Normal fall conditions could beget an emergency declaration in September or October, MISO said in a seasonal outlook released Thursday.

The RTO also said excessive generation outages and high loads in autumn could exhaust every megawatt of its capacity and leave staff counting on non-firm imports to maintain system reliability.

Speaking during a Market Subcommittee teleconference, MISO Resource Adequacy Engineer Eric Rodriguez said this fall is projected to have “substantial risk,” particularly if there is an active shoulder maintenance season.

“Generation outages on monthly peak remain high during the fall, particularly in October and November,” Rodriguez said, referring to historical data. Last October, planned and forced outages on peak crept to more than 50 GW, a five-year high.

If outages are controlled and load doesn’t spike, staff said they could have at least November in hand this year.

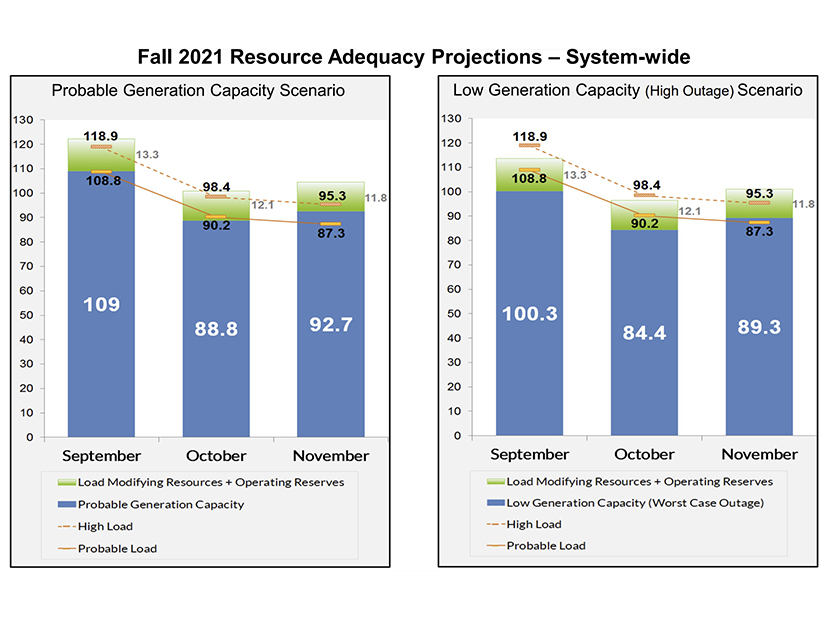

Using probable peak forecasts provided by its market participants, MISO said it would be left with 108.8 GW of non-emergency resources to cover a 109-GW September peak; 88.8 GW in in non-emergency capacity that would fall short of a 90.2-GW October peak; but 92.7 GW of non-emergency capacity to cover November’s projected 87.3-GW peak.

Those totals don’t account for 12 GW of load-modifying resources and operating reserves, which are only available for use once MISO declares an emergency. The grid operator said there’s a chance it could deplete all emergency resources in September and October and come up short if it encounters a double whammy of unusually high generation outages and load.

However, Rodriguez said MISO can maintain system reliability with wind generation that comes in higher than its accredited value. He also said non-firm imports could help meet demand. The RTO has previously dodged emergency declarations through neighboring imports, thanks to its Middle America footprint.

The National Oceanic and Atmospheric Administration anticipates average temperatures and precipitation throughout MISO’s region this autumn. Its 115-GW all-time fall peak occurred in September 2017, when unseasonably hot temperatures prompted a maximum generation declaration.

The grid operator’s late summer has been a whirlwind of two sustained northern heatwaves, back-to-back conservative operations declarations, and record-breaking hurricane destruction in Louisiana. (See Entergy Re-energizes Small Portion of New Orleans.)

However, the summer’s only maximum generation event occurred in early June when a heat wave struck the northern footprint.

June Pricing Evaluation

MISO revisited its June 10 emergency declaration in its North and Central regions after some market participants criticized its decision not to use some offered emergency resources. (See “MISO Defends June Emergency Declaration,” MISO Market Subcommittee Briefs: July 8, 2021.)

Economic, non-firm imports responded to pricing signals during the emergency, making some members’ emergency offers unnecessary and boosting imports’ prices between MISO’s ex-ante and ex-post pricing calculations. Emergency resources do not participate in the RTO’s pricing.

“It’s the inflexibility of some of these out-of-market, emergency resources that drives this,” Kevin Vannoy, MISO’s director of market design, said. “When it comes to emergency-type conditions, MISO is in the position where a lot of its capacity supply stack are inflexible, emergency-only, out-of-market resources.”

Vannoy pointed out that MISO has emergency offer floors, not emergency price floors, and makes no guarantee of prices.

Staff said they only use emergency offers when its economic supply, including non-firm imports, is exhausted.

Vannoy said imports provide “more flexible and more economic” resources. He said if emergency-only resources want more certainty in pricing, they should register as market assets.

“We can and probably will see this in the future,” he said, predicting imports will supplant the need for MISO’s slowest emergency resources.

ITC Holdings’ Marguerite Wagner said the emergency scenario raises the question of whether slow-moving emergency resources should be able to clear MISO’s capacity auction.

Shawn McFarlane, the grid operator’s executive director of market operations, said staff will hold more stakeholder discussions on the topic during upcoming Market Subcommittee meetings.