Staff, Members Call for More Coordination with Gas Industry

SPP staff told stakeholders last week they are searching for ways to urge change in the energy industries following February’s disastrous winter storm, when natural gas curtailments led to the RTO’s first rolling outages in its 75-year history.

Several members urged the grid operator to focus on the gas curtailments they said were the root cause of the generation outages during the storm, an opinion shared by FERC and NERC in the draft report of the joint inquiry into the storm and its impacts. (See FERC, NERC Share Findings on February Winter Storm.)

“You can argue all day long whether the curtailments started happening before the outages started. … Seventy percent of firm gas was curtailed. That to me is the root cause,” Southwestern Public Service’s (SPS) Bill Grant said during the Oct. 11-12 Markets and Operations Policy Committee meeting.

“I know we need to look at all this other stuff, but we should do so without being told. That’s common practice,” he said. “The main focus should be on [gas-electric] coordination and domestic [gas] contracts.”

Mike Wise, whose Golden Spread Electric Cooperative sits in West Texas along with SPS, said most of the co-op’s problems occurred because of ERCOT’s problems. The Texas grid operator lost more than half of its thermal generation because of curtailments and freeze-offs of natural gas facilities, which led to ripple effects elsewhere.

“The real issue is electric reliability in ERCOT is impacting others besides ERCOT,” Wise said. “We have firm transportation arrangements with our pipeline providers. They said they were available and ready to go. It was the fuel-processing plants on interruptible rates and fuel suppliers that were on ERCOT outages [that failed]. It was the other pieces of the gas infrastructure feeding into [the pipelines] that forced them to declare force majeure. We need to complete that analysis.”

“Duly noted,” SPP COO Lanny Nickell said. “We did notice there was some increase in generation outages due to fuel issues before we had to shed load. We can sure dig into that information.”

The RTO in July released a comprehensive report on its response to the storm’s effects that said a lack of fuel supplies led to generation’s unavailability and was “the largest contributing factor to the severity of the winter weather event’s impacts … exacerbated by record wintertime energy consumption and a rapid reduction of energy imports.” (See “Grid Operator Releases Report on Performance During Winter Storm,” SPP Board of Directors/Members Committee Briefs: July 26-27.)

Among the report’s 22 recommendations are two aimed at improving fuel assurance: evaluate and, if necessary, advocate for improvements in gas industry polices to assure supplies are “readily and affordably” available during extreme events; and developing policies to improve gas-electric coordination to improve emergency response.

“There’s not a lot we can do about it but talk about it and advocate as best we can,” Nickell said. “We can make sure our facilities are hardened and do everything we can, but if the gas doesn’t show up, there’s nothing we can do about that.”

“If you would have asked everybody in January if they felt like they were ready for the winter, everybody would have said, ‘Yes, we feel good,’” Grant said. “But even when you’re in good communications with the suppliers, you can’t stop them from declaring force majeure. You could still have 70% curtailments on firm gas deliveries … and we can’t do a thing about it.”

SPP in August followed up on the report by surveying its generator owners and operators to learn about their plans for having available fuel supplies for the upcoming winter. The survey generated 60 responses, reflecting 85% of the RTO’s nameplate capacity and including 52 spreadsheets with unit-specific information. It revealed that 68% of the respondents already have plans and process in place.

The survey’s data will only be used for planning purposes and itself does not have any compliance implications, Nickell said.

“It feels to me we’re going to be in better shape this upcoming winter than we were last winter,” he said. “If the upcoming winter is worse than the last one, that may be a moot point. That’s about all we can do with the information we have right now.”

Nickell said the newly constituted Improved Resource Availability Task Force will have an opportunity to weigh in. The task force, under the Regional State Committee, has already met four times in tackling the Tier 1 recommendations from the winter-storm review related to fuel assurance and resource planning and availability.

The group is chaired by Arkansas Public Service Commission Chair Ted Thomas, with Golden Spread’s Natasha Henderson as vice chair. They are joined by five regulatory commissioners and staff and five member representatives. The conference calls have drawn more than 70 dial-ins each time, Nickell said.

“What we’ve done gives us a head start with the FERC-NERC recommendations,” he said.

Midwest Energy’s Bill Dowling noted that FERC lacks the jurisdiction to impose reliability standards on its own and said that work should reside with the North American Energy Standards Board (NAESB), which has jurisdiction over both the gas and electricity industries.

