NYISO on Tuesday presented stakeholders a comprehensive buyer-side mitigation review, provided the final draft of a study on related market impacts and updated the timeline for implementing associated rule changes.

As its resource mix evolves quickly to renewables, the ISO must ensure that it provides the right market incentives and signals to the types of resources needed to keep the lights on, Michael DeSocio, NYISO director of market design, told the Installed Capacity (ICAP) Market Issues Working Group.

“The crux of the capacity accreditation proposal is that we need to step away from a protracted four-year debate on what capacity accreditation factors should be and move towards a more deterministic process based on transparent models and assumptions,” DeSocio said.

The New York State Reliability Council process for establishing the installed reserve margin database should be “the starting point for any [capacity] accreditation studies, and we think we need to be doing those studies annually because, frankly, the changes on the grid aren’t going to wait,” DeSocio said.

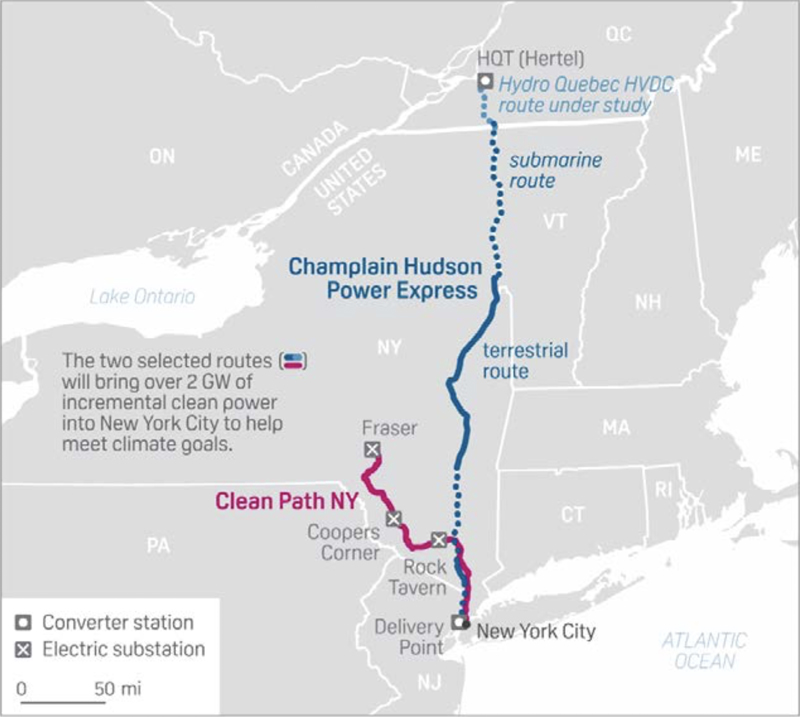

Gov. Kathy Hochul on Sept. 20 announced the state’s solicitation process had chosen the 1,250 MW high voltage direct current (HVDC) Champlain Hudson Power Express project from Quebec to New York City, as well as the 1,300 MW Clean Path New York HVDC project from upstate to the city. Both lines will be buried under the Hudson River for many miles. (See Two Transmission Projects Selected to Bring Low-carbon Power to NYC.)

The transmission sensitivity assumptions in the Analysis Group’s market impacts study include the 2.5 GW these two transmission lines provide New York City.

NYISO in August introduced the Analysis Group study that will model 10-year capacity supply and demand curves and identify the resulting market outcomes to support buyer-side mitigation (BSM) rule revisions. (See NYISO Unveils Draft BSM Study.) The company’s Paul Hibbard will take questions from stakeholders at the Oct. 5 ICAP meeting.

Not So Fast

In July, the ISO presented a proposal to exempt most new renewable installed capacity (ICAP) resources from BSM evaluation.

As proposed, resources required to satisfy the goals specified in the CLCPA will not be subject to review by the ISO under the BSM rules, or otherwise subject to an offer floor. Exempted resources include wind, solar, storage, hydroelectric technologies, geothermal, fuel cells that do not use fossil fuels, and demand response (participating as a special case resource or distributed energy resource).

Several stakeholders asked the ISO to provide adequate time to go over the needed tariff revisions, a review that prolonged a scheduled two-hour presentation to four.

NYISO is pursuing these reforms in time for the Class Year 2021 BSM evaluations and intends to address capacity accreditation in different phases, with the Phase 1 tariff changes for the new framework to be discussed through year-end 2021, and Phase 2 discussion of procedures and details expected to start around January and continue throughout 2022.

Phase 3 will focus on implementation of the capacity accreditation review, and the ISO intends to implement the updated capacity accreditation rules for the Capability Year beginning May 1, 2024. Assessment of financial risk of changes in future revenues will be incorporated into the next Demand Curve Reset process beginning in 2023.

NYISO proposes adopting the recommendation of its Market Monitoring Unit, Potomac Economics, to translate the ICAP reference price into an unforced capacity (UCAP) reference price using the derating factor of the peaking unit underlying the relevant ICAP demand curve, DeSocio said.

Several stakeholders questioned the ISO’s emphasis on providing correct capacity market signals, suggesting that the real market mover is the state and its multibillion dollar contracts for renewable energy.

One stakeholder said that while other market regions have explored mechanisms such as an integrated clean capacity plan or forward clean energy market to help send the correct market signals to align with state policy, NYISO only is offering the capacity accreditation proposal.

Energy market prices create investment signals and operational control signals that incent resource owners to make the right decisions on following dispatch, but also provide incentives on what types of attributes the resource mix should include, Desocio said, prompting the ISO to include a carbon price in the day-ahead and real-time energy market.

“A carbon price would bolster those signals to be clear about times when we are heavily emitting carbon and therefore need a solution at a particular location that will help us avoid emitting that carbon,” DeSocio said. “There is no better way to pinpoint that need other than to put it in a locational based marginal price in the energy market. There’s no more granular way to do it.”

The capacity market is designed to ensure sufficient supply for real-time grid operations to minimize the times the ISO has to rely on involuntary load curtailment, he said.

NYISO plans to submit tariff revisions of the full proposal to the Business Issues Committee and Management Committee in October.