PJM’s narrowed minimum offer price rule (MOPR) took effect Wednesday after FERC deadlocked 2-2 on the RTO’s proposal to apply it only to resources connected to the exercise of buyer-side market power or those receiving state subsidies conditioned on clearing the capacity auction.

The proposal, filed by the Board of Managers on July 30, became effective “by operation of law” under Section 205 of the Federal Power Act when the commission failed to act on it within 60 days.

“The commission did not act on PJM’s filing because the commissioners are divided two against two as to the lawfulness of the change,” the commission said in a notice (ER21-2582).

Chairman Richard Glick and Commissioner Allison Clements, Democrats who said PJM’s “expanded” MOPR (MOPR-Ex) was undermining renewable growth, are believed to have supported the PJM filing, with Republicans James Danly and Mark Christie apparently opposed. The commissioners are expected to file statements explaining their positions.

The PJM board backed the “focused MOPR” proposal that was approved by almost 84% of stakeholders in June — the only one of nine proposals voted on to receive majority support. Chair Mark Takahashi said it “accommodates state policy and self-supply business models,” addresses “attempted exercises of buyer-side market power” and creates a “sustainable market design” by “keeping clearing prices consistent with supply and demand fundamentals.”

The vote concluded an 18-month saga that whipsawed PJM and caused the cancellation of the 2020 Base Residual Auction (BRA).

PJM adopted the extended MOPR in response to FERC’s 2-1 ruling in December 2019 saying it should apply to all new state-subsidized resources to combat price suppression in the capacity market (EL16-49, EL18-178). Then-Chair Neil Chatterjee and fellow Republican Bernard McNamee formed the majority, with Glick angrily dissenting. Glick asked PJM to undo the rule after he was named chairman by President Biden in January.

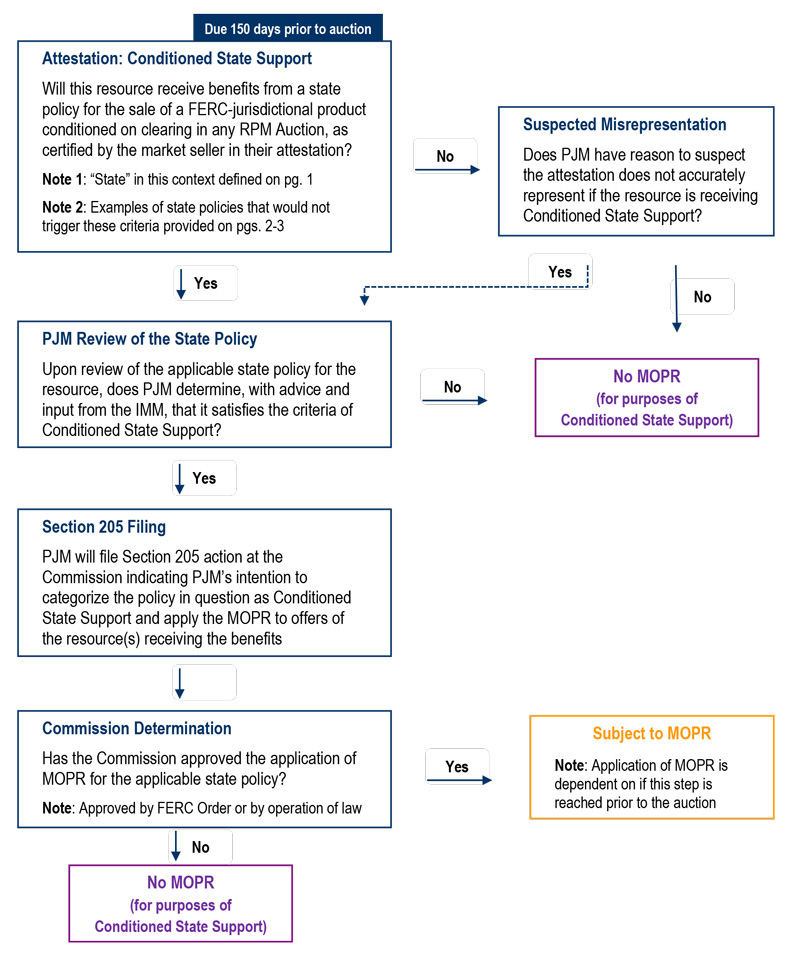

Market participants will be asked to sign attestations declaring they are not exercising market power or receiving state funds tied to clearing in the auction. PJM and the Independent Market Monitor will conduct “fact-specific, case-by-case reviews” if market power is suspected, and referrals will be made to FERC for a final determination.

PJM’s filing was opposed by gas-fired merchant generators as well as some electric cooperatives and state utility regulators. (See Mixed Stakeholder Reception to PJM MOPR Replacement.)

The new rules — which will eliminate both the expanded MOPR and PJM’s prior MOPR, which was limited to new natural gas resources — will be effective for the 2023/24 delivery year BRA scheduled to begin Dec. 1.

PJM has asked FERC to delay the auction by nearly two months to give it time to respond to a commission order on unit-specific offer review thresholds (ER21-2877). (See PJM Proposing 2-Month Capacity Auction Delay.) The Monitor reminded market participants Wednesday that the deadline for submitting market seller offer cap (MSOC) requests and must-offer exception requests for the auction is Oct. 1.

Reaction

Renewable advocates on Wednesday expressed relief over the approval of the new MOPR but regret that they came without an explicit imprimatur from FERC.

“It is disappointing that a majority of the commissioners could not agree on these important principles of federal and state comity and send a strong signal that it is not the place of federal regulators or wholesale market rules to ‘mitigate’ state clean energy policies,” said Jeff Dennis, general counsel of Advanced Energy Economy.

Sean Gallagher, vice president of state and regulatory affairs at the Solar Energy Industries Association, said the focused MOPR is “a vast improvement for the PJM market.”

“As proposed, the MOPR would have undermined PJM’s competitive market and punished states and independent power producers for providing affordable clean energy during annual capacity market auctions. The focused MOPR clears a path forward for IPPs that want to bid into PJM’s Base Residual Auction and acknowledges the right for states to choose affordable and reliable clean energy,” he said. “The focused MOPR also removes unnecessary administrative burdens and project assumptions that favor incumbent generators. The end result is a more efficient capacity market that protects market participants and customers alike.”

“Today is a great day for millions of ratepayers in PJM, America’s largest electricity market, who will be saved from paying more money than they should for clean power,” said Greg Wetstone, CEO of the American Council on Renewable Energy. “The MOPR, as previously designed, was a poorly disguised effort to undermine the success that low-cost renewables have enjoyed in competitive electricity markets nationwide by financially bolstering uneconomic fossil fuel generators. We commend PJM for working to reverse a destructive policy that distorted the market and directly conflicted with state efforts to accelerate the transition to pollution-free renewable power.”

“We’re considering all our options, including requesting rehearing,” said Todd Snitchler, CEO of the Electric Power Supply Association. “Given our strong protest in response to the PJM filing, we will continue to pursue what we think is the better path forward, which would be to reject the as-filed MOPR and allow sufficient time to pursue a more holistic approach to respond to the concerns raised by FERC and the states.”

Fears not Realized

Although MOPR-Ex was in place for the RTO’s 2022/23 BRA in May, predictions that it would inflate prices and block renewables’ entry did not materialize. Rest-of-RTO prices dropped by nearly two-thirds to $50/MW-day, and prices in the Eastern and Southwest Mid-Atlantic Area Council regions fell to their lowest on record. Nuclear generators, natural gas, renewables and energy efficiency increased their market share, while coal saw its contribution shrink. (See Capacity Prices Drop Sharply in PJM Auction.)