Jones Defends Roadmap to Grid Reliability, TAC Shakeup

What began as another hum-drum CEO’s report to ERCOT’s Board of Directors on Tuesday devolved into a battle over words between interim CEO Brad Jones and Director Shannon McClendon, who represents the market’s retail electric provider (REP) segment.

Speaking for her members — “I’ve got a segment that is really chewing on me,” she said — McClendon repeatedly questioned why load resources are being excluded from the ancillary services ERCOT is purchasing to guard against emergency conditions.

She said the REPs are unhappy with the grid operator’s approach to conservative operations, which includes procuring up to 7.8 GW of operating reserves, after they had committed to and hedged their contracts for the year.

Noting one slide in Jones’ report referred to “PUC/ERCOT collaboration,” McClendon said it should be changed to “PUC/ERCOT staff collaboration,” as stakeholders were not included. She asked that the minutes reflect that ERCOT’s 60-point “Roadmap to Improving Grid Reliability” was never approved by the board or the Public Utility Commission, though she did concede that many people, including board members, provided input.

McClendon, a former director who rejoined the board after the flurry of resignations in the wake of the February winter storm, has been one of its most vocal members in the months since. She was supported by Oncor’s Mark Carpenter, the investor-owned utility segment’s representative, when the discussion turned to No. 36 on the roadmap, “ensure the Technical Advisory Committee is comprised of senior-level members from each member organization to promote timely decision-making.”

The 30-member TAC, representing seven different stakeholder segments, works on protocol changes and makes recommendations on ERCOT policies and procedures to the board. Last month, it pushed back on Jones’ proposed change during its regular monthly meeting. (See ERCOT Technical Advisory Committee Briefs: July 28, 2021.)

“That particular group is a highly functional, technical group. It has broad knowledge of the committees and subcommittees that report to it,” Carpenter said. “The makeup seems to be working very well. I think there’s quite a bit of concern … there’s going to have to be some discussion at some point.”

Jones agreed with Carpenter and said his proposal to restructure the TAC is “controversial.” As he did before the committee last month, Jones said the state government has lost confidence in ERCOT’s stakeholder process following the storm, but he said the committee is “working through that.” The TAC has scheduled its first workshop for Aug. 18 to discuss alternatives.

Texas lawmakers passed several pieces of legislation in responses to the ERCOT’s near collapse during the storm. None was more important than Senate Bill 2, which replaces the board’s market participant representatives with independent directors from outside the market.

A three-person selection committee appointed by the state’s political leadership will select the new board members; the first board members aren’t expected to be seated until September.

“That’s what I want to see improved,” Jones said, referring to politicians’ lost trust. “I want to see we are reacting to that sentiment so they have trust in TAC that the new board may not have. Changes need to be made to improve the way [committee members] work with the new board, whenever that new board is seated.”

McClendon, who sat on the TAC before joining the board, said she “adamantly” disagreed with Jones’ perception of politicians’ level of confidence in ERCOT stakeholders.

“You’re leaping to conclusions when you say they’ve lost confidence in the stakeholder process,” she said. “For everyone you say that has lost confidence, I can give you two [who haven’t]. I will need to see that in writing, from whomever you need to get it from.”

“Very good,” Jones replied.

PUC Chair Peter Lake, who has also chaired board meetings in the absence of a chair, jumped into the conversation. He said SB2 clearly made “substantial changes” to ERCOT’s governance with its removal of market participants on the board.

“Leadership is moving forward with that transition process,” he said. “While we’ll have to defer to the yet-to-be named ERCOT board, rest assured that while the stakeholder process may look different, depending on how the new board approaches it, I am confident there will be a robust stakeholder process going forward, and the new board will work with the membership to identify the best version that we can deliver for Texas.”

McClendon did wrangle a commitment from Jones that ERCOT staff would consider including contributions from load-serving entities as they continue to increase operating reserves with ancillary services. Jones said that when load resources are used, it results in a drop in ERCOT’s physical responsive capability, which must then be replaced by generation.

“We think this is the most conservative approach in meeting the needs of all Texans,” Jones said.

When McClendon continued to contend that ERCOT staff are making the decisions on procuring ancillary services without the board’s input, Jones reminded her that staff spent two sessions before the TAC explaining their actions.

But McClendon responded, “It was a directive. It was a one-way conversation. I don’t think we necessarily want to get into the politics of how that was approved.”