“They’ve been in a slumber for decades on these types of issues. That needs to be addressed,” Dowling said.

Michael Desselle, SPP’s chief compliance and administrative officer and a member of the NAESB board, advised the MOPC to “stay tuned.”

“We will put in a standards request, and [NAESB] won’t have the option not to do anything,” he said. “If they choose to, they will be on the record for not doing anything.”

MOPC Chair Denise Buffington, of Evergy, said an education session on NAESB would be scheduled for the committee’s next meeting.

“We need to be cautious about getting into the gas business,” she said. “We need a little more research on the lines of jurisdiction between what FERC does and what NAESB does.”

MOPC Approves SCRIPT Report

The MOPC endorsed the Strategic and Creative Re-engineering of Integrated Planning Team’s (SCRIPT) report, but only after declining to endorse the team’s 46 recommendations over questions of project oversight and demand on staff. Members approved the endorsement motion with 97% approval.

The Board of Directors formed the SCRIPT last year and directed it to recommend broad changes to the RTO’s transmission planning processes that would better meet customer needs and resolve concerns about transmission investment amid rapid industry changes. The team came up with 35 recommendations and 11 sub-recommendations for business practices, policies and tariff revisions to consolidate planning processes, improve services processes, optimize SPP’s transmission network, improve decision quality, facilitate beneficial interregional energy transfers and improve cost sharing.

“There’s a lot of recommendations built into the report,” said Grant, the lone member to vote against the motion during the MOPC meeting and Wednesday’s Strategic Planning Committee call. “Some of them are good to implement, but if I endorse the recommendations, then it will be misinterpreted that I support those recommendations. There are a couple we don’t support and will not support. That being said, I think there’s a lot of good work and a lot of good work that needs to happen.”

“I still have concerns about resources on both sides. I don’t hear these are mandates,” Oklahoma Gas and Electric’s Usha Turner said. She noted staff and members will have their hands full responding to FERC’s Advanced Notice of Proposed Rulemaking on transmission planning and cost allocation (RM21-17), the winter weather report and implementing SPP’s new strategic plan.

“What do we reshuffle? What do we throw out?” Turner asked.

“The proof in the pudding will be what we get out of the end with cost allocation,” American Electric Power’s Richard Ross said.

Nickell said he will work with Directors Mark Crisson, who also chairs the SCRIPT, and Bronwen Bastone to coordinate the work going forward. The board could designate an existing stakeholder group or commission a new one to oversee the team’s implementation.

Central to the SCRIPT’s work are the overarching consolidation policy recommendations. During a MOPC education session last month, Nickell told members that that the new consolidated transmission planning process will save $3 million to $4 million annually in administrative cost savings once it is in place. SPP currently incurs about $28.5 million in annual costs for its planning processes. (See SPP: Consolidating Tx Planning Could Yield Big Savings.)

Staff said the improved processes should also lead to more optimal transmission, equitable cost-sharing, timely outcomes, increased certainty and greater transmission value.

The board will consider the recommendations during next week’s meeting. If approved, staff and stakeholder groups will either perform additional assessments to determine future action or work to implement policy direction through further design and process development.

“This will require some group, somewhere,” Crisson told the SPC on Wednesday. “The industry environment is rapidly changing around us, and we need to be able to respond to that.”

“These are good concepts. If we don’t get started, we’re not going to finish,” board Chair Larry Altenbaumer said. “No one should view that everything else is grinding to a halt and we’re moving forward full barrel. The challenge of leadership is with the board.”

SPP Asks for Z2 Rehearing

General Counsel Paul Suskie told the committee that a recent U.S. appeals court decision denying petitions by SPP and OG&E to review a FERC order on transmission upgrade costs lays out a clear path forward in finally resolving Attachment Z2’s never-ending saga.

The D.C. Circuit Court of Appeals ruled in August that FERC was correct in reversing a retroactive waiver it had granted SPP over collecting transmission upgrade costs under the tariff’s Attachment Z2 (20-1062). The commission had granted the waiver so that it could invoice transmission service customers for Z2 credit payment obligations for 2008-2016 (ER16-1341) but reversed course in 2019. FERC said its original decision was prohibited by the filed-rate doctrine and the rule against retroactive ratemaking. (See DC Circuit Upholds FERC Ruling on SPP Z2 Saga.)

