The upcoming months should be easier on the U.S. energy sector than the “particularly challenging” winter of 2020-2021, according to FERC staff presenting the commission’s 2021-2022 Winter Energy Market and Reliability Assessment on Thursday, though they warned that severe weather like February’s winter storm remains unpredictable.

Presenting the report at FERC’s monthly open meeting, Patricia Schaub of FERC’s Office of Energy Policy and Innovation noted that temperatures are expected to be above the 30-year average across most of the U.S., according to the National Oceanic and Atmospheric Administration, with a “small probability that this winter will be slightly colder than last winter.”

Positive Temperature Forecasts

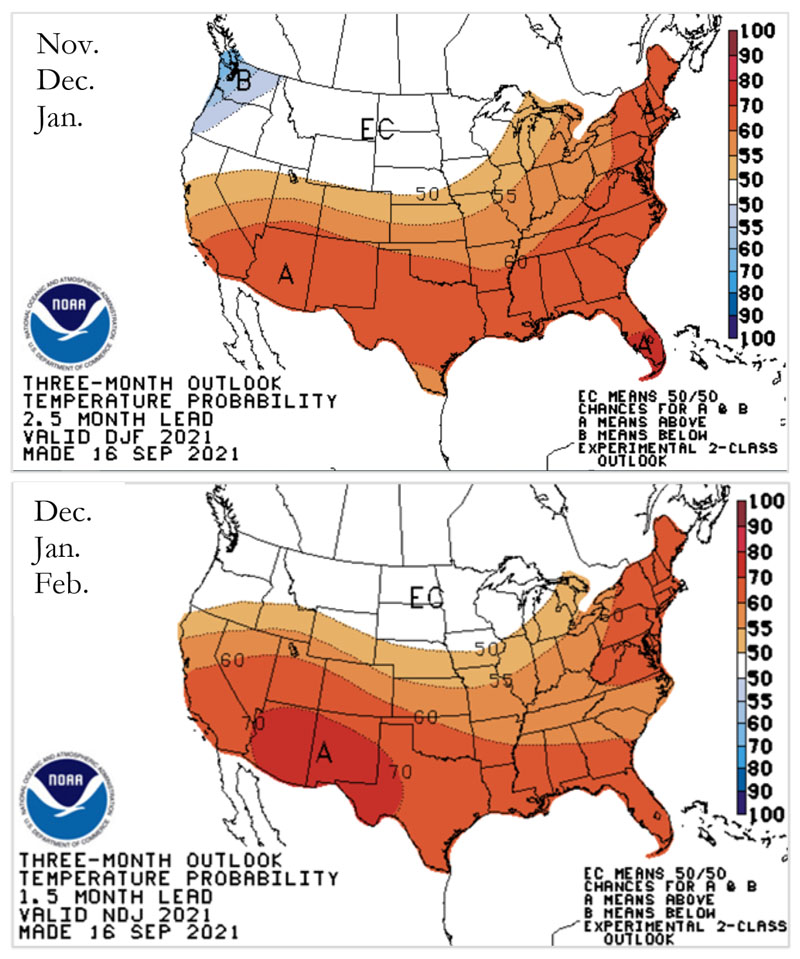

Winter 2021-2022 temperature forecast from the National Oceanic and Atmospheric Administration. Above: the three-month outlook for November through January. Below: the outlook for December through February. | NOAA

Winter 2021-2022 temperature forecast from the National Oceanic and Atmospheric Administration. Above: the three-month outlook for November through January. Below: the outlook for December through February. | NOAAMore detailed figures in the report show NOAA projecting a 70 to 80% chance of above-normal temperatures in Arizona, New Mexico and West Texas, and a 60 to 70% chance of above-average temperatures in New England, the Southeast, the Gulf Coast and the Southwest, including California. In the Carolinas, the Ohio River Valley, the Midwest, Ozarks, Rockies, Northern California and Southern Oregon, NOAA assess a 50 to 60% likelihood of above-normal temperatures, while the Upper Midwest and “some of the Northwest” have an equal chance of being below or above normal.

These predictions are stronger than those in last year’s report, in which the likelihood of above-average temperatures in most regions was less than 50%, and the report noted that higher winter temperatures “typically imply lower-than-average demand for electricity and natural gas. (See COVID-19, Weather Drive FERC Winter Outlook.)