“We want to stay out of [energy emergency] alerts [EEAs]. We want to stay out of emergency conditions,” Jones said. “That’s our goal.”

There, he found agreement.

“We don’t want the public to think we can’t manage a grid by sending out EEAs or conservation messages,” McClendon said. “Load can keep that from happening.”

Board Signs off on 2022-2023 Budget

The board agreed with the Finance and Audit Committee’s recommendation to approve the 2022-2023 biennial budget and to keep the administrative fee at its current 55.5 cents/MWh rate.

The approval authorizes operating expenses, project spending and debt-service obligations of $322.2 million and $287 million for 2022 and 2023, respectively. The committee said the budget will fund additional costs resulting from the February storm and the Texas Legislature’s numerous bills addressing the event.

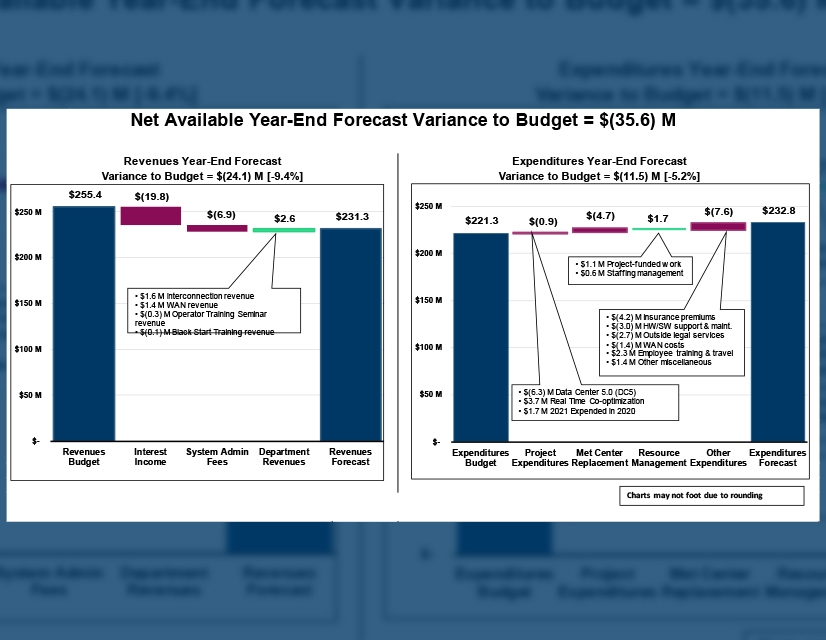

The budget is an increase over the current 2021 budget of $275.2 million, which is currently projected to be off by $35.6 million at year-end. Revenues are projected to come in under $24.1 million and expenses $11.5 million over budget.

ERCOT expects to take a $6.9 million hit from insurance premiums and legal costs stemming from the winter storm, Jones said. Staff’s move to a new office space early next year is also forecast to come in $4.7 million over budget.

ERCOT CFO Sean Taylor said staff shared the committee’s recommendation to leave the administrative fee untouched, saying the grid operator could recover costs in future years “when market participants have the ability to absorb the increase.”

The city of Dallas’ Nick Fehrenbach, who chairs the FAC and represents the commercial consumer segment, voted against the measure over previously disclosed concerns that the market’s uncertain future design and deficit could put the new board in a position where a fee increase will be necessary. (See “‘Strong Upward Pressure’ on Budget,” ERCOT Briefs: Week of July 19, 2021.)

Garland Power & Light’s Tom Hancock, who speaks for the municipal segment, also voted against the budget’s approval. McClendon abstained.

Passport Program ‘Uncoupled’

Staff delivered a final board update on the Passport Program, which bundles together several high-profile initiatives but has been thrown off schedule by the work needed to address the winter storm’s effects.

The program has been “decoupled” into “manageable pieces,” ERCOT’s Matt Mereness said, to keep the focus on the energy management system’s (EMS) technology upgrade. The upgrade, the first since 2017, is scheduled to be completed in mid-2024; Mereness has previously said the upgrade is “non-negotiable.” (See “Passport Pushed Back 18 Months,” ERCOT Technical Advisory Committee Briefs: April 28, 2021.)

However, staff will need at least 18 months after the EMS project to add real-time co-optimization (RTC) and its $51.6 million price tag to the ERCOT market. Real-time co-optimization, which clears energy and ancillary services every five minutes in the real-time market, accounts for the biggest chunk of Passport’s $85.5 million cost.