“The ruling helps define the future of Z2,” Suskie said.

SPP and OG&E on Oct. 12 filed a joint request with the D.C. Circuit for an en banc rehearing, with a decision expected between November and February. If the request is denied and there are no further appeals, the RTO expects to receive a refund order from FERC for $138.5 million in credit payment obligations.

Suskie said SPP would then have to resettle Z2 credit obligations from September 2015 on, amounting to about $371 million.

SPP has a compliance filing pending at FERC, where five other dockets involve litigation over the Z2 process, filed by OG&E (EL19-77), EDF Renewables (EL19-75), Western Farmers Electric Cooperative, (EL19-93), Cimarron Windpower (EL10-96) and Kansas Electric Power Cooperative (EL17-21).

The grid operator expects to make additional filings at FERC clarifying how it will handle the refunds. “Much, much more to come in the future,” Suskie said.

“I would like to say I’m looking forward to it,” said Chair Buffington, who led a Z2 task force several years ago. “I’ll bite my tongue because I know how complicated it is.”

ITP Mitigation Plan Successful

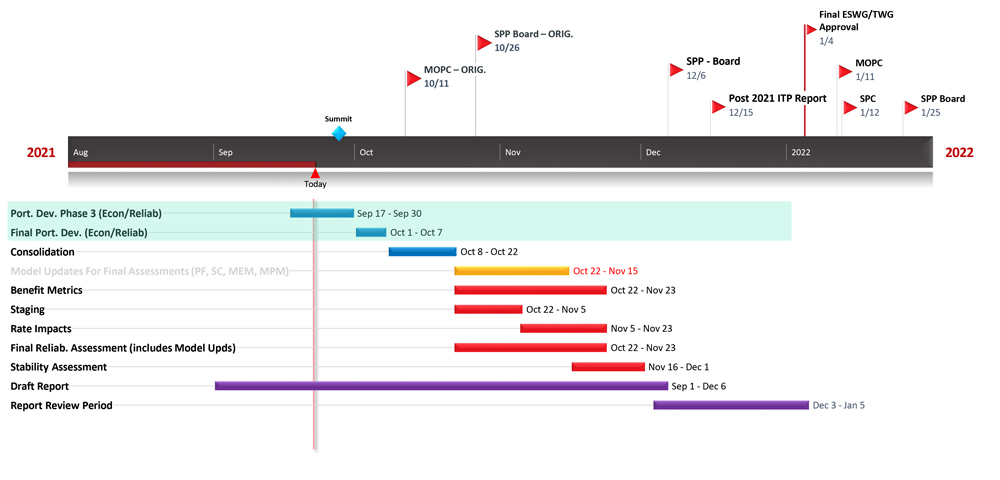

SPP’s mitigation plan to get the 2021 Integrated Transmission Planning (ITP) study back on track has been a success, chopping 40 days off the delayed scheduled, staff told members.

The study was to be shared with the MOPC and board in October but will now be presented in January. The 2021 ITP report will be posted in mid-December.

Eliminating model builds and assessments has helped SPP reduce the ITP 2021’s delayed schedule. | SPP

Eliminating model builds and assessments has helped SPP reduce the ITP 2021’s delayed schedule. | SPPThe mitigation activities, approved by both governance groups in July, include waiving requirements to build and assess power-flow models during the 2021 reliability needs assessment; modifying the 2021 scope to allow schedule adjustments within the study; and extending the 20-year assessment’s due date to 2023. (See “Tx Planning Mitigation Gets OK,” SPP Markets and Operations Policy Committee Briefs: July 12-13, 2021.)

“The 20-year assessment is on pause. It’s very important to SPP, but it will be unpaused after we focus on the 2021 ITP,” SPP’s Casey Cathey said.

Staff will eventually be diverted back to the 20-year assessment as they continue to grapple with three studies at the same time.

Annual VRL Analysis Approved

The committee approved the Market Working Group’s recommendation to approve the 2020-2021 annual violation relaxation limits (VRLs) analysis. Staff are not proposing any changes to the VRLs, saying the analysis showed no operating constraint sensitivity that reduced both the cost and the number of breaches and that the current VRL blocks provide a proper balance between economics and reliability.