However, the memory of February’s winter storms, which left hundreds of people dead and caused billions of dollars in damages in Texas and the Midwest, led the report’s authors to temper their optimism with warnings about “severe cold weather events that drive up energy demand.”

“Last year’s NOAA forecast showed an even greater probability of milder conditions in regions that were ultimately affected by the February 2021 winter storm,” the report said. “Forecasts for arctic oscillation … are only available 14 days ahead of time, making it difficult to forecast far in advance whether a similar winter storm event will happen again this year.”

Speaking at Thursday’s meeting, Matthew Adeleke of FERC’s Office of Electric Reliability emphasized the need to be prepared for the worst and — with the support of Chairman Richard Glick and the other commissioners — reiterated the preliminary recommendations from the commission’s joint inquiry with NERC into February’s storm. (See FERC, NERC Share Findings on February Winter Storm.) That report advised generator owners to:

- identify and protect cold weather-critical components and systems for each generating unit;

- design new or retrofit existing generators to operate to specific ambient temperatures and weather based on extreme temperature and weather data;

- take into account the effects of wind and precipitation in winterization plans;

- create corrective action plans for generator owners that experience freeze-related outages; and

- ensure the system operator is aware of the generating fleet’s operating limitations so that they can plan mitigation actions.

Adequate Reference Margin Levels

NERC’s winter 2021 anticipated reserve margins | NERC

NERC’s winter 2021 anticipated reserve margins | NERCOutside of the chance of severe weather, however, FERC’s assessment portrayed the grid as adequately prepared for normal conditions. Data from NERC, RTOs and ISOs show that anticipated reserve margins (the available electric generation capacity in excess of expected peak demand) exceed reference reserve margins for all markets and regions. SERC-East, which encompasses North and South Carolina, reported the lowest reserve margin with expected reserves of 26%, but this is well above the region’s reference level of 15%.

The report cautioned that “reserve margins are not guarantors of reliable operations,” which can be affected by many factors such as fuel availability and the performance of intermittent generation resources like wind and solar. The latter is especially important as wind and solar resources represent the vast majority of generation capacity added in ERCOT, the area most affected by February’s cold snap, and where nonfunctioning wind turbines contributed to the generation loss during the storm. (See ERCOT Focuses on Restoration, not Blame.)

NERC is predicting that net demand for electricity will increase by about 1% in the winter months compared to last year. The increase is expected to be highest in the SERC-Florida subregion, ERCOT and the WECC-NWPP subregion, while MISO and SERC-East should see a decrease in demand. Other regions and subregions are expected to remain similar to last year’s levels.

Export Demand to Keep Gas Prices High

Seasonal change in natural gas storage inventories in the lower 48 states over the last five years | EIA

Seasonal change in natural gas storage inventories in the lower 48 states over the last five years | EIANatural gas production in the U.S. is expected to rise this winter, FERC said, with the Energy Information Administration forecasting an average dry natural gas production rate of 94 Bcfd for the winter, up from 90.8 Bcfd last year. The increase represents the market returning to the growth trajectory experienced over the last decade before the decline in production observed in 2020-2021, which FERC attributed to the COVID-19 pandemic.

Demand for natural gas is also on the rise, with EIA forecasting an average of 111 Bcfd for the winter, up 2.5% from last year. This is in spite of falling demand for gas as a generating resource. Upward pressure on prices is expected because of strong global demand: LNG exports are projected to average 11 Bcfd between November and February, up 21% from the average last winter, while pipeline gross exports will rise 15%, to 9.3 Bcfd.

East Asian countries, particularly China, Japan, South Korea and Taiwan, are the leading drivers of LNG export demand. Natural gas imports will be needed to balance the gas markets during the winter months, with LNG imports averaging 0.3 Bcfd — up 93% year over year — and gross pipeline imports falling 12% year over year to 7.4 Bcfd.

Storage inventory levels for natural gas are predicted to begin the winter withdrawal season — which runs from November to April — at 3,752 Bcf, 5% below the five-year average, because of a lower-than-average injection season between April and October and record withdrawals during February’s winter storms.

Propane is also starting with low stocks: For the first week of October, they were 72.3 million barrels, 20% below the five-year average for the same week and lower than any recorded level for the same period in the last five years.