FERC’s inquiry into transmission planning and cost allocation prompted a flood of comments this week, most of them agreeing with the commission on the need for changes to aid the transition to a low-carbon grid.

But there was no consensus over whether the commission should eliminate participant funding or create independent transmission monitors. And transmission owners used the docket to call for a restoration of incumbents’ right of first refusal to construct upgrades in FERC-approved tariffs.

FERC received more than 165 comments from utilities, independent power producers, state regulators, RTOs and others in response to the Advance Notice of Proposed Rulemaking (RM21-17) the commission issued following a bipartisan 4-0 vote in July. In opening the inquiry, FERC acknowledged that Order 1000 has failed to provide interregional expansions to deliver increased renewables and meet the challenge of climate change. (See FERC Goes Back to the Drawing Board on Tx Planning, Cost Allocation.)

As is often the case in such dockets, the commission heard many entreaties against a “one-size-fits-all” rulemaking.

“Concerns with the transmission planning and generator interconnection processes are likely to be highly regional in nature,” said the American Public Power Association, opposing a “blanket move away from participant funding in regions where it is currently permitted.”

Dominion Energy (NYSE:D) said the commission should continue to acknowledge and respect the differences between RTO and non-RTO regions.

“FERC should refrain from establishing overly prescriptive rules, particularly around the inputs into planning studies and analyses, so that planning processes will be able to accommodate evolving technology, state laws, regulatory structures, and policy preferences,” said the National Association of Regulatory Utility Commissioners (NARUC).

States’ Roles

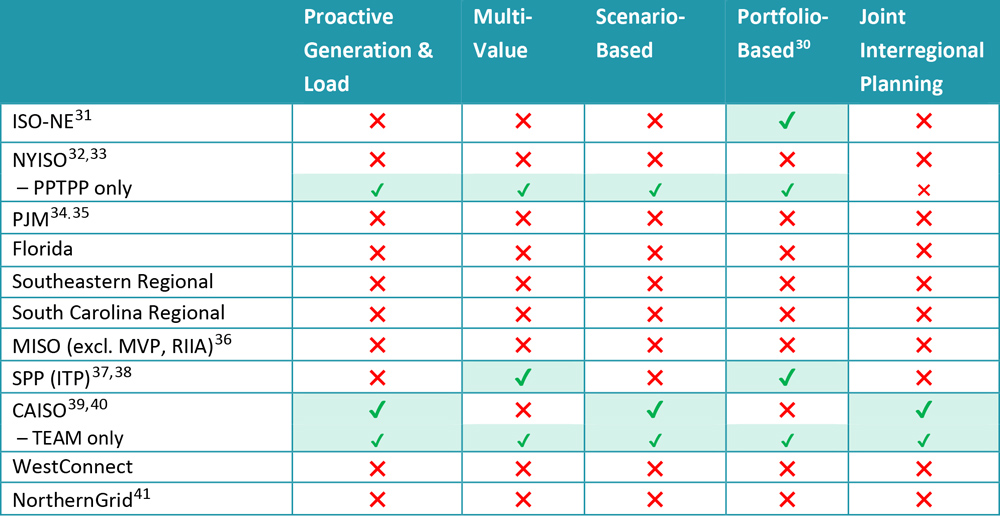

“The failure to conduct multi-value, scenario-based transmission planning on a regional and interregional portfolio basis is endemic to the grid,” the Natural Resources Defense Council, the Sierra Club and other public interest organizations told FERC in their comments on the transmission ANOPR. | The Brattle Group and Grid Strategies

“The failure to conduct multi-value, scenario-based transmission planning on a regional and interregional portfolio basis is endemic to the grid,” the Natural Resources Defense Council, the Sierra Club and other public interest organizations told FERC in their comments on the transmission ANOPR. | The Brattle Group and Grid StrategiesMany comments dealt with what role the states — whose renewable portfolio standards and climate policies are helping drive the historic transition in the generation mix — should play in planning the transmission needed to connect renewables to load centers.

NARUC said it “shares the commission’s perspective on the need to reform existing planning processes.”

But it said “the commission should not lose sight of the need to ensure that all potential transmission planning reforms explicitly recognize the essential role states, and state laws, play in this process.”

The National Conference of State Legislatures (NCSL) called for a “coordinated effort between FERC and states in the development and implementation of any regulatory change, including devising improved mechanisms to bring state legislatures into the energy decision-making process as full participants on an ongoing basis.”