AEP’s Ross, who chairs the MWG, suggesting adding language that a Market Monitoring Unit revision request (RR414) pursue possible VRL adjustments for extreme weather events and that it “come to fruition” before making additional changes. Ross agreed to pull his language after additional discussion, saying he was sensitive to concerns about additional studies being necessary “before we start monkeying around with the VRLs.”

The annual VRL analysis passed with 92% overall approval.

Members also approved the Supply Adequacy Working Group’s proposed RR462 that implements a process that includes a methodology for prioritizing and allocating the available effective load-carrying capability for standalone energy storage resources (ESRs) that qualify as capacity in the SPP balancing authority. The accreditation policy would be the first implemented by SPP for ESRs.

GOTF Nears its Sunset

Members approved four recommendations from the Generator Outage Task Force (GOTF) addressing outage-scheduling practices and concerns over how to reliably schedule outages.

Pointing to the changing resource mix’s effect on performing maintenance on conventional resources, staff secretary Kathryn Dial said the task force recommended revising the generation assessment process (GAP), used to help ensure balancing authority capacity adequacy in scheduling outages, be changed from a short-term GAP to generate hourly maintenance margin values.

The GOTF’s recommendations also include revising outage-coordination methodology by changing the outage/derate reporting threshold from 25 MW to 10 MW; allowing forced outages to have up to seven days of maximum lead time to align with NERC’s generating availability data system; and updating the cause codes.

The committee also endorsed the group’s request to be sunset, a move that thrilled Ross. Always eager to see the number of stakeholder groups reduced, Ross said he would send a gold star to Dial, who promised to have it framed.

The task force was created after SPP declared a Level 1 energy emergency alert and called for conservative operations 10 times in 2019. The grid operator attributed six of the 10 operations events to generation outages.

Tariff Updated with Admin Fee’s Cap

CFO Tom Dunn had the line of the meeting as he sought to explain a revision request (RR463) on the consent agenda that updates tariff language in Schedule 1-A to reflect the recently approved increase to the cap on recoverable costs. The Members Committee and board approved the change from 43 cents/MWh to 46.5 cents/MWh in July, but members wanted to ensure SPP wouldn’t take advantage of the increase. (See “Admin Fee Cap Bumped 8.1%,” SPP Board of Directors/Members Committee Briefs: July 26-27.)

Dunn said the cap’s increase does not mean an increase to SPP’s costs but is a “look out into the future.” He said staff believe the cap is “valid into 2026.”

“The tariff language change … doesn’t mean we’ll hit the number every year. Will you do everything you can to keep it low?” Chair Buffington asked.

“Tom’s life is easier when members are happy with the rate,” Dunn said.

And Dunn’s life did indeed get easier when the committee placed RR463 back on the consent agenda.

RCAR Hybrid Approach OK’d

RR463 was one of four items MOPC members pulled off the consent agenda for further discussion, eventually returning three to the agenda. RR461, which proposes a new hybrid approach for the regional cost allocation review (RCAR), was voted on separately and passed with 94% overall approval. The consent agenda passed with 97% approval.

The Regional Allocation Review Task Force recommends using real market data for facilities that have been in service for more than two years and a more theoretical, study-based approach for those approved projects that are still under construction or have not been in service for at least two years, effective with the 2022 RCAR.

The consent agenda included:

- RR456: clarifies that ESRs co-located or integrated with generating resources may register as a single resource and can use the market storage resource (MSR) model if desired.

- RR453: adds language to clarify which rounds or stages electrically equivalent settlement locations can be nominated during the auction revenue rights allocation process.

- RR459: updates the tariff to replace a reference to MSRs’ loss factor with ERSes’ loss factor.

- RR475: corrects the production version of the Integrated Marketplace’s protocols to remove market participants’ financial harm from an incorrect calculation because of overlapping revision requests.

- RR460: updates the minimum transmission design standards for competitive upgrades.

- RR464: updates Attachment W’s index of grandfathered agreements with changes identified during the annual review.

- RR466: cleans up the transmission owner selection process’ governing documents to more accurately capture their intent and execution.

- RR454: modifies business practices to increase the deadline for issuing notifications to construct from 15 business days to 45 calendar days.

- RR458: adds additional generator interconnection change to reduce and ultimately clear the queue backlog as part of the SCRIPT process.

- RR467: revises the tariff’s Attachment AQ by reducing the waiting period for preliminary study results of new load additions to adding a rolling submission and response window and posting delivery point network studies once the new or modified load is confirmed.