“We’re on at least a one-year delay,” Mereness said. “We’ll put [RTC] on the shelf. When it’s time to bring it off the shelf, we can do so.”

Staff will ask the TAC next month to formally retire the RTC Task Force.

New Wind, Solar Generation Highs

ERCOT has set new instantaneous records for wind and solar generation this summer, Jones told the board. Wind energy reached 23.6 GW at 10:32 p.m. on June 25, while solar peaked at 6.9 GW at 10:30 a.m. July 31.

The grid operator also set a new peak for June when demand hit 70.2 GW during the afternoon on June 23.

Staff have said they have sufficient capacity to meet a projected peak demand of 77.1 GW this summer. That would break the record of 74.8 GW set in August 2019, but demand has topped out at 72.9 GW on July 26 so far this summer.

ERCOT is expecting demand to near 74 GW later this week.

SCT Directive, 14 Changes Approved

The board approved the latest in a series of directives tied to Southern Cross Transmission, a proposed HVDC line in East Texas that would ship more than 2 GW of energy between the Texas grid and Southeastern markets. (See “Members Debate Southern Cross’ Bid to be Merchant DC Tie Operator,” ERCOT Technical Advisory Committee Briefs: Feb. 22, 2018.)

Directive 9 required staff to evaluate whether the project would require any modifications to existing or additional ancillary services. In a white paper, staff said NPRR1034, approved in February, gives ERCOT authority to establish limits on DC tie transfers and to curtail their schedules when necessary to address the risk of unacceptable frequency deviations. They found there was no need for other changes to accommodate the project.

The board also passed eight Nodal Protocol revision requests (NPRRs), a single change to the Nodal Operating Guide, two modifications each to the Planning Guide (PGRRs) and the resource registration glossary (RRGRRs), and a system-change request (SCR), all previously endorsed by the TAC in June and July:

-

-

-

- NPRR995: sets the term “settlement-only energy storage system” (SOESS) and further defines it as transmission-connected or distribution-connected; relocates the settlement-only generator (SOG) term from under resource to standalone as its own unrelated term; and incorporates the relevant SOESS terms into the market information system (MIS) reporting created for SOGs.

- NPRR1005: redefines point of interconnection (POI) to refer to any physical location where a generation entity’s facilities connect to a transmission service provider’s facilities; removes references to load interconnections; introduces the term “point of interconnection bus” (POIB) for the bus in the substation closest to the resource’s POI or any electrically equivalent bus in the substation; and changes POI to POIB throughout the protocols, among other revisions.

- NPRR1063: requires ERCOT to post dynamic rating approval information to the MIS secure area.

- NPRR1073: prevents a market participant from exiting the market to escape uplift charges and then trying to re-enter under a different name.

- NPRR1078: ensures only amounts owed to ERCOT by counterparties through the default uplift process can be collateralized.

- NPRR1079: separates ERCOT contingency reserve service, which will come in a future release, from fast frequency reserve project language being added to the 48-hour day-ahead market report requirements.

- NPRR1083: prohibits uplift charges to qualified scheduling entities acting as central counterparty clearinghouses in wholesale market transactions or regulated as derivatives clearing organizations as defined by the Commodity Exchange Act.

- NPRR1086: aligns the protocols with the PUC’s recent order eliminating the market’s pricing mechanism link to natural gas prices and adds a provision to ensure a resource, through its qualified scheduling entity, can recover its marginal costs during scarcity pricing situations while the low systemwide offer cap’s is in effect.

- NOGRR210: clarifies language in the revised POI term and NPRR1005’s POIB.

- PGRR089: revises the list of data sets posted to the MIS by removing the planning horizon transmission capability methodology and adding long-term system assessment postings, geomagnetic disturbance vulnerability assessments and the monthly generator interconnection status.

- PGRR091: gives interconnecting entities 60 days to complete an application for a full interconnection study.

- RRGRR025: clarifies language for NPRR1005’s defined POIB term by modifying the existing POI term to conform to the generation agreement’s conception of the POI as the point of ownership change. The revision also removes the generation agreement’s reference in that definition.

- RRGRR028: adds transformer manufacturer test reports to the data collection requirements and clarifies the required transformer information.

- SCR815: aligns market guides, streamlines processes, increases transparency and tracking, and improves communication among market participants in the MarkeTrak tool used to resolve retail market issues.

-

-