NCSL said FERC should support the development of state-created regional mechanisms, such as interstate compacts and regional reliability boards, “to address transmission reliability, problems related to the interconnectedness of the energy grid, environmental impact of generating electricity, and other regional energy issues.”

But the National Rural Electric Cooperative Association (NRECA) said state commissions “should retain their role as stakeholders in Order No. 1000 regional transmission planning and cost allocation processes and not as overseers. Any expansion of that role, such as the SPP Regional State Committee authority noted in the ANOPR, should be the result of regional decision-making and not commission mandate.”

Participant Funding

One question FERC asked commenters to answer was whether it should eliminate rules that allow RTOs/ISOs to use participant funding for interconnection-related network upgrades or whether the costs should be “allocated more broadly among those that benefit” from increased transmission capacity.

EDP Renewables North America said it has “effectively abandoned” development plans in much of MISO West and SPP because of the high costs assigned to its proposed projects. It said it was forced to cancel a 100-MW wind project in Minnesota that was in the final stages of a power purchase agreement negotiation after learning it would be assessed more than $70 million in network upgrades.

Filing jointly, the American Clean Power Association and the U.S. Energy Storage Association, said the commission should eliminate participant funding for network upgrades and shift transmission planning and cost allocation to “a holistic and proactive process that simultaneously addresses key drivers, including — but not limited to — economic, reliability, public policy, and future generation needs.”

The groups proposed that generators, or clusters of generators, would have the sole responsibility for the costs of interconnection-related network upgrades up to and including the interconnection substation, with upgrades electrically “downstream” from the interconnection substation being the responsibility of the transmission provider.

But NRECA said existing policy, including allowing participant funding, “provides the appropriate price signal in nearly all cases.”

NRECA agreed that improvements are needed in generation interconnection processes in some regions. “NRECA members support generation-interconnection reforms that address these issues directly rather than simply shift most of the costs and risks to the customers of load-serving entities and thereby dampening if not eliminating appropriate economic incentives and price signals to interconnecting generators.”

NARUC also urged more incremental changes, saying FERC should “retain the core tenet of participant funding, while exploring the as yet untapped potential economies of scale that could result from increased coordination among participants,” including generators sharing costs in “clusters.”

“Contrary to the apparent presumption in the ANOPR, some state commissions’ experience is that the network upgrades needed to allow generation interconnection do not provide benefits to transmission customers as a whole,” NARUC said.

The Transmission Access Policy Study Group (TAPS), which represents transmission-dependent utilities, recommended allocating costs of proactively planned upgrades to beneficiaries. “If costs remain to be allocated, consideration of load zones expected to rely on the generation that the proactively planned transmission is designed to support could be appropriate. Consistent with fundamental cost allocation principles and given the tensions associated with broad cost allocation, it should be used sparingly.”

TAPS said eliminating RTOs’ ability to directly assign interconnection-related network upgrades costs would remove interconnection customers’ incentive to site wisely, “an inducement that will be essential as we move toward reliance on proactively planned facilities.”

Dominion said the commission should continue to ensure that those who receive the benefits of the investments are assigned the costs. “This means not generically socializing transmission costs, refraining from using transmission as a subsidy to speculative generation projects, and avoiding stranded costs for customers.”

“Wind and solar are important components to a clean energy future, but … new technologies, such as green hydrogen, small modular nuclear reactors, and new battery technology, could transform power generation in the future as well,” it continued. “Such technologies for the benefit of Dominion Energy’s customers should not be discounted by a transmission policy that favors certain types of resources over others.”

The Electric Power Supply Association (EPSA) also opposed broad socialization of transmission upgrade costs, saying the commission should instead “focus on reducing transaction costs, speeding up lagging processes, and adopt market-based approaches, like an open season” for transmission access.

“System planners could hold an open season competitive procurement to solicit bids from suppliers, developers, customers, or even states which could support the build of long-line transmission facilities or network upgrades,” EPSA said. “Rather than using a model like CREZ in Texas which socializes the costs to build transmission first to incent an influx of hopeful supply, an open season brings the interconnection customers to the table to demonstrate that transmission development would be prudently located and supported by sufficient commercial interest.”

