NYISO plans to bring most employees back to its headquarters building Nov. 1 and resume holding in-person stakeholder meetings on Nov. 17, CEO Rich Dewey told the ISO’s Management Committee on Wednesday.

The ISO made the decision based on state and federal guidance regarding COVID-19 protocols, Dewey said.

“The ISO intends to hold the Nov. 17 Management Committee meeting in person and still provide a remote option for individuals that want to participate in that manner, but that would be our first in-person meeting since the pandemic started back in early March of 2020,” he said.

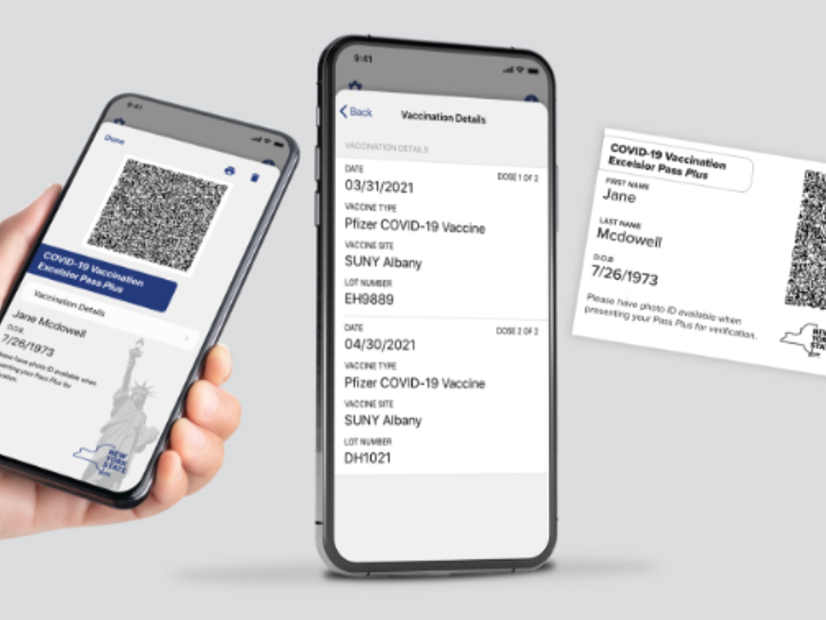

All employees and visitors will be required to demonstrate proof of vaccination. Dewey recommended that stakeholders take advantage of New York’s Excelsior Pass to gain admittance if they don’t want to carry vaccination cards.

“If the situation changes with respect to the pandemic, or we take a left-hand turn in terms of health conditions and that sort of thing, we’ll adjust,” he said. “But at this point our plan is full speed ahead for Nov. 17.”

While masks are advisable and encouraged, NYISO will not require visitors to wear them.

NYISO is taking that stance based on guidance from the CDC and the New York Health and Essential Rights Act, which recommends only voluntary wearing of masks if every attendee in a meeting or space is vaccinated, Dewey said.

OKs 2022 Draft Budget

The Management Committee unanimously recommended that NYISO’s Board of Directors approve the ISO’s draft 2022 budget Rate Schedule 1 revenue requirement totaling $169.2 million, which is allocated across a forecast of 150 million MWh for a charge of $1.128/MWh, up about 1% compared with the 2021 budget.

“NYISO kicked off a lessons learned process on the project prioritization process at yesterday’s BPWG meeting with two more meetings on deck for this year, Nov. 12 and Dec. 8,” said Alan Ackerman of Customized Energy Solutions, chair of the Budget and Priorities Working Group, who presented the budget.

“In January, we will look to work through that feedback with NYISO so any process changes can be implemented in next year’s process,” Ackerman said.

Comparatively, the 2021 budget was $167.4 million, allocated across 147.3 million MWh for a Rate Schedule 1 charge of $1.137/MWh.

NYISO’s projected 2022 throughput represents a 2.7 million MWh increase, or up about 1.8% compared with the 2021 budget.

Dewey thanked Ackerman and stakeholders for helping make this year’s budget planning “a fully collaborative, very useful and productive process.”

Grid Planning Concerns

New York officials in September selected two projects — Clean Path NY and Champlain Hudson Power Express — under the Tier 4 renewable energy solicitation issued by the New York State Energy Research Development and Authority (NYSERDA). (See Two Transmission Projects Selected to Bring Low-carbon Power to NYC.)

One stakeholder said that it’s clear that commencing service of the two Tier 4 projects would require thousands of megawatts of steam units in New York City and the lower Hudson Valley to shut down with no replacements in order for ISO markets to remain competitive for generators. He asked for assurances that the ISO will work to facilitate an efficient and appropriate exit of the steam units.

“We are committed,” Dewey said. “And I can assure you that we will take all deliberate and meaningful steps to make sure that we maintain reliability.”

Expressing a commitment to maintain the efficacy of the market signals, Dewey said that markets are a “very useful, powerful and necessary tool to attract and retain the kind of resources that we need to promote reliability, and also from a cost-effective standpoint for consumers, are the most efficient means to do that.”

Another stakeholder asked why NYISO was not involved in the NYSERDA and E3 study to help the New York State Climate Action Council shape its scoping plan to reach the environmental goals outlined in the state’s Climate Leadership and Community Protection Act (CLCPA). (See New Analysis Sets Low-carbon Focus for NY Climate Plan.)

“We have good communication with NYSERDA on a regular basis … and I think that we’re very open and transparent in terms of sharing the results of the studies that we have,” Dewey said.

In addition, the scoping plan will be shaped into a final plan over the coming year, so NYISO and stakeholders will have plenty of opportunity to weigh in, said NYISO Executive Vice President Emilie Nelson.

CSR-related and Other Tariff Revisions

The Management Committee also recommended the Board of Directors approve tariff revisions related to implementation of co-located energy storage resources (CSR) injection and withdrawal scheduling limit constraints that accommodate CSR-generator specific operating parameters.

“In particular, as we were working to implement the CSR model, we recognized that there are unique situations where scheduling limits could actually be going up against other operating parameters,” said Zachary Stines, manager of energy market design.

FERC in March accepted the ISO’s rules allowing an energy storage resource to participate in the wholesale markets with wind or solar as a CSR, and NYISO has since been working on the market software. (See FERC Approves NYISO Co-located Storage Model.)

Language will be added to the applicable manuals (likely the Day-Ahead Scheduling Manual, Ancillary Services Manual and the Transmission and Dispatch Operations Manual) describing how the scheduling limits will interact with unit-specific constraints, such as ramp, upper operating limit and lower operating limit.

If approved by the board in November, NYISO will file the tariff changes with FERC and request a flexible effective date that is prior to year-end, Stines said.

The MC also approved tariff revisions related to implementing a revised approach to the current transmission constraint pricing logic.

The project seeks to develop enhancements to the current transmission constraint pricing logic to better align transmission demand force with the severity of transmission constraints, said Kanchan Upadhyay, energy market design specialist.

The proposal includes establishing a revised six-step transmission demand curve for facilities currently assigned a non-zero constraint reliability margin value.