel strongly that this solution is in the best interest of stakeholders,” McLaughlin said.

If FERC does not approve the Section 205 filing, McLaughlin said, PJM’s backup plan includes implementing the pre-emption process with its July 27 compliance filing, but the process would be conducted in a “customized and more streamlined way” with stakeholders to avoid delays in OASIS.

Susan Bruce, counsel to the PJM Industrial Customer Coalition (ICC), said some ICC members were struggling to understand the “urgency” on the ROFR process as the issue hasn’t been discussed much in stakeholder meetings. Bruce wanted to know what market segments were directly impacted by the issue and asked whether the Independent Market Monitor thought the change would cause any problems.

McLaughlin said the change primarily impacts OASIS users and could create too much uncertainty for them. After reviewing with its legal team, the RTO realized a Section 205 filing was necessary to modify the existing tariff language in order to avoid the uncertainty the NAESB standards could create.

Market Monitor Joe Bowring said the IMM supported PJM’s changes “both on the substance and the speed” in which they were being implemented. He said gaming opportunities could be “more severe” under the NAESB rules than under the PJM approach.

“We don’t see unintended market power consequences or gaming issues associated with PJM’s approach,” Bowring said.

Fast-start Manual Revisions

The Monitor questioned PJM about potential manual revisions resulting from the implementation of fast-start pricing.

PJM’s Vijay Shah, lead engineer for real-time market operations, and Rebecca Stadelmeyer, manager of market settlements development, reviewed proposed revisions to Manual 11: Energy & Ancillary Services Market Operations, Manual 18: PJM Capacity Market and Manual 28: Operating Agreement Accounting to address PJM’s filing of its fast-start tariff changes approved by FERC in May. (See FERC Accepts PJM Fast-start Tariff Changes.) The manual changes were introduced in a first read at the July Market Implementation Committee meeting. (See “Fast-start Pricing Manual Revisions,” PJM MIC Briefs: July 14, 2021.)

Shah said section 2.1 in Manual 11 was reorganized and includes new sections on fast-start-capable resources, fast-start-capable adjustment processes and eligible fast-start resources. Manual 11 changes also feature new day-ahead sections, Shah said, including energy offers used in day-ahead price calculations and day-ahead integer relaxation, along with real-time sections on how energy offers are used in the real-time price calculation.

Multiple sections were updated to provide clarity on how fast-start pricing will impact current business rules in PJM, Shah said.

“There’s a slew of changes throughout the manual with fast-start,” Shah said.

Stadelmeyer highlighted the changes in Manual 28, including the dispatch differential lost opportunity cost credits and double counting of commitment costs. She said the credits ensure resources dispatched to accommodate the “inflexibility” of fast-start resources follow PJM’s dispatch instructions to maintain power balance.

The Monitor originally called attention to section 4.2.9: Synchronized Reserve Market Clearing Price Calculation in Manual 11 at the July MIC meeting. The updated manual languages states, “In the pricing run, the cost of the marginal synchronized reserve resource may also include amortized start-up and amortized no-load costs due to integer relaxation for eligible fast-start resources.”

The Monitor noted that FERC required PJM to implement fast-start pricing for locational marginal pricing by relaxing the eco min constraint for fast-start units. Integer relaxation relaxes both the eco min and eco max constraint for fast-start units.

PJM’s filings do not state that integer relaxation applies fast-start pricing to reserve prices, the Monitor said, and the Sept. 1 implementation includes application of fast-start prices to reserve prices in some situations. This change to reserve prices was not included in PJM’s filings or accepted by FERC, according to the IMM.

The Monitor said it believes PJM should not be implementing fast-start pricing in that way because FERC did not approve that change in its fast-start order issued in December.

Bowring said FERC did not approve PJM’s approach to “integer relaxation” in section 4.2.9 that the proposed implementation must be modified to reflect what the commission issued in its order. He said the Monitor believes the existing manual language in the section is adequate and doesn’t need to be updated.

Bowring said he will provide more comments for stakeholders on the section at the August MIC meeting.

5-Minute Dispatch Revisions

Aaron Baizman, PJM senior engineer for real-time market operations, provided a first read of revisions to Manual 11: Energy & Ancillary Services Market Operations that would address changes and transparency to five-minute dispatch at the MRC, calling it a “heavily edited version.”

Baizman provided a first read of the revisions at the July MIC meeting. (See “5-Minute Dispatch Manual Revisions,” PJM MIC Briefs: July 14, 2021.)

PJM updated and added a “significant amount of sections” in Manual 11, Baizman said, with some of the sections seeing major changes. He highlighted section 2.3.3.1: Capacity Resource Offer Rules, which includes an added rule stating hydropower capacity resources “shall meet the must-offer requirement by either self-scheduling or may allow the day-ahead market to schedule by using the pumped storage optimization model.”

