Markets and Reliability Committee

Regulation Mileage Ratio Fails

PJM stakeholders rejected two different proposals at last week’s Markets and Reliability Committee meeting to change the undefined regulation mileage ratio calculation in Manual 28 and the tariff, sending the issue back to the Market Implementation Committee for further discussions.

One proposal from PJM failed in a sector-weighted vote of 2.12 (42.4%), short of the 3.33 (66.6%) threshold for endorsement. A separate proposal from the Independent Market Monitor did better but also failed, receiving a sector-weighted vote of 3.07 (61.4%).

Both proposals were the source of several months of stakeholder debates, but the PJM proposal received endorsement at the September MIC meeting. (See “Regulation Mileage Ratio Calculation Endorsed,” PJM MIC Briefs: Sept. 9, 2021.)

Michael Olaleye, senior engineer with PJM’s real-time market operations, reviewed the RTO’s proposal. Olaleye said PJM had not received any additional feedback from stakeholders since the issue was discussed at the September MRC meeting, so no changes had been made to the proposal.

Regulation mileage is the measurement of the amount of movement requested by the regulation control signal that a resource is following; it is calculated for the duration of the operating hour for each regulation control signal. PJM’s performance-based regulation market splits the dispatch signal in two: RegA for slower-moving, longer-running units; and RegD for faster-responding units that operate for shorter periods, including batteries. If a signal is “pegged” high or low for an entire operating hour, the corresponding mileage would be zero for that hour.

PJM has seen an increased frequency of RegA signal pegging and times the RegA signal is pegged for extended periods, highlighting a potential problem in the regulation mileage ratio calculation. The RegA mileage can be set at zero for a given hour and create a divide-by-zero error in the calculation of the mileage ratio.

PJM proposed setting the RegA mileage floor at 0.1 instead of zero, which would provide a solution for the division ratio and still maintain market design objectives while having no impact on the regulation signal design, operations or regulation market clearing.

Adrien Ford of Old Dominion Electric Cooperative offered the Monitor’s proposal, which failed an endorsement vote at the September MIC meeting. It called for a cap of 5.5 on the realized mileage ratio in all hours instead of 0.1, indicating the cap would eliminate the current undefined mileage ratio result that PJM is attempting to address. The Monitor said that based on data it collected over a 15-month span, the 5.5 cap would reduce but not eliminate the market distortion resulting from the use of mileage ratios when they incorrectly represent regulation output and that the change would affect less than 50% of impacted hours.

Steve Lieberman, assistant vice president of transmission and PJM affairs for American Municipal Power, suggested sending the issue back to the MIC to possibly come up with a different proposal and to “rehash” why stakeholders either supported or opposed the existing proposals.

“It certainly seems like an issue we need to fix,” Lieberman said. “We need a solution we can rally around.”

Stu Bresler, PJM’s senior vice president of market services, said the regulation mileage ratio issue could be taken back up at the Nov. 3 MIC meeting. But “the sooner we resolve this, the better,” he said.

Carl Johnson of the PJM Public Power Coalition said there’s “no right answer” to the regulation mileage ratio. Johnson said the choice was between a “very simple mathematical fix” from PJM and the Monitor attempting to tackle some larger structural market issues.

Johnson suggested a possible solution to “resolve some of these longstanding issues with a colossally broken regulation market.”

“This is just one tiny symptom of an overall broken structure,” Johnson said.

Paul Sotkiewicz of E-Cubed Policy Associates said the undefined regulation mileage ratio issue started off as a “math problem” to solve and morphed into an examination of larger problems in the regulation market. Sotkiewicz said the Monitor’s proposal had a “huge” impact on mileage ratios and was “like taking a sledge hammer when all you need is a scalpel.”

Sotkiewicz suggested revisiting the scope of the original the issue charge and possibly come up with a new issue charge and problem statement to examine the market problems in a long-term fix while accepting a short-term compromise on the calculation.

“If we’re going to open the hood up on the regulation market, I think we need to do this the right way,” Sotkiewicz said.

Resource Adequacy Charter Approved

A new senior task force aimed at addressing resource adequacy topics and recommending possible changes to the capacity market won stakeholder approval.

The Resource Adequacy Senior Task Force (RASTF) was approved by acclamation vote, with three members voting against it and one abstaining. The task force was presented for a first read at the September MRC meeting. (See “Resource Adequacy Charter,” PJM MRC Briefs: Sept. 29, 2021.)

David Anders, director of stakeholder affairs for PJM, reviewed the charter for the RASTF, calling it the “central clearinghouse” for work related to resource adequacy that follows discussions on the minimum offer price rule (MOPR) conducted under the Critical Issue Fast Path (CIFP) stakeholder process. The RASTF will report directly to the MRC.

The task force was partially the result of a letter issued by the Board of Managers on April 6 that urged stakeholders to address a series of topics related to the capacity market, including the evaluation of characteristics of the appropriate level of capacity procurement and the examination of the need to strengthen the qualification and performance requirements on capacity resources.