EPSA said such a plan would not “rely on forecasting — which is rarely sufficiently accurate, if accurate at all — but could allow states or local entities to sign on to a project to signal a future need to fulfill state policies or goals.”

“While cost allocation may require consideration for revisions, a full reassessment or reversal of participant funding and cost causation principles in order to socialize costs may overstate identified benefits and warp the signals needed to support baseline transmission upgrades, even public policy projects,” EPSA said.

Planning Methodology

FERC also asked what metrics and time horizons transmission planners should use and whether they should consider potential generation not in their interconnection queues.

Several commenters said the transmission planners should use longer time horizons.

American Electric Power (NASDAQ:AEP) said need analyses should consider a 20-year horizon. “The commission’s focus is best directed at working with the North American Electric Reliability Corporation (NERC) and the RTOs to develop a set of planning standards, including benefits metrics and study scenarios, drawing on best practices found in existing planning processes, to create a baseline methodology for transmission planning that will apply to all RTOs and non-RTO regions,” AEP said.

NARUC said it supported “a long-term planning process to allow stakeholders to evaluate transmission system needs and conditions as the system integrates resources that states want to develop in the future. In some cases, states’ energy laws and policies look well beyond the ten-to-fifteen-year timeframe typical for transmission planning studies,” it noted.

MISO planners seek the least cost sweet spot, where transmission additions are lower and there is both a mix of local and remote generation. | MISO

MISO planners seek the least cost sweet spot, where transmission additions are lower and there is both a mix of local and remote generation. | MISOBut NRECA said a planning horizon of 10 years is “generally … appropriate” and consistent with NERC’s transmission planning (TPL) reliability standards and state integrated resource plans (IRPs).

Numerous commenters, including the Edison Electric Institute (EEI), which represents investor-owned utilities, agreed with the commission that one way to account for future uncertainty is with increased use of scenario planning that considers several plausible futures.

The Solar Energy Industries Association (SEIA) said planners should include carbon reduction and integrating renewable generation among the “benefits” considered in evaluating potential projects. “The commission, therefore, should require transmission providers, and ISO/RTOs in particular, to monetize the broader societal effects in transmission planning and cost allocation,” SEIA said.

It said FERC should require transmission providers to establish a fee, separate from any interconnection deposit, based on project size, to be charged for submitting an interconnection request. “For projects that require network upgrades, the fee would be applied towards the cost of the network upgrades. The remaining cost of the network upgrade would be allocated to the load zone served by the project.”

But the Southeastern Regional Transmission Planning Process (SERTP), which includes Duke Energy (NYSE:DUK), the Tennessee Valley Authority and Southern Co. (NYSE:SO), warned FERC against “unlawfully intruding into resource/IRP planning reserved to the states or inappropriately seeking to force ‘substantive outcomes’ rather than merely regulating the transmission planning process.”

It said FERC should “retain the prevailing quantitative, objective assessment of transmission benefits used for regional transmission cost allocation processes. The suggested consideration in the ANOPR of qualitative and ‘hard to quantify’ benefits would unnecessarily complicate cost allocation.”

NRECA opposed building transmission facilities to accommodate anticipated future generation not yet in the interconnection queue.

“The ANOPR cites no data to support a finding that ‘too much’ network transmission infrastructure (e.g., in dollars or transfer capacity or number of projects) is built through the existing generation interconnection process — much less any data on the lost efficiency in transmission investment that this might entail or the efficiency gains and losses to be expected by potential replacement processes.”

It said the commission lacks “the authority or expertise to require regional transmission planning processes to quantify the benefits of clean-air attributes of newly interconnected generation and identify the beneficiaries for purposes of regional transmission cost allocation.”

ROFR and Transmission Competition

EEI and Dominion were among those urging the commission to reinstate the federal right of first refusal for projects selected for regional cost allocation, which was eliminated in Order 1000, although the commission allowed states to enact their own ROFRs.

“This policy has resulted in a near standstill in transmission development for regional projects and a substantial increase in process-related costs,” EEI said.

“Allowing transmission owners to work with the state and outside of the constraints imposed by the current inflexible and inefficient RTO process can expedite transmission projects,” Dominion said.

EPSA disagreed, insisting “any reforms to transmission policies leverage the commission’s commitment to competition to ensure that cost-effective transmission investments are signaled and supported by planning, cost allocation, and/or interconnection processes, including the use of competitive procurement processes.”