Baizman said the hydropower resources section had minor language changes based on stakeholder feedback at the July MIC for consistency throughout the tariff.

Section 2.5: Real-time Market Clearing Engine was “heavily edited” with multiple diagrams updated and additional information added for real-time security-constrained economic dispatch (RT SCED) optimization concerning the marginal resource identification process. Section updates also include additional inputs for RT SCED and information for transparency.

The MRC will vote on endorsement of the revisions at its August meeting, Baizman said, and PJM is looking to have the revisions effective by Nov. 1.

Consent Agenda Manual Endorsements

Several manual changes were endorsed on the MRC consent agenda with one stakeholder objecting. The endorsements included:

- Revisions to Manual 13: Emergency Operations to address conservative operations, PJM’s emergency protocols to ensure the bulk electric system remains reliable during extreme events. The manual changes were originally endorsed at the July Operating Committee meeting. (See “Manual 13 Changes Endorsed,” PJM Operating Committee Briefs: July 15, 2021.)

- Conforming revisions to Manual 14A: New Service Request Process to address the new service requests deficiency review requirements. The revisions were endorsed at the July Planning Committee meeting. (See “Manual 14A Revisions Endorsed,” PJM PC/TEAC Briefs: July 13, 2021.)

- Conforming revisions to Manual 18: PJM Capacity Market, Manual 20: PJM Resource Adequacy Analysis, Manual 21: Rules and Procedures for Determination of Generating Capability and Manual 21A: Determination of Accredited UCAP Using Effective Load Carrying Capability Analysis to address the effective load-carrying capability (ELCC) for limited-duration resources and intermittent resources. The revisions require a unit’s ELCC accreditation to be updated annually based on system conditions and unit performance. (See “ELCC Manuals,” PJM MRC/MC Briefs: June 23, 2021.)

- Revision to Manual 33: Administrative Services for the Operating Agreement around the operating reserve demand curve (ORDC) data in accordance with FERC transparency requirements. The new section states that PJM may publish annual information on aggregated forced outages for the RTO and other reserve zones directly relevant to the ORDC calculations. (See FERC Approves PJM Reserve Market Overhaul.)

- Revisions from the Governing Document Enhancement and Clarification Subcommittee (GDECS) addressing administrative changes and clarifications in the tariff and OA. PJM said the eight tariff and OA revisions were found to be “simple and non-controversial enough” that they were reviewed one time at the GDECS, receiving unanimous stakeholder support.

Members Committee

Manual 34 Revisions

Stakeholders are looking to update Manual 34 regarding media and photography rules at PJM meetings.

John Horstmann, director of RTO affairs at AES Ohio, presented the proposed revisions to Manual 34: PJM Stakeholder Process addressing photography in meetings and media guidelines.

Horstmann said both changes resulted from feedback by members and have been discussed extensively at the Stakeholder Process Forum. He said the photography issue was initially introduced for discussion in June 2019 at the forum.

The photography manual change states, “All photographs must be approved by the subject(s) of the photo for use in print, newsletters, advertisements, marketing materials, electronic and social media. Photographers must obtain a written release from the subject(s) prior to taking their picture.”

“It’s nothing more than a courtesy to ask somebody before publishing their photograph,” Horstmann said.

The PJM media relations team brought manual changes to clarify what constitutes a media outlet after some stakeholders challenged information being disseminated by members after meetings.

The media change states, “Any individual or organization that disseminates information on a public platform from a PJM stakeholder meeting that includes direct quotation and attribution of any comments, and/or images, is subject to the rules pertaining to media regarding the quoting of individuals and/or their companies and photographing meeting participants. ‘Public platform’ includes but is not limited to publicly accessible social media, website, blogs, audio, video, or electronic and hard copy print media.”

Horstmann said when Manual 34 was originally written, social media was in its infancy. He said stakeholders don’t want a running dialogue of conversations from meetings ending up on social media because the information could stifle discussions.

The MC will be asked to approve the proposed revisions at its September meeting.

Consent Agenda

Two different revisions were approved on the MC consent agenda. They included:

- Revisions to Manual 34: PJM Stakeholder Process to address clarifications within the newly revised section 9.5: Motion Amendments. The changes give committees the chance to defer a main motion or an alternate motion on an issue to the next meeting through a two-thirds sector-weighted vote if they’re “not timely published” before a meeting.

- Tariff revisions to address concerns associated with the pro forma interconnection construction service agreement’s lack of superseding language and current automatic termination provision. The revisions were endorsed at the June MRC meeting. (See “ICSA Revisions Endorsed,” PJM MRC/MC Briefs: June 23, 2021.)