Anders said the charter includes a reporting protocol for work on the capacity market performed at other PJM groups like the Quadrennial Review currently being discussed at special sessions at the MIC, load forecasting at the Load Analysis Subcommittee, and reliability products and services at the Operating Committee to be brought to the RASTF for coordination of efforts. A dashboard on the task force website will be established to list all the capacity work being discussed.

“The idea is to provide a useful tool for folks to see where everything is and to be able to access documentation,” Anders said.

PJM received stakeholder feedback to include a discussion on opportunities to address the social cost of carbon along with procurement of clean resource attributes in the RTO’s capacity, energy and ancillary services markets.

A draft of the specific scope of the work to be addressed by the task force is being developed in an issue charge that will be presented for approval at a future MRC meeting.

Transparency Forum Debated

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), reviewed the proposed charter on behalf of the New Jersey Division of the Rate Counsel for the creation of a new Transparency Process Forum. Poulos first presented the charter at the September Members Committee meeting but moved the proposal after some stakeholders said the discussion would be more appropriate for the MRC. (See “Transparency Forum,” PJM MRC/MC Briefs: Sept. 29, 2021.)

Poulos said the current Stakeholder Process Forum has done a “great job” providing members with an outlet to have discussions and express concerns about the existing stakeholder process. He said there are some items that “don’t fit within that stakeholder process discussion,” and the proposed forum could provide a place to openly discuss matters that “currently take place in the back of the room.”

One of the items presented by the advocates as a possible topic for the forum was establishing a formal process to request information and data from PJM and to keep track of responses. He said having access to data was the “most pressing” issue.

“The advocates and folks from other sectors see it as an important aspect for us having the ability to get answers to certain things they’re struggling to get answers to and doing it in a public forum,” Poulos said.

Jason Barker of Exelon said his company “still [has] some concerns” after the concept for the forum was first discussed at the MC. Baker said it appears to be “a solution in search of a problem” with no clear transparency concerns.

“A new venue doesn’t seem necessary,” Barker said.

Alex Stern, director of RTO strategy for PSEG Services, asked if the sponsors would be supportive of incorporating a provision in the charter to allow stakeholders to provide input to the Monitor and PJM prior to them both filing items at FERC or in state commissions.

Poulos said he wouldn’t have a concern adding that language with the understanding that both PJM and the Monitor will do what they want to do in FERC and state commission filings.

The PJM Public Power Coalition’s Johnson said he had concerns about whether the charter was specific enough regarding how the forum will work and if enough guidance is provided for facilitators and stakeholders as to what issues should be brought to it.

“I’m really unclear as to how topics are going to be raised there and how PJM will be asked to respond to them,” Johnson said.

Carbon Pricing Senior Task Force Sunset

Members are being asked to sunset the Carbon Pricing Senior Task Force (CPSTF) after a majority of stakeholders indicated they were not ready to move forward with developing rules on leakage mitigation in carbon pricing.

Eric Hsia, senior manager in PJM’s applied innovation department, reviewed the recommendation to sunset the CPSTF, which was established in July 2019. The main objective of task force’s issue charge was to explore the impacts of emissions and price leakage between regions with and without carbon pricing policies, such as the Regional Greenhouse Gas Initiative states, and to develop business rules to manage leakage where appropriate.

The first stage of the task force included education on carbon pricing concepts like a carbon tax versus carbon cap-and-trade programs and an introduction on leakage between states. Analysis in the first stage included studies on a range of carbon prices and potential leakage mitigation approaches.

A survey conducted in summer 2020 indicated that 65% of the respondents suggested not moving forward to rule development in a second stage of the CPSTF. Hsia said some suggested that there needs to be more state interest or federal legislation to move forward with carbon pricing in the RTO.

“We want to be responsive to stakeholder feedback,” Hsia said. “And from the survey results, we did not see a strong interest from stakeholders to move forward with a market rule design.”

The committee will be asked to endorse sunsetting the CPSTF at its next meeting.

HVDCSTF Sunset

Stakeholders requested sunsetting a senior task force created last year to examine integrating HVDC converters as a new type of capacity resource in PJM.

Johnson, speaking on behalf of American Municipal Power, moved to sunset the High Voltage Direct Current Senior Task Force (HVDCSTF). An issue charge by Direct Connect Development was endorsed by the MRC in May 2020, seeking to establish HVDC converter stations’ eligibility to participate in the capacity market. (See HVDC Initiative Endorsed by PJM Stakeholders.)

