Texas regulators last week discussed the lack of competition in Entergy Texas’ (NYSE:ETR) footprint in the state’s southeastern portion, questioning whether the costs that previous commissions have allowed the utility to recover have benefited ratepayers.

At issue is a transmission-to-competition rider the Public Utility Commission approved in 2006, allowing Entergy to recover $14.5 million annually over a 15-year period for expenses incurred in 1999 through 2005, plus carrying costs, a figure that amounted to $207 million. The order was a result of 2005 legislation (House Bill 1567), which allowed an investor-owned utility to recoup spending more for capacity under power purchase agreements than were included in its last rate case (31544).

“It troubles me that ratepayers in the southeast spent [$200 million] on the transition to competition, and they have nothing to show for it,” Commissioner Jimmy Glotfelty said during the PUC’s open meeting Thursday.

The order stipulated three true-up periods every five years, with the last occurring this year. Entergy’s final true-up, approved by the PUC on Thursday, reflected a cumulative overcollection of $3.1 million (51806).

“It seems to me competition has been good for the rest of the state,” Glotfelty said. “If this moves us toward a competitive market in that area, I think that would be prudent. Stakeholders need to tell us is it’s time to move forward with competitive choices in the southeast region.”

Commissioner Will McAdams echoed Glotfelty’s comments, saying expanding competition into the southeast has been “heavily debated” within the state legislature, where he once worked. He also noted opinions over whether Entergy Texas should join ERCOT’s competitive market have gone back and forth.

The February winter storm “has made people evaluate that maybe [competition] is not such a good thing,” McAdams said. “If consumers and ratepayers want to see any type of competitive benefit in the future, we should provide them a venue at the PUC during the interludes between legislative sessions, where they can speak in front of their elected representatives.”

Commissioner Lori Cobos reminded her peers that one of the reasons Entergy joined MISO was that it wanted to “garner some of the benefits of being in an actual RTO or ISO.”

“As a commission, we should continue to review whether that is producing the benefits that were proffered to us as joining MISO. This merits a lot deeper consideration,” Cobos said.

After listening to the debate, PUC Chair Peter Lake offered his opinion on what Entergy’s customers can do.

“If they want to have that conversation, they should let us know,” he said.

ERCOT to Continue Conservative Ops

ERCOT staff told the commission that they will continue with their conservative operations approach through the winter and into next summer because of maintenance outages during the shoulder months.

After assuring the commission they would recall or deny thermal maintenance outages should unseasonably warm or cold weather create tight conditions, staff did just that on Friday, issuing an advanced action notice for Monday. The grid operator said it expects to withdraw or delay approved or accepted outages from 3 to 9 p.m. to scrounge up 94 MW of capacity to meet expected demand.

According to the notice, ERCOT expects wind and solar contributions to amount to about 6 GW from 6 to 7 p.m.

Dan Woodfin, senior director of system operations, told the PUC the amount of thermal capacity taken offline for maintenance outages has increased this fall to 18 GW, up from 10 GW a year ago.

Woodfin and Kenan Ögelman, vice president of commercial operations, also briefed the PUC on the recently completed summer season that they summarized as cooler than normal, wetter than normal, less windy than normal and conservative.

Average daily temperatures were 1 to 2 degrees cooler than normal, without the widespread temperatures across the state that generally mark Texas summers. ERCOT did set new monthly peaks for June (70.2 GW) and September (72.2), but the summer peak of 73.5 GW on Aug. 31 was far short of the projected 77.2 GW.

Additional solar resources led to higher solar generation June through August, peaking at a record 7.04 GW on Aug. 31. Wind energy also set a new demand peak, hitting 23.6 GW on June 25.