TAPS also called for continuation of the current rules on competitive transmission development, which it said “has been effective in reducing costs where it has been used.”

Independent Transmission Monitors

There was no consensus on whether the commission should establish independent transmission monitors to evaluate plans to ensure that the projects are the most efficient or cost-effective.

Pine Gate Renewables, a utility-scale solar developer based in Asheville, N.C., said a monitor is essential, contending that transmission planning processes in non-RTO/ISO regions are “opaque with virtually no opportunity for meaningful input from independent power producers or other stakeholders.”

It said SERTP “provides very little information to stakeholders and essentially no opportunity for substantive engagement,” noting that it is comprised exclusively of load-serving entities. “Order Nos. 890 and 1000 have had no meaningful impact on the Southeast,” the group said.

NRECA, EEI and SERTP opposed the concept.

“There is sufficient oversight and transparency in the transmission planning and cost allocation process and another layer of review through an independent transmission monitor is not needed,” said EEI. “… There is no evidence that the existing processes, whether in or outside of a RTO/ISO region, are failing to implement tariffs appropriately or that the processes produce unjust and unreasonable outcomes.”

SERTP said a monitor “would unlawfully second-guess state-regulated IRP and bundled retail transmission service decisions, create friction points in the system expansion process, and cause resulting delays, litigation, and increased costs.”

It conceded SERTP could expand its transmission planning “to better inform decision makers and stakeholders by accommodating additional, proactive scenario-based planning processes that would not directly dictate construction.”

NARUC said such monitors “may be beneficial” but that the “concept and role that the commission envisions for transmission monitors is, at this time, unclear.”

It also questioned whether the commission has the authority to order independent monitors in areas outside of ISO/RTOs.

TAPS said a monitor “could play an important role in non-RTO regions and for local planning in RTOs.”

SEIA said a monitor that evaluates plans to ensure that the projects are the most efficient or cost-effective “could ensure that projects benefit the whole region, and not just a single utility.”

RTOs Weigh In

RTOs also called for the commission to allow regional flexibility in any new rules.

CAISO said it agrees that planning should include anticipated future generation but said FERC should “grant regions sufficient flexibility to implement this approach based on their specific circumstances.”

PJM said its current rules are balanced “in that interconnecting generators pay their ‘but for’ costs to interconnect to the existing transmission system, while load thereafter bears the costs of ensuring continued deliverability of those generators once interconnected.”

Any change to the policy “should account for a reasonable allocation of risk and reward to ensure that the change in policy choice does not result in an unreasonable shift of costs or risks to load,” it said.

The RTO also said resilience must be part of transmission planning and that FERC should create a “common working definition” of the concept and “resilience-based industry planning drivers.”

PJM said an independent monitor is not needed in RTOs and ISOs and “would be far more appropriate … in areas where there is no structural independence as between the transmission planner and its generation affiliates.”

“The oversight function over costs of transmission and the prudence of those investments not reviewed through the [Regional Transmission Expansion Plan] are best addressed by improving customers’ ability to make their voices heard through the commission’s regulatory process,” it said.

ISO-NE said FERC should “explore process enhancements to address any identified concerns before establishing another independent entity to monitor transmission planning, which could inadvertently weaken, and introduce delays and risks into a well-functioning, open and transparent process, at the expense of getting transmission built in time to meet identified needs.”

NYISO said “incremental, yet significant, reforms can meaningfully address many of the issues raised in the ANOPR.

“Adoption of targeted reforms can have a more immediate impact than a complete overhaul of the existing processes, which would take considerable time to develop, implement and, ultimately, to result in new transmission,” it said. “Moreover, attempting to address all transmission needs and issues simultaneously through a single, unified process may be overly complex, slow and inflexible.”

SPP said it already uses several of the commission’s proposed initiatives, noting that its Integrated Transmission Planning uses several future scenarios to evaluate a range of potential outcomes “under a variety of projected load, generation mix, and grid usage conditions.”

MISO said it has been conducting stakeholder processes “addressing nearly all of the topics raised in the ANOPR, and more, to address the evolving system.”

Grid-enhancing Technologies

One solution likely to get a boost from the rulemaking is grid-enhancing technologies (GETs).

“Going forward, GETs may play an important role in increasing efficient use of the system and providing a short-term solution until needed transmission is built,” EEI said. “However, additional experience is needed to determine how best to model and operate these technologies.”