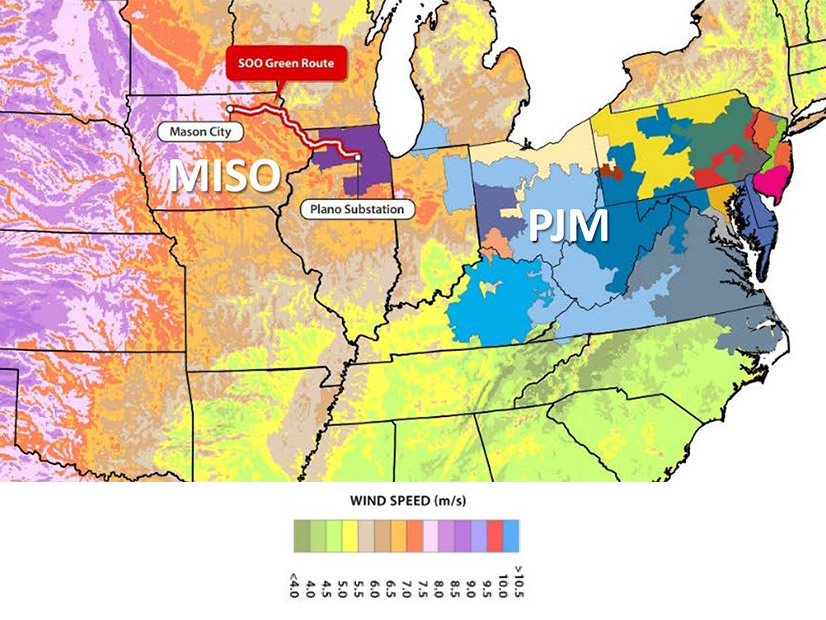

The HVDC change would allow Direct Connect’s SOO Green HVDC Link — the 350-mile, 2,100-MW, 525-kV underground transmission line planned to deliver renewable energy from upper MISO to Illinois and the PJM grid — to compete in the market.

Johnson said a few education sessions were held in 2020, but “numerous” stakeholders expressed concerns about whether any solution could be found that wasn’t precluded from current FERC-approved approaches to providing capacity to PJM’s market from outside the RTO.

The task force stopped meeting last October. Several stakeholders requested that it be sunset earlier this year. (See “HVDC Senior Task Force Update,” PJM MRC/MC Briefs: March 29, 2021.) Johnson said that because the task force stopped meeting, SOO Green has brought an official complaint to FERC seeking approval of the proposal. (See SOO Green Seeks Relief from PJM Rule on External Capacity.)

“That’s probably the best way to figure out a resolution to their issue, as I don’t think the rest of the stakeholder body felt there was one available to us,” Johnson said.

The committee will be asked to endorse the motion to sunset the HVDCSTF at its next meeting.

Consent Agenda

The committee unanimously endorsed several revisions as part of the consent agenda. They included:

- endorsement of the 2021 reserve requirement study results for the installed reserve margin and the forecast pool requirement. The study was unanimously endorsed at the Oct. 5 Planning Committee meeting. (See “Reserve Requirement Study Endorsed,” PJM PC/TEAC Briefs: Oct. 5, 2021.)

- endorsement of proposed updates addressing behind-the-meter generation business rules on status changes and corresponding revisions to Manual 14D, Manual 14G and the tariff. The updates were developed in special sessions of the Market Implementation Committee. (See “Manual 14G Updates Endorsed,” PJM PC/TEAC Briefs: Aug. 31, 2021 and “Manual 14D Endorsed,” PJM Operating Committee Briefs: Sept. 10, 2021.)

- endorsement of proposed revisions to Manual 15: Cost Development Guidelines, the Operating Agreement and the tariff to address incremental and no-load energy offers. The Cost Development Subcommittee proposed revising the no-load cost and incremental energy offer definitions to clearly define what costs can be included, including operating costs, tax credits and emissions allowances. (See “Manual 15 Revisions Endorsed,” PJM MIC Briefs: Sept. 9, 2021.)

- endorsement of the proposed solution and manual revisions to address the calculation of the energy efficiency add-back in Reliability Pricing Model auctions. The proposal, which called for modified language to section 2.4.5 of Manual 18 to reflect revisions to the EE add-back method, was endorsed at the Oct. 6 MIC meeting. (See “Energy Efficiency Add-back Endorsed,” PJM MIC Briefs: Oct. 6, 2021.)

Members Committee

Manual 34 Revisions Approved

Stakeholders unanimously approved proposed revisions to Manual 34: PJM Stakeholder Process, addressing the inclusion of forums as stakeholder bodies. The revisions were originally discussed at the Stakeholder Process Forum and presented for a first read at the September MC meeting. (See “Manual 34 Revisions,” PJM MRC/MC Briefs: Sept. 29, 2021.)

Michele Greening, senior lead stakeholder affairs consultant for PJM, said several new forums have been created, but PJM found that Manual 34 didn’t define a forum as an official type of stakeholder group. The manual revisions define a forum as a stakeholder body to provide consistency with other defined stakeholder groups and to provide clarity to the purpose and role of a forum in the stakeholder process. The charters for all new forums must be approved by the MRC.

A forum is now defined as a “stakeholder body formed to address specific topics and scope as outlined in its Markets and Reliability Committee-approved charter. Forums are non-decisional stakeholder groups.”