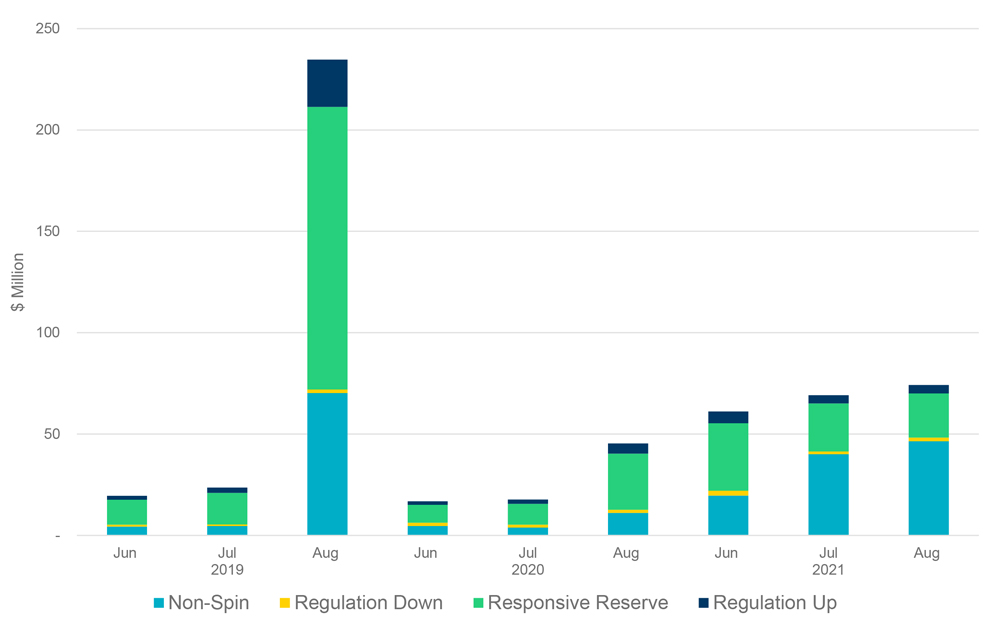

Ögelman said prices were relatively low during the summer, with few spikes. ERCOT committed more resources through reliability unit commitments than it has in previous summers — for more than 2,000 effective hours, compared to about 200 in 2020 — and spent more than $50 million each month during the summer procuring non-spin reserves and other ancillary services.

ERCOT has drafted a nodal protocol revision request (NPRR) that will allow non-controllable load resources to participate in non-spin reserves, Ögelman said. The measure has cleared the Technical Advisory Committee and goes before the Board of Directors next. (See ERCOT Technical Advisory Committee Briefs: Sept. 29, 2021.)

“There’s no good reason not to allow load to participate,” Ögelman said when asked the reason for the change. “You want all the resources that can provide value to that space providing value to that space. Secondarily, this adds more liquidity to that market.”

When Ögelman told the commissioners the NPRR may not be implemented until the middle of next summer, Lake said softly, “We can work on that.”

PUC Clarifies Securitization Order

Staff have filed draft orders codifying the commission’s response to ERCOT’s requests for debt-obligation orders that would allow the grid operator to securitize $2.9 billion in market debt as a result of high charges incurred during February’s storm (52321, 52322). (See Texas PUC Finances Market Debt over Lt. Gov.’s Objections.)

The commissioners agreed that companies that opt-out of ERCOT’s proposal to finance $2.1 billion in debt would have to form a new entity if they want to start serving unaffiliated customers. Upon re-entering the market, the entities would be assessed uplift charges.

An NPRR wending its way through the ERCOT stakeholder process would strengthen the grid operator’s market-entry qualification and continued participation requirements. The commissioners decided to wait on the NPRR, rather than direct ERCOT to develop and implement it.

In another storm-related docket, the commission agave staff the go-ahead to publish a rulemaking for public comment that cuts the high systemwide offer cap (HCAP) from $9,000/MWh to $4,500/MWh. It will become effective Jan. 1 (52631).

The HCAP is currently set by rule at $2,000 after it was stuck at $9,000 for too many consecutive hours during the storm but was to revert back to $9,000 on Jan. 1. The cap was designed to incent generation to come online during tight conditions. (See “Offer Cap Could be Halved,” Texas PUC Directs Tx Construction in Valley.)

“By no means will this be the only action we take on the ERCOT market design structure,” Lake promised.

Status Reports for Valley Project

Following the PUC’s directive last month to three utilities that they add a second 345-kV circuit to an existing transmission line in the Rio Grande Valley, Cobos requested quarterly updates on the project (52682).

Cobos asked that effective Nov. 1, AEP Texas, Sharyland Utilities and South Texas Electric Cooperative file progress reports detailing tasks, time estimates, coordination with ERCOT, delays, and reliability and safety measures necessary to complete construction.

In other actions, the PUC:

- rejected Entergy Texas’ application to acquire a proposed 100-MW solar facility in southeast Texas, agreeing with an administrative law judge that the utility did not prove the acquisition was a cost-effective way to provide consumer benefits when compared to alternatives (51215);

- signed off on a unanimous settlement agreement between AEP Texas, staff and other parties under which the utility will refund $23.4 million to ratepayers for transition bonds issued by its AEP-Central Division (51484);

- granted requests by Southwestern Public Service (52072) and Texas-New Mexico Power (52153) to adjust their energy-efficiency cost recovery factors for the 2022 program year by $6.3 million and $7.2 million, respectively; and

- assessed a $56,000 administrative fee against AEP Texas for exceeding SAIDI and SAIFI standards by more than 5% during its 2019 reporting year (52034).